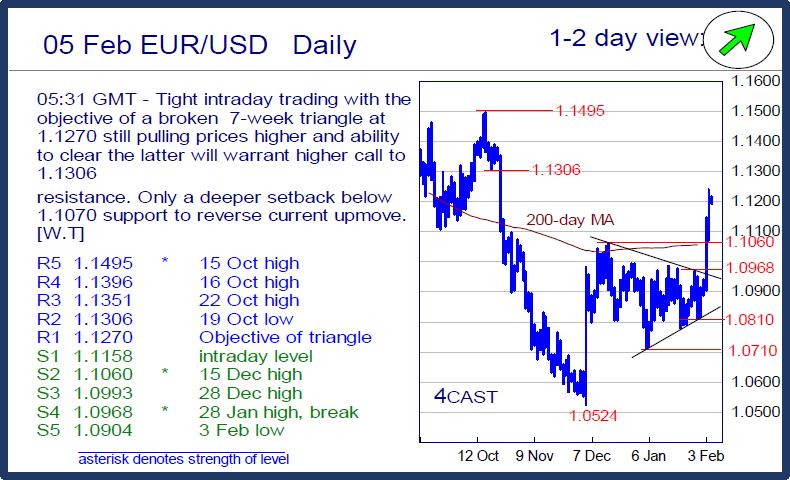

EUR/USD Daily

Tight intraday trading with the objective of a broken 7-week triangle at 1.1270 still pulling prices higher and ability to clear the latter will warrant higher call to 1.1306 resistance. Only a deeper setback below 1.1070 support to reverse current upmove. [W.T]

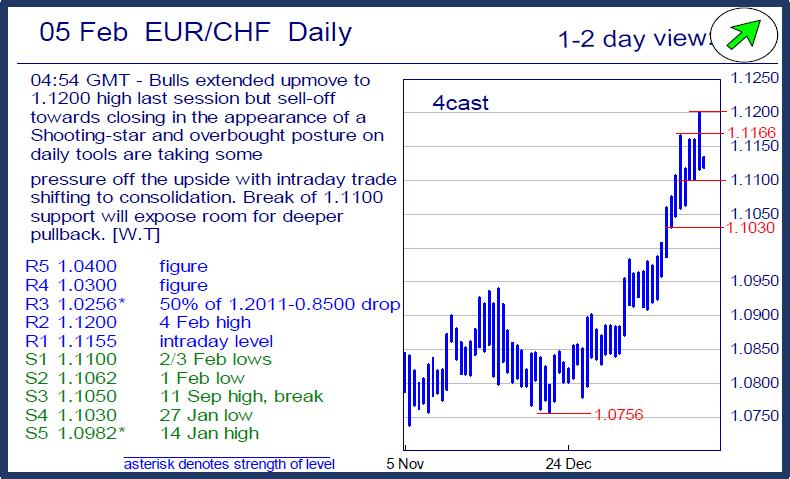

EUR/CHF Daily

Bulls extended upmove to 1.1200 high last session but sell-off towards closing in the appearance of a Shooting-star and overbought posture on daily tools are taking some pressure off the upside with intraday trade shifting to consolidation. Break of 1.1100 support will expose room for deeper pullback. [W.T]

USD/CHF Daily

Decline showing no signs of abating with another sharp decline last session below .9959 support and negative cross-over seen on daily MACD and poised for extension to next support at .9881. Only swing above 1.0074 resistance to reverse current downmove. [W.T]

