EUR/USD Daily

Tight intraday trading but the sharp sell-off last session below 1.0904 support and negative crossing seen on daily Stochastic are turning pressure towards downside and should keep this currency pair on a subdued tone. Below 1.0899 low set last session to expose move to 1.0870/48. [W.T]

USD/CHF Daily

Strong rally last session with a higher closing triggered a positive cross-over on daily Stochastic and seen boosting this currency pair with immediate threat to 0.9946 hurdle and break will see stronger level at 0.9990 targeted. [W.T]

USD/JPY Daily

With the year 2015 coming to an end , trades are getting thinner with prices stuck in tight consolidation and with the preceding down move from 123.56 high still dominating, selling into upticks still favoured. Below 120.14/07 supports will signal bears back in control. [W.T]

EUR/CHF Daily

Upmove stretching and currently stalled by the 1.0859 congestion high and the appearance of a High-wave candle last session is slowly taking pressure off the upside and downside break of 1.0827 support will help tilt pressure lower to 1.0800 then 1.0773. [W.T]

GBP/USD Daily

Intraday trade remains consolidative but the strong decline seen last two sessions with break of 1.4806 strong support is helping bears regain control and eyes lower support at 1.4740 ahead of 1.4700. Strong resistance is now seen at 1.4970 and lift above latter will shift focus towards upside. [W.T]

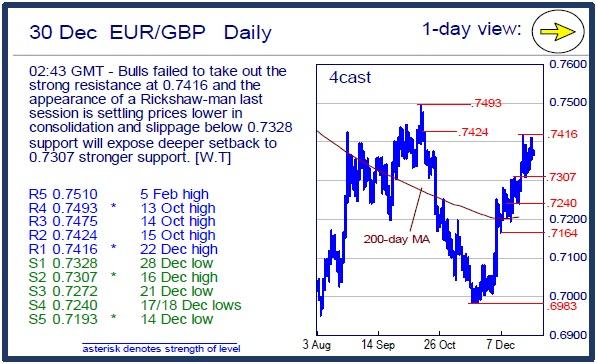

EUR/GBP Daily

Bulls failed to take out the strong resistance at 0.7416 and the appearance of a Rickshaw-man last session is settling prices lower in consolidation and slippage below 0.7328 support will expose deeper setback to 0.7307 stronger support. [W.T]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.