EURUSD

The Euro keeps near-term focus at the upside, but renewed probe above near-term congestion top, did not result in sustained break again.

The pair remains within 1.1325/1.1452 range, after seven consecutive long-legged daily candles, which confirmed indecision.

However, technicals remain bullish, with strong bullish momentum, showed on fresh rise of daily Tenkan-sen line, which underpins bullish action just under 1.1400 handle and keeping dips-buying scenario favored for now

Firmly bullish daily studies are supportive for fresh upside attempts, with sustained break higher, expected to open next significant barrier at 1.1500 zone.

Daily close above 1.1452 is needed to confirm scenario and signal resumption of larger uptrend from 1.0519 (03 Dec 2015 low).

Rising daily Tenkan-sen / 10SMA, offer initial support at 1.1390, followed by 1.1325 (n/t congestion floor), above which, extended dips should be contained.

Res: 1.1465; 1.1494; 1.1550; 1.1600

Sup: 1.1416; 1.1390; 1.1370; 1.1325

GBPUSD

Cable probes above 1.4300 barrier, on data-driven rally, after completing 1.4284/24 correction. Yesterday’s strong rally that penetrated into daily Ichimoku cloud, met its last target at 1.4284 (Fibo 61.8% of 1.4457/1.4004 downleg), which marks yesterday’s high and left long bullish daily candle.

Daily studies are in firm bullish setup, after the pair rallied above 10/20 SMA’s and daily Tenkan-sen / Kijun-sen lines, keeping focus at the upside. Sustained break above 1.4300 handle to confirm bullish resumption and expose next targets at 1.4350 (Fibo 76.4% of 1.4457/1.4004 downleg and 1.4388 (top of thick daily Ichimoku cloud), in extension.

Broken daily Kijun-sen line marks initial support at 1.4258, followed by session low at 1.4221, reinforced by daily 10SMA, which is expected to contain corrective dips.

Res: 1.4350; 1.4388; 1.4423; 1.4457

Sup: 1.4258; 1.4221 1.4170; 1.4145

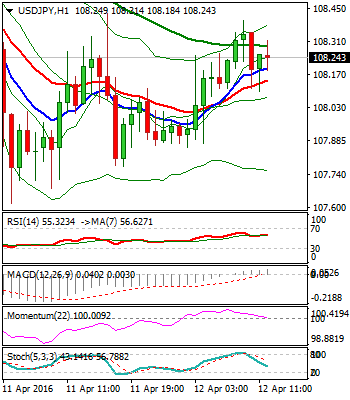

USDJPY

The pair trades within narrow consolidation range, above fresh 17-month low at 107.61, posted yesterday. Upside attempts were repeatedly capped at 108.40, which marks initial resistance, which is expected to cap and guard 109.08 (08 Apr recovery high).

Overall structure remains firmly bearish, since critical supports at 111.00/110.65 were lost and looks for fresh bearish action towards initial 107.61 support. Break lower is expected to open next targets at 107.00 (round-figure support) and 106.70 (Fibo 76.4% of 100.81/125.84 rally).

Res: 108.40; 108.52; 109.08; 109.35

Sup: 108.09; 107.61; 107.00; 106.70

AUDUSD

The pair rallies for the third day, extending recovery rally from 0.7490 (07 Apr low), through cracked daily 10SMA / Tenkan-sen barriers at 0.7605, showing scope for full retracement of 0.7721/0.7490 downleg. The notion is supported by fresh bullish extension that cracked 0.7666 (Fibo 76.4% of the downleg).

Fresh rally returned daily studies back to full bullish setup, which supports further upside action, however, pullback on overbought near-term studies, could be anticipated.

Broken daily Tenkan-sen, offers good support at 0.7605, followed by daily Kijun-sen at 0.7564, loss of which is needed to revive bears.

Res: 0.7670; 0.7700; 0.7721; 0.7769

Sup: 0.7630; 0.7605; 0.7581; 0.7564

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.