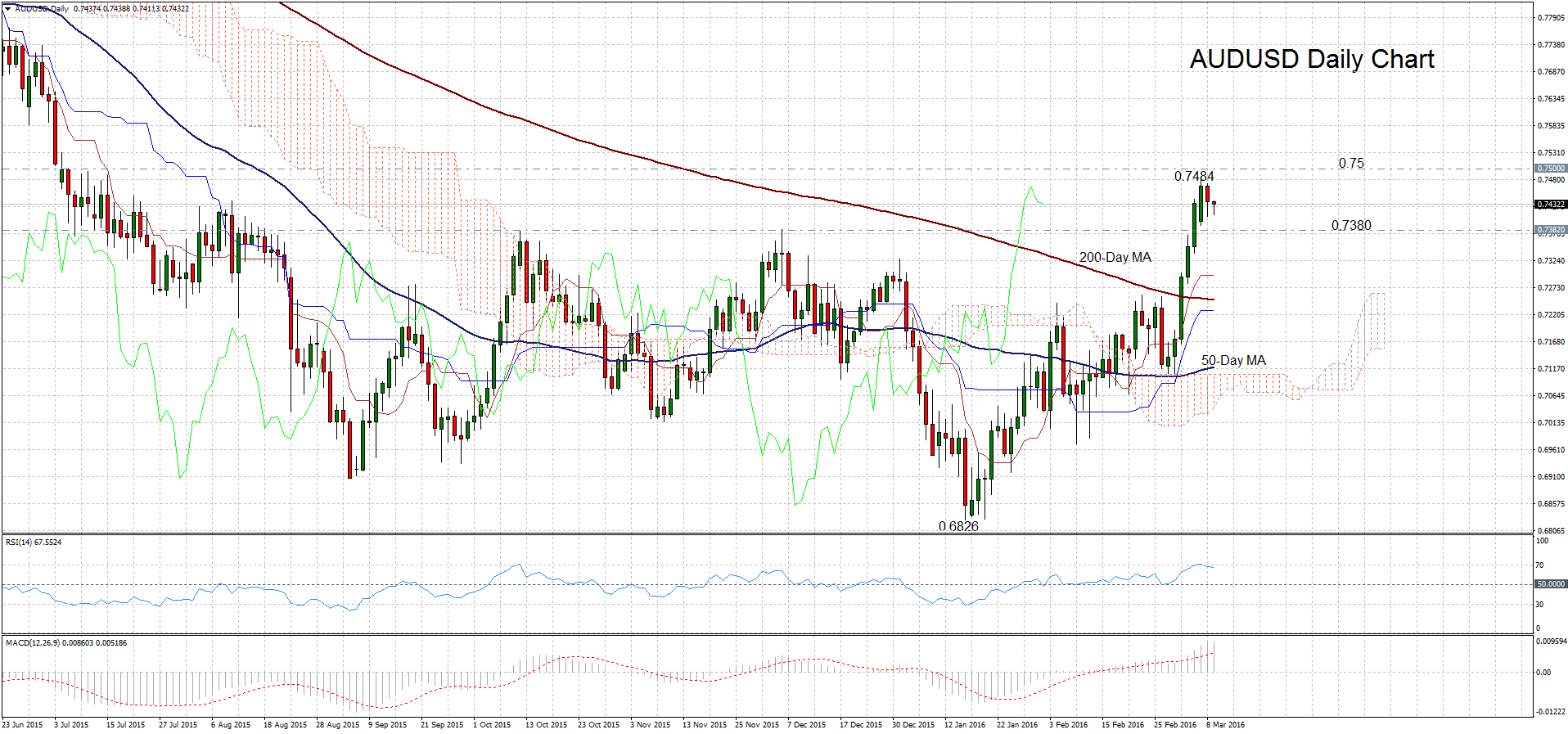

AUDUSD has retreated from an 8-month high of 0.7484 it set on March 7 but has held on to the 0.74 handle. Prices remain firmly above the 200-day moving average and the Ichimoku cloud but the tenkan-sen and kijun-sen lines are moving sideways, suggesting the bullish bias has lost some steam from the losses of the past two days.

This is also evident from the RSI which has come down from over bought levels and is currently flat. But the MACD is still trending up, indicating that there is scope for further gains.

The nearest resistance is the key psychological level of 0.75 – a break above this level would strengthen the bullish bias. To the downside, the nearest support in sight is around 0.7380 - a previous resistance level. Failure to hold above this level could open the way for a decline towards the 200-day moving average and weaken the positive bias.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

AUD/USD: Further losses retarget the 200-day SMA

Further gains in the greenback and a bearish performance of the commodity complex bolstered the continuation of the selling pressure in AUD/USD, which this time revisited three-day lows near 0.6560.

EUR/USD: Further weakness remains on the cards

EUR/USD added to Tuesday’s pullback and retested the 1.0730 region on the back of the persistent recovery in the Greenback, always against the backdrop of the resurgence of the Fed-ECB monetary policy divergence.

Gold flirts with $2,320 as USD demand losses steam

Gold struggles to make a decisive move in either direction and moves sideways in a narrow channel above $2,300. The benchmark 10-year US Treasury bond yield clings to modest gains near 4.5% and limits XAU/USD's upside.

Bitcoin price dips to $61K range, encourages buying spree among BTC fish, dolphins and sharks

Bitcoin (BTC) price is chopping downwards on the one-day time frame, while the outlook seen in the one-week period is a horizontal trade. In this shakeout moment, data shows that large holders are using the correction to buy up BTC.

Navigating the future of precious metals

In a recent episode of the Vancouver Resource Investment Conference podcast, hosted by Jesse Day, guests Stefan Gleason and JP Cortez shared their expert analysis on the dynamics of the gold and silver markets and discussed legislative efforts to promote these metals as sound money in the United States.