- AUD is currently enjoying a period of stable interest rates

- The downside pressure seems to be abating with a recovery in the commodity markets

- Australian economy continues to shift away from a commodity based economy with investments continuing to rise in the non-mining sector

While the markets are large priced in a no rate hike at the March meeting, there was a bit of skepticism as far as the tone of the Fed statement went, with expectations that the dovish no rate hike would be offset by a hawkish tone. Fortunately or unfortunately, the Fed opted to come out dovish, thereby sending the trade weighted US Dollar Index to a 5 month low.

The outcome of the Fed's meeting has been that the other Central banks who have been active in keeping their exchange rates low relative to the US Dollar were caught off guard. With the US interest rates likely to grow at a gradual pace, the search for high yield currencies continue. While emerging markets are a good starting point, it does come with significant risk of volatility and rather strong and surprise policy changes.

For the average retail forex trader looking for a high yield currency, the Australian dollar is likely to be offer more. The RBA's benchmark lending rates currently stands at 2.0%, and have remained at 2.0% since May of 2015. Incidentally, the Australian dollar has always stayed a favorite among speculators who often call for the RBA rate cuts, for just about any reason.

At its latest policy meeting in early March of 2016, the Reserve Bank of Australia said that domestic growth remains slightly above par and that there was reasonable confidence that there were prospects for continued growth in the Australian economy, while noting that the RBA would maintain an ‘accommodative’ monetary policy.

Speculators would have continued to call for another rate cut, but thanks to February’s unemployment rate falling back to 5.80%, from January’s surprise 6.0% spike, the Aussie is likely to enjoy a brief period of quiet rally, supported by stable interest rates, easing speculation on rate cuts, weaker US Dollar and a broad commodity rally (regardless of how long it may last).

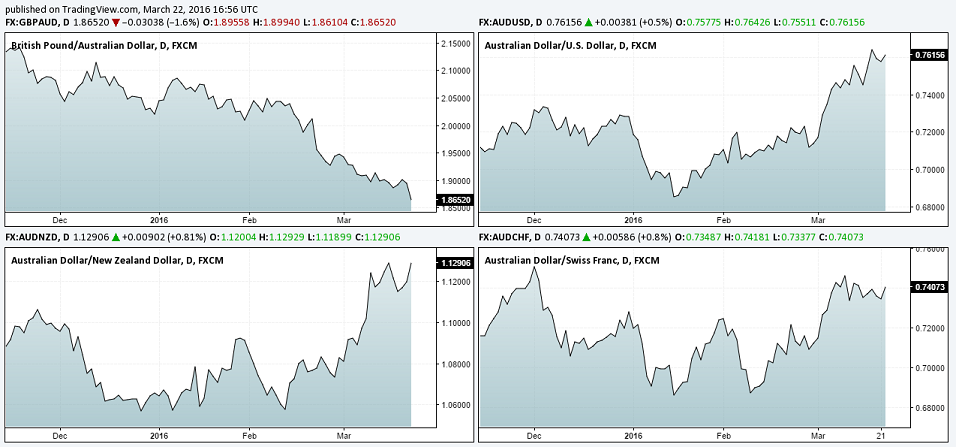

AUDUSD recently cleared the $0.76 handle and looking back, it was not so long ago that the RBA’s board member John Edwards preferred to see the Aussie trade near $0.65 which according to him was a more preferred exchange rate. With prices above the $0.76 handle, AUDUSD is likely to aim for $0.78, a level that could definitely turn even the more optimistic bull cautious. RBA Governor Glenn Stevens, spoke at an event earlier today in Sydney and the Aussie was trading cautious ahead of the speaking engagement, prepared for any dovish rhetoric to talk down the currency. However, the RBA Governor seemed rather relaxed today at the Aussie’s exchange rate which seems to clear a short term hurdle for the AUD.

On a year to date basis, the AUD is currently up by over 4.0% against the US Dollar, and has performed much better against the British Pound which seems to be the preferred currency to sell in light of the Brexit uncertainty. GBPAUD has notched gains of over 6.0% and there looks to be a lot more juice left in this trade. With most of the central banks (BoJ, ECB, SNB) talking about negative interest rates, the Australian dollar remains an attractive currency which has more leg to the upside in store.

AllFXBrokers does not bear any responsibility for losses incurred from depositing with brokers we list or advertise. If in doubt please seek independent investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.