EURUSD

The Euro trades in sit and wait mode, as EU/Greek negotiations are entering critical phase. Choppy trading is seen in past two days, holding above fresh low of 23 June at 1.1134, reinforced by thick daily Ichimoku top and daily Kijun-sen line, few ticks lower that marks the lower limit of near-term congestion. Also, not much of the upside action was seen so far, as daily 20SMA, broken on Tuesday’s fall, now caps near-term action and marks the upper boundary. Overall picture still shows bullish elements, while lower timeframes show neutral/negative stance, as the pair awaits verdict from marathon meeting. Bearish resumption is expected on penetration of daily cloud top and Kijun-sen support and could extend to Fibonacci 61.8% of 1.0818/1.1434 upleg at 1.1053, with psychological 1.10 support, expected to come in focus. Alternative scenario sees lift above daily 20SMA, for test of daily 10SMA at 1.1274 and broken bull-trendline at 1.1283, with fresh acceleration seen on clear break higher, also to confirm higher low formation.

Res: 1.1228; 1.1274; 1.1283; 1.1304

Sup: 1.1150; 1.1140; 1.1126; 1.1053

GBPUSD

Near-term tone remains weak, as Cable extended weakness through daily 10SMA / Kijun-sen supports, to find footstep at 1.5664, yesterday’s low. Today’s action shows near-term basing attempt, as the pair bounces off narrow consolidation and returns above daily 10SMA. However, near-term structure remains weak, as the price hold below initial hurdle at 1.5765, Fibonacci 38.2% of 1.5928/1.5664, three-day pullback. Improvement of near-term studies requires regain of 1.58 handle, yesterday’s high and lower top, where recovery rally stalled, with sustained break, to shift near-term focus higher. Otherwise, risk of early upside rejection and fresh weakness, will remain in play, for further correction of 1.5168/1.5928 bull-leg.

Res: 1.5765; 1.5800; 1.5835; 1.5865

Sup: 1.5711; 1.5675; 1.5664; 1.5623

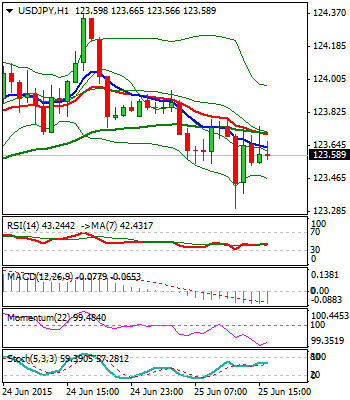

USDJPY

The pair remains in range play, following yesterday’s rejection under 124.42 pivot / range top and subsequent pullback. Fresh weakness, seen today, extended lower and cracked daily 10SMA at 123.38 that marks lower pivot. Near-term technicals are weak, with bearish daily momentum studies, maintaining the downside risk. Daily close below 123.30, to confirm negative stance and expose the lower side of two-week 122.44/124.42 range. Conversely, return above psychological 124 barrier, below which today’s action was capped, is required to shift near-term focus towards 124.36/42 pivots.

Res: 123.78; 124.00; 124.42; 125.04

Sup: 123.30; 123.00; 122.55; 122.44

AUDUSD

Aussie dollar pared yesterday’s losses that bottomed at 0.7681 and closed day in red, as today’s recovery action stabilizes in the upper side of near-term 0.7678/0.7769 range. Rallies were so far capped by daily Tenkan-sen at 0.7745, guarding pivotal 0.7769 barrier, yesterday’s high, reinforced by daily Kijun-sen / 100SMA. Neutral near-term tone signals further sideways trading, with break of either side of congestion, required to establish fresh direction. Rally through 0.7769 pivot, to open psychological 0.78 level and shift focus towards key barrier at 0.7847, 18 June top and daily Ichimoku cloud base. Otherwise, violation of near-term base at 0.7678, would risk return to key short-term support and range base at 0.76 zone.

Res: 0.7747; 0.7769; 0.7800; 0.7846

Sup: 0.7722; 0.7700; 0.7678; 0.7643

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.