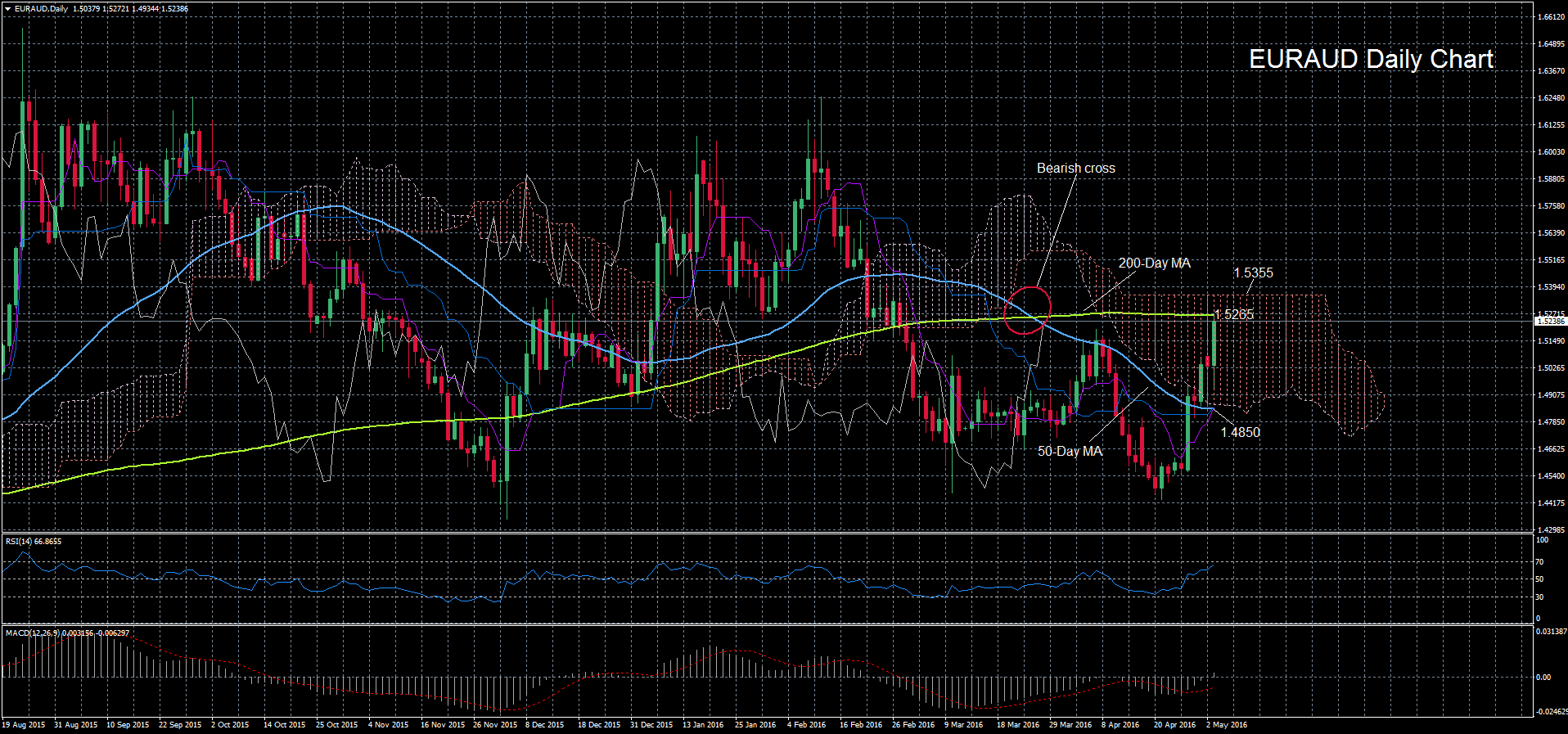

EURAUD has seen a strong rally over the past week and this has taken prices above the 50-day moving average and towards the 200-day moving average. The near-term bias is bullish with RSI sharply above 50 and the MACD histogram turning positive. However, with RSI fast approaching overbought territory, there may be limited scope for further strong gains.

In the medium term, EURAUD remains within its 8-month range and the neutral outlook is supported by prices moving into the Ichimoku cloud. But the recent bearish cross of 50-day moving average with the 200-day moving average points to a slight underlying bearish trend.

Prices are currently capped by the 200-day moving average around 1.5265. A break above the 200-day moving average would strengthen the current upside momentum and drive prices above the Ichimoku cloud. However, the top of the cloud is likely to prove the next key resistance at 1.5355.

To the downside, the 50-day moving average, which is also where the tenkan-sen and kijun-sen lines converge is the key support level to watch out for at around 1.4850.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD retreats to 1.0750, eyes on Fedspeak

EUR/USD stays under modest bearish pressure and trades at around 1.0750 on Wednesday. Hawkish comments from Fed officials help the US Dollar stay resilient and don't allow the pair to stage a rebound.

GBP/USD remains on the defensive around 1.2500 ahead of BoE

The constructive tone in the Greenback maintains the risk complex under pressure on Wednesday, motivating GBP/USD to add to Tuesday's losses and gyrate around the 1.2500 zone prior to the upcoming BoE's interest rate decision.

Gold flirts with $2,320 as USD demand losses steam

Gold struggles to make a decisive move in either direction and moves sideways in a narrow channel above $2,300. The benchmark 10-year US Treasury bond yield clings to modest gains near 4.5% and limits XAU/USD's upside.

SEC vs. Ripple lawsuit sees redacted filing go public, XRP dips to $0.51

Ripple (XRP) dipped to $0.51 low on Wednesday, erasing its gains from earlier this week. The Securities and Exchange Commission (SEC) filing is now public, in its redacted version.

Softer growth, cooler inflation and rate cuts remain on the horizon

Economic growth in the US appears to be in solid shape. Although real GDP growth came in well below consensus expectations, the headline miss was mostly the result of larger-than-anticipated drags from trade and inventories.