EURUSD

The Euro stabilizes above yesterday’s low at 1.1126, where Fibonacci 38.2% of 1.0709/1.1374 rally, also the lower boundary of strong 1.1160/20 support zone, contained two-day pullback.

Consolidation remains capped by initial barrier at 1.1200 for now, however, attempt above and stretch to the breakpoint 1.1225, Fibonacci 38.2% of 1.1374/1.1126 downleg, cannot be ruled out.

Sustained break above 1.1225 is needed to signal near-term base and trigger stronger retracement of 1.0709/1.1374 downleg, towards 1.1250 and 1.1280, 50% and 61.8% retracement, respectively.

Otherwise, downside will remain vulnerable, as near-term studies are soft and bias turned lower on yesterday’s dovish comments of ECB’s Draghi.

Loss of 1.1120/00 support zone will signal further weakness and expose pivotal support at 1.1055, 200SMA.

Res: 1.1200; 1.1225; 1.1250; 1.1279

Sup: 1.1144; 1.1120; 1.1075; 1.1055

GBPUSD

Cable probed above 1.45 handle, on today’s fresh rally that emerged after repeated failure to clearly break below 1.4441 support, Fibonacci 38.2% of 1.4078/1.4665upleg.

Rally was so far short-lived and capped by sideways-moving daily 10SMA, which marks the upper limit of narrower range, established between daily 30SMA at 1.4403 at the downside and 10SMA at 1.4500, at the upside.Today’s price action holds within this range for now, as quick pullback from session high at 1.4514, sidelined hopes of eventual attack at 1.4576 pivot, top of near-term congestion.Mixed setup of daily MA’s suggests extended sideways trade, however, bearishly aligned daily indicators and soft near-term studies, keep the downside vulnerable.

Cracked Fibonacci 38.2% support at 1.4441 and daily 30SMA at 1.4403, remain as downside pivots and sustained break lower will re-open key support at 1.4350,08 Feb low.

Res: 1.4494; 1.4514; 1.4576; 1.4612

Sup: 1.4441; 1.4403; 1.4380; 1.4350

USDCAD

The pair returns to firm bearish mode, following yesterday’s break and close below 10SMA, which currently lies at 1.3854.

Today’s fresh weakness that extends below 1.3781, Fibonacci 61.8% of 1.3637/1.4014 upleg, signals an end of corrective phase and focuses key supports, daily Ichimoku cloud base / former low of 04 Feb at 1.3675/37, as fresh bearish acceleration dipped to psychological 1.3700 support.

Sustained break below 1.3637 to signal fresh bearish extension of larger pullback from 1.4688 and expose next support at 1.3589, daily 100SMA.

Meantime, corrective rallies are seen as positioning for fresh attempts lower, with hesitation on approach to 1.3675/37 pivots to be anticipated, as daily Slow Stochastic is approaching oversold territory.

Only return and close above 10SMA would sideline immediate downside threats and signal prolonged consolidation.

Res: 1.3881; 1.3919; 1.3962; 1.4014

Sup : 1.3795, 1.3781; 1.3726; 1.3707

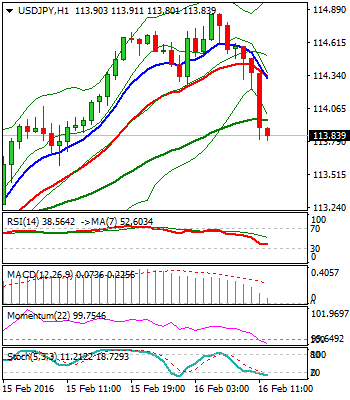

USDJPY

Two-day correction extended to fresh high at 114.85 today and is so far capped by falling daily 10SMA, which guards pivot at 115.06, Fibonacci 38.2% retracement of sharp 121.67/110.97 fall.

Subsequent pullback is looking for 113.30 support zone, Fibonacci 38.2% of 110.97/114.85 upleg / top of thick hourly Ichimoku cloud, where dips should be ideally contained, to keep freshly established hourly bulls in play, for renewed attempt at 115.06 breakpoint.

Otherwise, initial signal of recovery stall will be generated on sustained break below 113.30 pivot.

Next downside breakpoint lies at 112.50, hourly Ichimoku cloud base / Fibonacci 61.8% retracement.

Res: 114.27; 114.85; 115.06; 115.95

Sup: 113.58; 113.30; 112.90; 112.50

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.