Interested in more FX key technical levels? Take a look at Swissquote's daily technical outlook.

EUR/USD

Break above the 1.1465 high seeing follow-through to reach 1.1481 high so far and see the 1.1495, Oct high, now within reach. However, stretched intraday tools caution pullback with support now at the 1.1400 level and 1.1370 sustaining the upside focus. [PL]

USD/CHF

Pressure stays on the downside with break of the .9600 level reaching .9568 low. Nearby see risk for retest of the .9549 support then the .9500 level though stretched intraday tools caution corrective bounce. Upside see resistance now at .9657 then the .9700 level. Need lift over the latter to ease downside pressure. [PL]

USD/JPY

Pressure stays firmly on the downside and see the 106.00 level now within reach. Failure to hold this will see further slide to the 105.44/23 support though the stretched intraday tools caution bounce. Upside see resistance now at 106.90 then the 107.63/108.00 area. Would need lift over this to slow downside momentum. [PL]

EUR/CHF

Bounce from the 1.0955 eye return to the 1.1000 level and lift over this will clear the way for retest of the 1.1016 high. Above this will trigger stronger recovery to 1.1061 then the 1.1100 level. Only below 1.0955 low expose deeper pullback to the 1.0930/00 area. [PL]

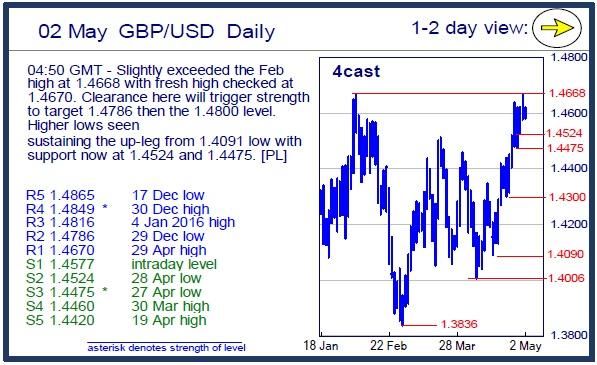

GBP/USD

Slightly exceeded the Feb high at 1.4668 with fresh high checked at 1.4670. Clearance here will trigger strength to target 1.4786 then the 1.4800 level. Higher lows seen sustaining the up-leg from 1.4091 low with support now at 1.4524 and 1.4475. [PL]

EUR/GBP

Lift over the .7800/12 resistance triggers stronger recovery towards .7882 then the .7900/25 resistance. While the latter caps, risk is seen for pullback to further pressure the downside later. Support now at the .7800 level then the .7755/35 lows. [PL]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

AUD/USD regains the constructive outlook above the 200-day SMA

AUD/USD advanced strongly for the second session in a row, this time extending the recovery to the upper 0.6500s and shifting its focus to the weekly highs in the 0.6580-0.6585 band, an area coincident with the 100-day SMA.

EUR/USD keeps the bullish performance above 1.0700

The continuation of the sell-off in the Greenback in the wake of the FOMC gathering helped EUR/USD extend its bounce off Wednesday’s lows near 1.0650, advancing past the 1.0700 hurdle ahead of the crucial release of US NFP on Friday.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.