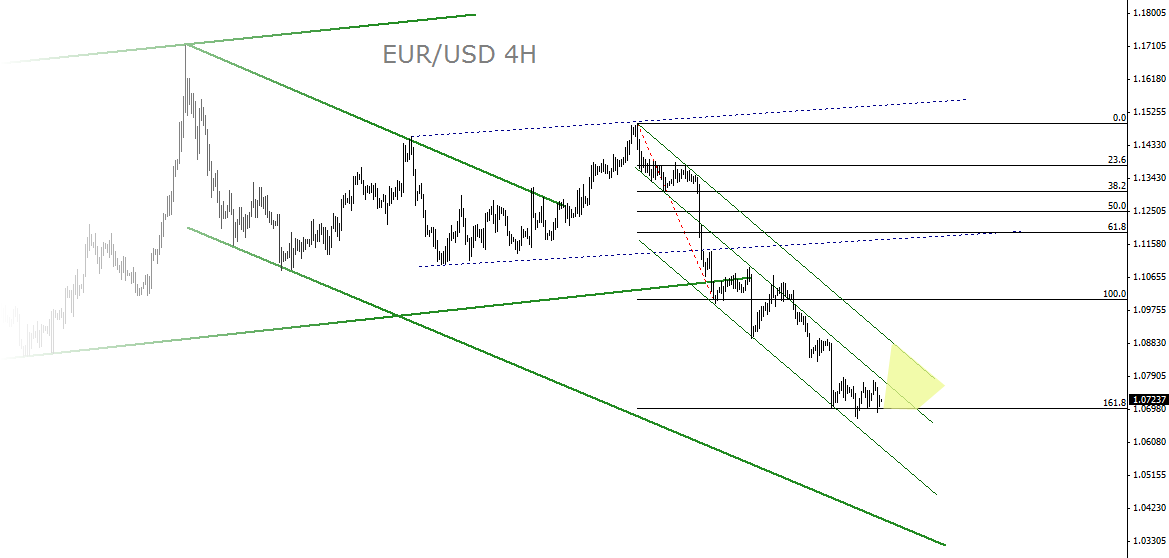

- EUR/USD keeps trending on the lower half of the channel which has been defining the pace of this down move;

- A consolidative tone has emerged once the pair found support at the 161.8% Fibo projection leaving the observer in doubt as to its true intention;

- The gut reaction at the first break below 1.07 was that the action is part of a flag correction unfolding, which would imply a trend continuation. But the time the price spent meandering has morphed into a possible “U†formation where 1.0870 on the North would be the end point of the U. Note this point will coincide with the channel resistance in about 24 hours;

- Standard MACD settings show an overextended level on monthly readings similar to those only seen in the year 2000. The weekly had plenty of time to recover to the neutral midline, so the down potential is huge in the mid-term horizon. The daily MACD is negative but not at extremes, and on the 4H seems like a new indicator low would create three successive higher lows divergent to the lower lows in price, a positive sign in the short-term.

- Long entries are likely is not coming into the book before we are sniffing around March's low or thereabout;

- As sellable points I see many of them, but sell-on-upticks just for the sake of it may be too risky. Therefore, selling the following acceleration levels are the only take for now: 1.0851, 1.0913, 1.0922 and 1.0939.

The trading methodology reported in this analysis is based on a non-directional approach. It is meant to capture the most amount of pips from the constant price oscillations, either up or down. Each trade has a take profit of 50 pips, a stop loss of 500 pips. The size of each trade is regular, but trades can be stacked around key support and resistance zones, increasing the overall position size around certain price zones. The system can perform either in trending or range bound markets, but it suffers when there is an extreme unidirectional price advance. Buy and sell positions are taken with two separate real accounts.

To learn more about the method, you can watch these special webinar series:

Exploring the Coast Line of Foreign Exchange Land - Part I

Exploring the Coast Line of Foreign Exchange Land - Part II

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Australian Dollar maintains ground amid subdued US Dollar, US Nonfarm Payrolls awaited

The Australian Dollar rises on hawkish sentiment surrounding the RBA prolonging higher interest rates. Australia’s central bank is expected to maintain its current rate at 4.35% until the end of September. US Nonfarm Payrolls is expected to print a reading of 243K for April, compared to 303K prior.

EUR/USD: Optimism prevailed, hurting US Dollar demand

The EUR/USD pair advanced for a third consecutive week, accumulating a measly 160 pips in that period. The pair trades around 1.0760 ahead of the close after tumultuous headlines failed to trigger a clear directional path.

Gold bears take action on mixed signals from US economy

Gold price fell more than 2% for the second consecutive week, erased a small portion of its losses but finally came under renewed bearish pressure. The near-term technical outlook points to a loss of bullish momentum as the market focus shifts to Fedspeak.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.