The Euro slid below 1.06 handle, after weaker-than-expected EU inflation data, signaled that bounce from near-term base, established at 1.0556, could be short-lived. Quick acceleration lower, which followed repeated rejection at 1.0630, daily 10 SMA, surged through hourly Ichimoku cloud, to find footstep at 1.0580.

Structure of near-term studies is weak and sees increased risk of return 1.0556 base. In addition, firm bearish setup of daily technicals, favors limited recovery attempts, ahead of fresh push lower, which will be looking for key med-term support at 1.0461, 12 Mar yearly low.

Meantime, prolonged consolidation could be anticipated while 1.0556 base holds, with 10SMA expected to cap.

Only rallies above falling daily 20SMA, currently at 1.0682, would delay immediate bears.

Res: 1.0613; 1.0635; 1.0682; 1.0737

Sup: 1.0580; 1.0556; 1.0519; 1.0461

GBPUSD

Cable accelerated lower, on the third wave of pullback from 1.5125 and approaches psychological 1.50 support. Two-day recovery rally on failure t 1.50 support, was short-lived and stalled at 1.5125, Fibonacci 38.2% of 1.5334/1.4992 descend / falling daily 10SMA. This kept intact more significant barrier at 1.5188, weekly Ichimoku cloud base, which marks the breakpoint.

Fresh weakness brought near-term bears back to play, while overall picture remains negative and looks for renewed attempt through 1.50 pivot. Firm break here is expected to open another strong support at 1.4900, weekly bear-channel support.

Better-than-expected US ADP data additionally boosted the greenback and support scenario of final surge through 1.50 support.

Res: 1.5030; 1.5056; 1.5085; 1.5125

Sup: 1.4992; 1.4941; 1.4900; 1.4860

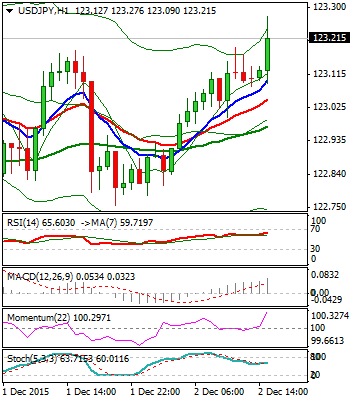

USDJPY

The pair regains traction and rises above 123 handle, after yesterday’s bearish Inside Day did not significantly affect price action. Rising daily 20SMA continues to underpin, after yesterday’s weakness managed to close marginally above it.

However, repeated failures to close above 123.17, cracked Fibonacci 61.8% retracement of 123.74/122.24 downleg, so far limit upside attempts, as two consecutive upside rejections occurred at 123.30 zone.

Daily studies hold firm bullish tone and support final break above 123.17/30 barriers, for extension towards near-term target at 124.74.

Initial supports lay at 122.87, daily 20SMA and 122.62, yesterday’s low, guarding 122.25/20 breakpoint.

Res: 123.32; 123.59; 123.74; 124.50

Sup: 122.87; 122.62; 122.20; 121.75

AUDUSD

Aussie remains well supported and consolidates under today’s marginally higher high at 0.7340, ahead of final attack at key 0.7380 barrier, high of 12 Oct. Yesterday’s extension of rally from 0.7168, 30 Nov higher low, left long bullish daily candle, which confirms strong bullish stance for full retracement of 0.7380/0.7014 downleg.

Technicals of all timeframes maintain firm bullish setup for further upside, however, hesitation on approach to key 0.7380 barrier could be anticipated, as daily slow Stochastic is breaking into overbought zone.

Rising daily 10 SMA which currently lies at 0.7240, offers good support and should act of ideal reversal point for corrective dips.

Res: 0.7340; 0.7361; 0.7380; 0.7435

Sup: 0.7302; 0.7275; 0.7240; 0.7214

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.