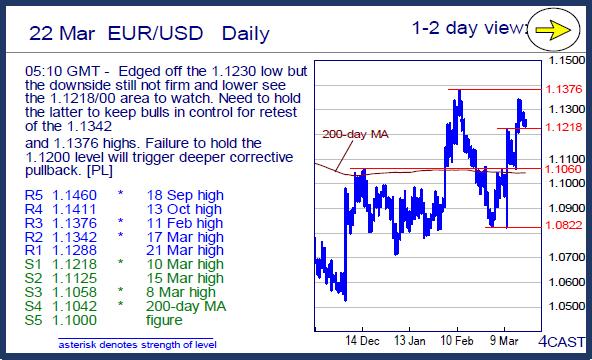

EUR/USD

Edged off the 1.1230 low but the downside still not firm and lower see the 1.1218/00 area to watch. Need to hold the latter to keep bulls in control for retest of the 1.1342 and 1.1376 highs. Failure to hold the 1.1200 level will trigger deeper corrective pullback. [PL]

USD/CHF

Higher in consolidation from the .9651 low though the upside still limited with resistance now at .9750 then the 200-day MA at .9804. Lower high sought to further pressure the downside later, below the .9661/51 lows will see further decline to the .9600 level then .9476 support. [PL]

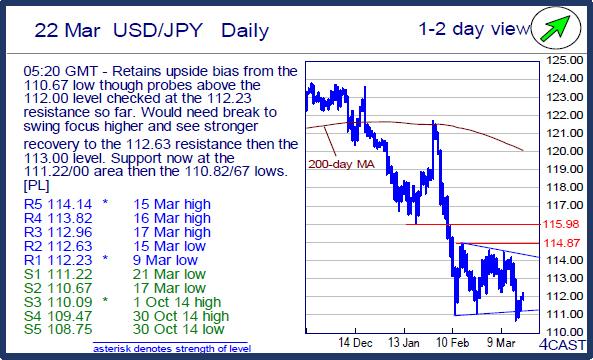

USD/JPY

Retains upside bias from the 110.67 low though probes above the 112.00 level checked at the 112.23 resistance so far. Would need break to swing focus higher and see stronger recovery to the 112.63 resistance then the 113.00 level. Support now at the 111.22/00 area then the 110.82/67 lows. [PL]

EUR/CHF

Break of the 1.0900 level see the 1.0893 support keeping bears in check though the downside still not firm and see risk for break to further extend the rejection from the 1.1023 high. Break will see return to the 1.0810 low and see possible extension of the broader decline from 1.1200 high. [PL]

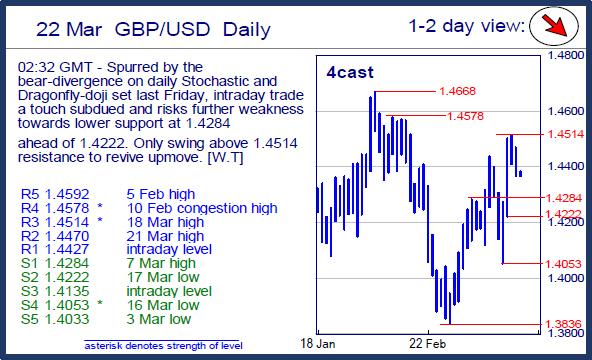

GBP/USD

Spurred by the bear-divergence on daily Stochastic and Dragonfly-doji set last Friday, intraday trade a touch subdued and risks further weakness towards lower support at 1.4284 ahead of 1.4222. Only swing above 1.4514 resistance to revive upmove. [W.T]

EUR/GBP

Higher in consolidation from the .7775 low but upside seen limited above the .7800 level with resistance at .7848 ahead of the .7912/29 highs. Would need break of the latter to see renewed strength to target the .8000 level. Break of the .7775 low will see deeper pullback to .7736 and .7691. [PL]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

EUR/USD stays in tight channel above 1.0750

EUR/USD continues to fluctuate in a narrow band slightly above 1.0750 after posting small gains on Monday. Disappointing Factory Orders data from Germany limits the Euro's gains as investors keep a close eye on comments from central bankers.

GBP/USD retreats below 1.2550 as USD recovers

GBP/USD stays under modest bearish pressure and trades below 1.2550 in the European session on Tuesday. The cautious market stance helps the USD hold its ground and doesn't allow the pair to regain its traction. The Bank of England will announce policy decisions on Thursday.

Gold declines below $2,320 amid renewed US Dollar demand

Gold trades in negative territory below $2,320 as the souring mood allows the USD to find demand on Tuesday. Nevertheless, the benchmark 10-year US Treasury bond yield stays below 4.5% and helps XAU/USD limit its losses.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is SEC filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.