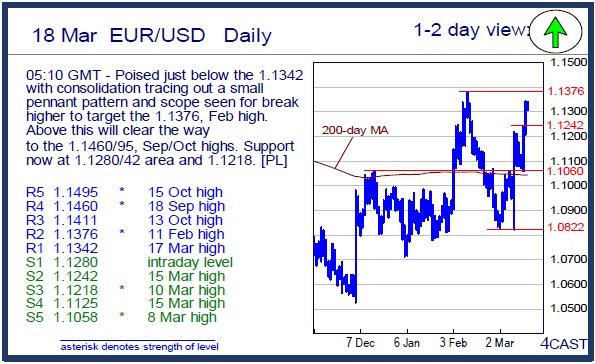

EUR/USD

Poised just below the 1.1342 with consolidation tracing out a small pennant pattern and scope seen for break higher to target the 1.1376, Feb high. Above this will clear the way to the 1.1460/95, Sep/Oct highs. Support now at 1.1280/42 area and 1.1218. [PL]

EUR/CHF

Faltered ahead of the 1.1000 level and rejection from 1.0996 high keep the 1.1023 high out of reach. More consolidation seen for now and break of the 1.0922 and 1.0893 support needed to weaken and see return to the 1.0810 low and see resumption of the drop from 1.1200 high. [PL]

USD/CHF

Sharp drop to break .9661 low reached fresh low at .9651. Below this see trendline from the May 2015 low at .9620 now within reach. Break here will trigger further decline to the .9600 level then .9476 support. Resistance now at .9750 then the .9800 level/200-day MA. [PL]

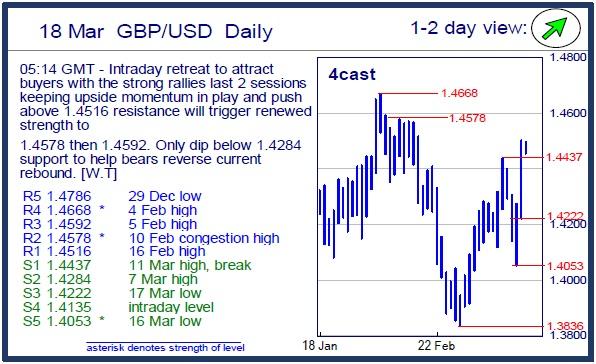

GBP/USD

Intraday retreat to attract buyers with the strong rallies last 2 sessions keeping upside momentum in play and push above 1.4516 resistance will trigger renewed strength to 1.4578 then 1.4592. Only dip below 1.4284 support to help bears reverse current rebound. [W.T]

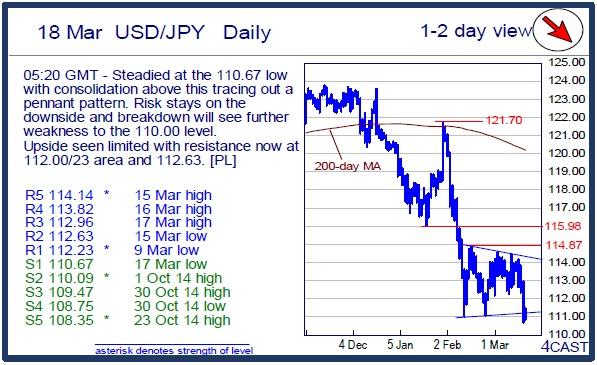

USD/JPY

Steadied at the 110.67 low with consolidation above this tracing out a pennant pattern. Risk stays on the downside and breakdown will see further weakness to the 110.00 level. Upside seen limited with resistance now at 112.00/23 area and 112.63. [PL]

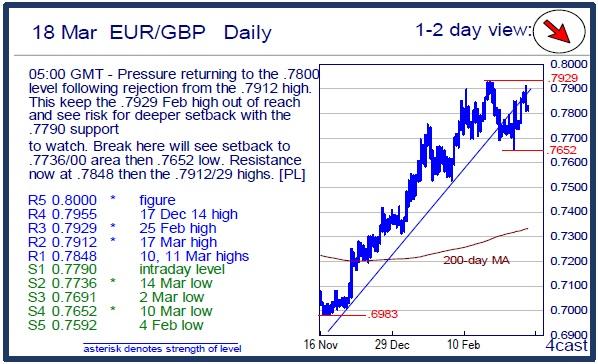

EUR/GBP

Pressure returning to the .7800 level following rejection from the .7912 high. This keep the .7929 Feb high out of reach and see risk for deeper setback with the .7790 support to watch. Break here will see setback to .7736/00 area then .7652 low. Resistance now at .7848 then the .7912/29 highs. [PL]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.