EUR/USD

Steadied at 1.1255 low but downside still vulnerable and deeper setback not ruled out from the 1.1342 high. Nearby see support at 1.1242 then the 1.1218/00 area. Above the latter keep focus on the upside for retest of 1.1342 high. Beyond this is the 1.1376, Feb YTD high. Break will clear the way to the 1.1460/95, Sep/Oct highs. [PL]

USD/CHF

Stays in consolidation above the .9651 low though the upside seen limited with resistance now at .9750 then the 200-day MA at .9802. Lower high sought to further pressure the downside later, below the .9651 low will see further decline to the .9600 level then .9476 support. [PL]

USD/JPY

Limited to 110.67 low last week on break of the 111.00 level though the downside still vulnerable and lower will see further weakness to target the 110.00 level. Upside seen limited with resistance now at 112.00/23 area and 112.63. Only above these will see scope for retest of the 114.00 level. [PL]

EUR/CHF

Bounce from the 1.0905 low keep consolidation in play within the 1.1000/1.0900 area. Would take break of the 1.0900 level to weaken and see return to the 1.0810 low and see possible extension of the drop from 1.1200 high. Above the 1.1000 level will expose the 1.1023 and 1.1061 highs. [PL]

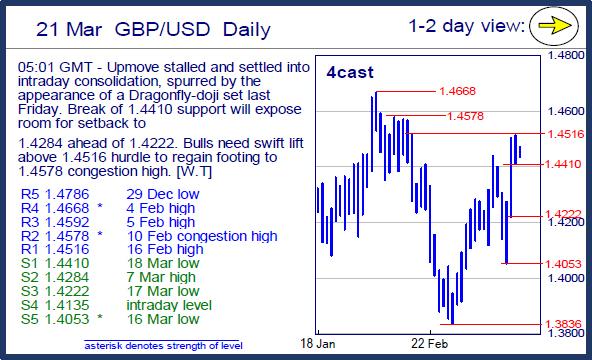

GBP/USD

Upmove stalled and settled into intraday consolidation, spurred by the appearance of a Dragonfly-doji set last Friday. Break of 1.4410 support will expose room for setback to 1.4284 ahead of 1.4222. Bulls need swift lift above 1.4516 hurdle to regain footing to 1.4578 congestion high. [W.T]

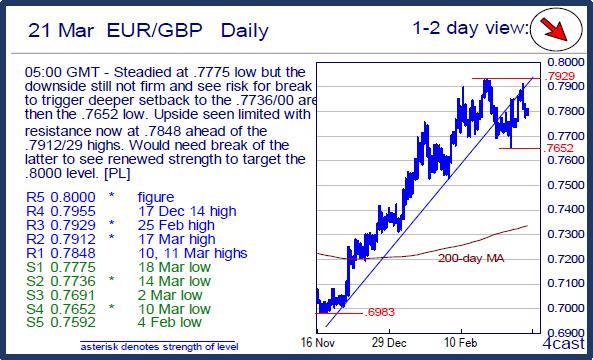

EUR/GBP

Steadied at .7775 low but the downside still not firm and see risk for break to trigger deeper setback to the .7736/00 area then the .7652 low. Upside seen limited with resistance now at .7848 ahead of the .7912/29 highs. Would need break of the latter to see renewed strength to target the .8000 level. [PL]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

EUR/USD clings to marginal gains above 1.0750

EUR/USD trades in positive territory above 1.0750 in the second half of the day on Monday. The US Dollar struggles to find demand as investors reassess the Fed's rate outlook following Friday's disappointing labor market data.

GBP/USD edges higher toward 1.2600 on improving risk mood

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold climbs above $2,320 as US yields push lower

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Three fundamentals for the week: Two central bank decisions and one sensitive US Premium

The Reserve Bank of Australia is set to strike a more hawkish tone, reversing its dovish shift. Policymakers at the Bank of England may open the door to a rate cut in June.