Interested in more FX key technical levels? Take a look at Swissquote's daily technical outlook.

EUR/USD

Break of the 1.1300 level swing focus lower to retrace the up-leg from the 1.0822, Mar low. The downside still not firm and lower will target the 1.1218 support and 1.1200 level. Upside see resistance now at the 1.1327/46 area, regaining needed to fade downside pressure. [PL]

USD/CHF

Rally above the .9600 level and follow-through to clear strong resistance at the .9651/61 recent lows swing focus back to the upside. Intraday tools now stretched and see the .9700 level out of reach for now and consolidation likely before further strength seen. Dips see support now at .9594 and .9549. [PL]

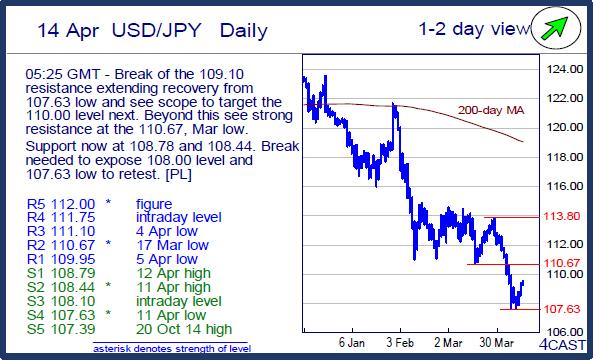

USD/JPY

Break of the 109.10 resistance extending recovery from 107.63 low and see scope to target the 110.00 level next. Beyond this see strong resistance at the 110.67, Mar low. Support now at 108.78 and 108.44. Break needed to expose 108.00 level and 107.63 low to retest. [PL]

EUR/CHF

Recovery from the 1.0843 low of last week to regain the 1.0900 level expose the 1.0913 resistance. Lift over this will clear the way for stronger recovery to 1.0933 then 1.0954 high. Only below the 1.0843 low will expose the 1.0821/10 lows to retest. [PL]

GBP/USD

Intraday trade exposed further weakness with the move below 1.4107 support and poised for extension towards the support line of 6-1/2 week triangle at 1.4040 and break will trigger a bearish call and expose more damage on the downside. [W.T]

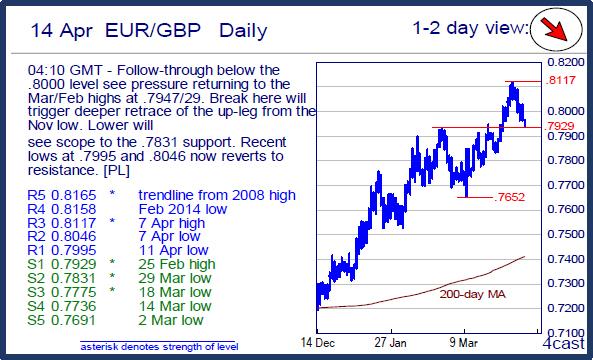

EUR/GBP

Follow-through below the .8000 level see pressure returning to the Mar/Feb highs at .7947/29. Break here will trigger deeper retrace of the up-leg from the Nov low. Lower will see scope to the .7831 support. Recent lows at .7995 and .8046 now reverts to resistance. [PL]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

EUR/USD retreats to 1.0750, eyes on Fedspeak

EUR/USD stays under modest bearish pressure and trades at around 1.0750 on Wednesday. Hawkish comments from Fed officials help the US Dollar stay resilient and don't allow the pair to stage a rebound.

GBP/USD struggles to hold above 1.2500 ahead of Thursday's BoE event

GBP/USD stays on the back foot and trades in negative territory below 1.2500 after losing nearly 0.5% on Tuesday. The renewed US Dollar strength on hawkish Fed comments weighs on the pair as market focus shifts to the BoE's policy announcements on Thursday.

Gold fluctuates in narrow range above $2,300

Gold struggles to make a decisive move in either direction and moves sideways in a narrow channel above $2,300. The benchmark 10-year US Treasury bond yield clings to modest gains near 4.5% and limits XAU/USD's upside.

SEC vs. Ripple lawsuit sees redacted filing go public, XRP dips to $0.51

Ripple (XRP) dipped to $0.51 low on Wednesday, erasing its gains from earlier this week. The Securities and Exchange Commission (SEC) filing is now public, in its redacted version.

Softer growth, cooler inflation and rate cuts remain on the horizon

Economic growth in the US appears to be in solid shape. Although real GDP growth came in well below consensus expectations, the headline miss was mostly the result of larger-than-anticipated drags from trade and inventories.