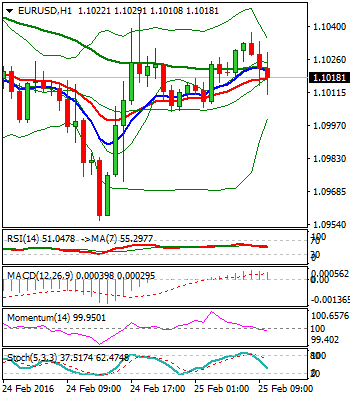

EURUSD

The Euro returned above 1.10 handle, after yesterday’s extended dip to 1.0955, where daily 100SMA contained dip. Yesterday’s trading was shaped in long-legged Doji, which signals indecision, as the second attempt to close below 1.10 handle failed.

Near-term technicals are mixed and suggest further consolidation, with strong resistance at 1.1046 (200SMA), which capped past two-day action, staying intact for now.

Consolidation should be ideally limited by 200SMA, to maintain downtrend from 1.1374, 11 Feb high, which is defined by series of nine consecutive lower highs and lower daily lows.

However, daily Slow Stochastic is reversing from oversold territory and gives bullish signal, which may result in extended correction above 1.1047.

Upside extension should be allowed to 1.1110 (daily 10/20SMA’s bear-cross / near Fibo 38.2% of 1.1374/1.0955 descend), before bears re-assert.

Early upside rejection, however, will signal fresh weakness towards initial target at 1.0955 and daily Ichimoku cloud top at 1.0870.

Fundamentals also give negative tone to the single currency, as Eurozone economy remains weak, with expectations of ECB’s repeated dovish stance, now being boosted by Brexit fears.

All these factors keep short-term focus at the downside, with fresh leg lower expected to commence after current consolidation phase.

Alternative scenario requires firm break above 1.1110 barrier, to sideline immediate downside threats and signal reversal.

Res: 1.1032; 1.1047; 1.1075; 1.1110

Sup: 1.1000; 1.0988; 1.0955; 1.0870

GBPUSD

Cable trades in a narrow consolidation above fresh seven-year low at 1.3876, posted yesterday on strong three-day fall from 1.4302, 22 Feb weekly high. The pair came under strong pressure on increased Brexit fears and took out significant supports at 1.4078, 21 Jan former low and 1.4000, psychological support, which now acts as strong resistance.

Strong bears so far ignore overextended conditions of daily studies, however, a pause in sharp fall of past three days, could be anticipated, when oversold daily Slow Stochastic reverses higher and generates bullish signal.

Session high at 1.3961 offers initial resistance, followed by psychological 1.40 barrier and 1.4078 (former low and Fibonacci 38.2% of 1.4385/1.3877 downleg), below which corrective actions should be capped.

Overall bears keep focus at next targets at 1.3720, Fibonacci 161.8% projection of descend from 1.5928, 2015 peak and 1.3680, June 2001 low, with extension to key longer term support at 1.3501, low of January 2009 and bottom of sharp Nov 2007 / Jan 2009 2.1161/1.3501 fall.

Res: 1.3961; 1.4000; 1.4078; 1.4150

Sup: 1.3876; 1.3800; 1.3720; 1.3680

USDCAD

The pair fell sharply yesterday, following fresh rally in oil prices, which turned near-term focus lower again. Recovery attempts were capped by descending daily 20SMA at 1.3857 that kept intact pivotal daily Ichimoku cloud barrier at 1.3870.

Yesterday’s close in red, with long upper shadow of daily candle, gives strong bearish signal, as fresh weakness pressures again near-term congestion low at 1.3660 and keeps key support, 1.3640 zone base under pressure.

Bearish setup of daily 10, 20 and 30 SMA’s, maintains bearish stance and limits short-term consolidation phase.

However, prolonged directionless trading could be expected while strong support at 1.3640 base holds. Break here is needed to commence fresh leg lower, an extension of larger downtrend from 1.4688 (peak of 20 Jan.

At the upside, falling daily 10SMA offers initial resistance at 1.3759, followed by 20SMA at 1.3832 and breakpoint at 1.3870 (daily Ichimoku cloud base, penetration of which will signal reversal and confirm base at 1.3640 zone.

Res: 1.3733; 1.3759; 1.3832; 1.3857

Sup : 1.3651; 1.3637; 1.3600; 1.3539

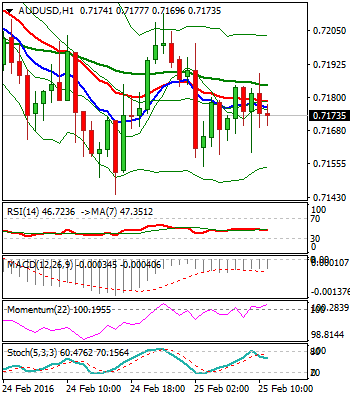

AUDUSD

The Aussie dollar remains soft in the near-term and holds below 0.72 handle, following yesterday’s close in red, but with long-tailed daily candle, which suggested strong bids at significant 0.7148 support (Fibo 38.2% of 0.6972/0.7257 upleg), where yesterday’s dip was contained.

Rising daily 10SMA at 0.7161, which underpins larger ascend, is under pressure again and break here and below 0.7148 support, is needed to trigger further easing, signaled by south-heading, reversed daily Slow Stochastic.

Plethora of good supports between 0.7161 and 0.7115, however, suggests limited corrective action off 0.7257 high.

Early reversal and sustained break above 0.7200 barrier is needed to shift focus higher and signal resumption of larger uptrend, on break above 0.7257 peak and 0.7270 (200SMA).

Conversely, expect deeper correction on break below 0.7114 (50% of 0.6972/0.7257, reinforced by 55SMA).

Res: 0.7209; 0.7257; 0.7270; 0.7325

Sup: 0.7148; 0.7131; 0.7114; 0.7081

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.