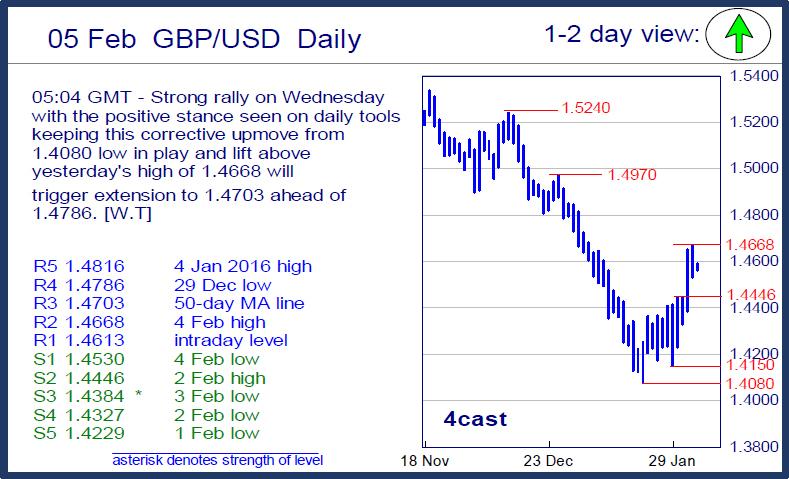

GBP/USD Daily

Strong rally on Wednesday with the positive stance seen on daily tools keeping this corrective upmove from 1.4080 low in play and lift above yesterday's high of 1.4668 will trigger extension to 1.4703 ahead of 1.4786. [W.T]

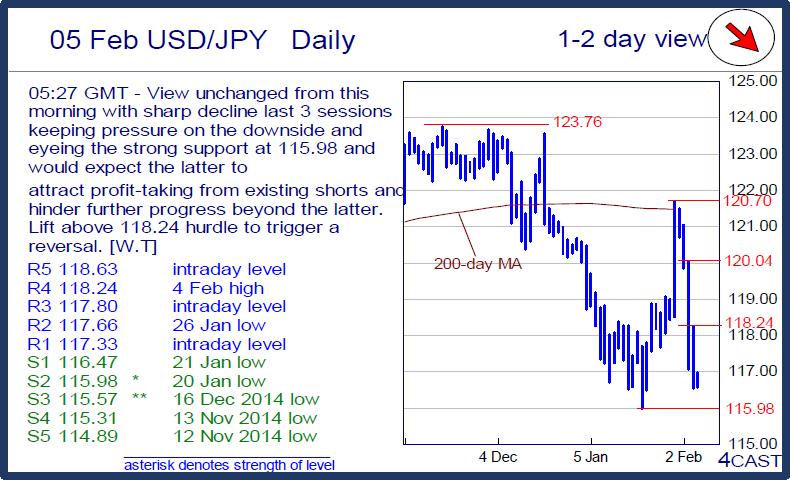

USD/JPY Daily

View unchanged from this morning with sharp decline last 3 sessions keeping pressure on the downside and eyeing the strong support at 115.98 and would expect the latter to attract profit-taking from existing shorts and hinder further progress beyond the latter. Lift above 118.24 hurdle to trigger a reversal. [W.T]

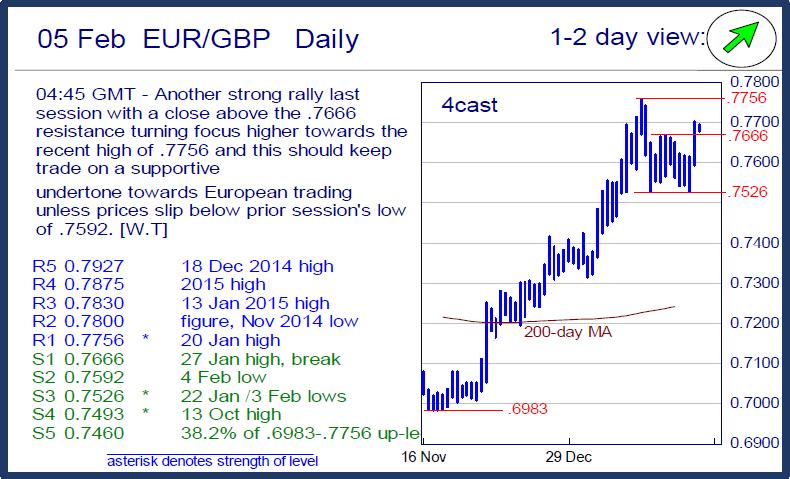

EUR/GBP Daily

Another strong rally last session with a close above the .7666 resistance turning focus higher towards the recent high of .7756 and this should keep trade on a supportive undertone towards European trading unless prices slip below prior session's low of .7592. [W.T]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after German inflation data

EUR/USD trades modestly higher on the day above 1.0700. The data from Germany showed that the annual HICP inflation edged higher to 2.4% in April. This reading came in above the market expectation of 2.3% and helped the Euro hold its ground.

USD/JPY recovers above 156.00 following suspected intervention

USD/JPY recovers ground and trades above 156.00 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.