Following the tumultuous start to the year, the first quarter saw the equity markets managing to recover from the initial bout of strong losses. The central bank decisions in the first quarter had something to do with it as the Federal Reserve switched sides to come out strongly dovish following the start of a rate hike cycle in 2015 December. The soft talk managed to help push the equities, which were hit by tighter monetary policy conditions and a global slowdown in the markets. By March end, a broad turnaround in the manufacturing sectors increased hopes of a recovery taking place. US ISM manufacturing PMI managed to expand, rising above the 50-level in the index for the first time in November/December of 2015, while China's manufacturing PMI also managed to make some gains following a bad start to the year.

Another major theme from the first quarter which was weighing on investors’ minds was the rather subtle approach by global central banks. The US dollar was subtly talked down, while Mario Draghi seemed unconcerned on the euro's rally post the March ECB meeting which saw strong policy decisions being made. This led many to believe that central bankers might have struck a deal at the earlier G20 summit not to indulge in currency wars.

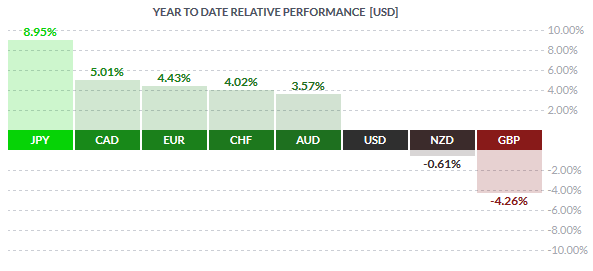

There was some kind of hope as most of the commodity linked currencies posted strong gains including the Canadian dollar and the euro while the British Pound was the exception to the case.

As the second quarter began however, the markets are starting to see a bit of the currency wars coming back. More recently, April's RBA statement brought back the reference to exchange rates. In the statement, the RBA said "The Australian dollar has appreciated somewhat recently. In part, this reflects some increase in commodity prices, but monetary developments elsewhere in the world have also played a role. Under present circumstances, an appreciating exchange rate could complicate the adjustment under way in the economy."

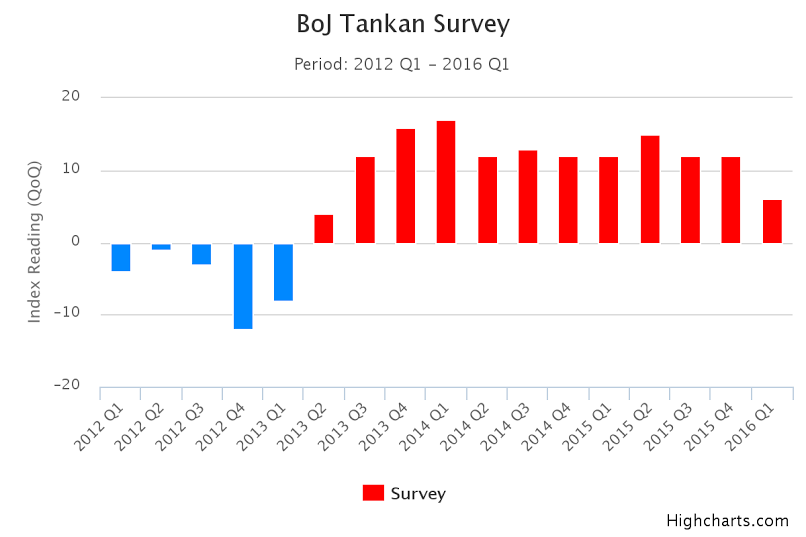

Meanwhile, officials in Japan are clearly worried on the appreciation of the yen which has made strong progress into the year. Although refraining from directly talking down the currency, Japanese officials sent a stern warning to speculators in reference to the yen’s exchange rate which has been clearing hitting business sentiment in an export oriented economy. This was followed by Japanese Premier, Shinzo Abe stating that central banks should refrain from actively devaluating their currencies, in a veiled attempt but clearly pointing to the Federal Reserve. This comes in light of Janet Yellen’s recent dovish remarks on US rate hikes which sent the dollar weaker across the board.

It could be only a matter of time before more such talk comes out in the open. Recently, Canadian trade deficit data showed a widening in the deficit as exports fell in the month of February as investors were concerned that following a strong 0.60% monthly GDP growth in January, the Canadian economy could start to flip over again. While previous gains came upon a weaker exchange rate of the CAD, it is quite evident that the recent appreciation is starting to take a toll on the economy already. On a year to date basis, the Canadian dollar has gained over 5.0% to the US dollar and a continued appreciation in the exchange rate could mean further weakness unless Oil prices start to post a strong rebound.

In conclusion, it is too early to tell whether central bankers have indeed agreed not to talk down their currencies but there is growing evidence that regardless of whether a deal was struck or not, export and commodity oriented economies are likely to feel the heat of a weaker dollar. Perhaps, currency wars will indeed make a comeback sometime this year.

AllFXBrokers does not bear any responsibility for losses incurred from depositing with brokers we list or advertise. If in doubt please seek independent investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.