At the April meeting, before the 25 May 2015 25 basis point OCR rate reduction, the Reserve Bank of Australia had left the OCR at 2.25% noting that “...Commodity prices have declined over the past year... ...These trends appear to reflect a combination of lower growth in demand and, more importantly, significant increases in supply... ...Prices for key Australian exports have also been falling... ...it appears likely that inflation will remain consistent with the target over the next one to two years, even with a lower exchange rate...”

It seemed that the RBA well understood and accurately projected the global situation. So then, why didn’t the RBA continue lowering rates? The answer might have to do with concerns over inflating property values. The RBA directly referred to that. “...Dwelling prices continue to rise strongly in Sydney, though trends have been more varied in a number of other cities. The Bank is working with other regulators to assess and contain risks that may arise from the housing market. In other asset markets, prices for equities and commercial property have risen, in part as a result of declining long-term interest rates...”

The RBA made note for the need to regulate investor lending at both the April and May meetings. “...The Bank is working with other regulators to assess and contain risks that may arise from the housing market...” Hence, the RBA needed to wait until legal regulations were put in place to check rising housing prices. Indeed, the RBA was able to reduce by 25 basis points at the May meeting just a few weeks before new lending regulations and foreign investment regulations were put into place. The combination of lending restrictions as well as the 25 basis point reduction now gave the RBA greater flexibility to deal with the regional economic slowdown. Perhaps this two month wait for regulation enforcement gave the RBA pause to think. As a result the RBA correctly called the ‘new normalized’ rate at 2.00%, as time proved further rate reductions would have accomplished little in the face of deteriorating commodity demand. Further, the 2.00% base rate was sufficient to govern reduced economic growth. The RBA would stick with the 2.00% OCR.

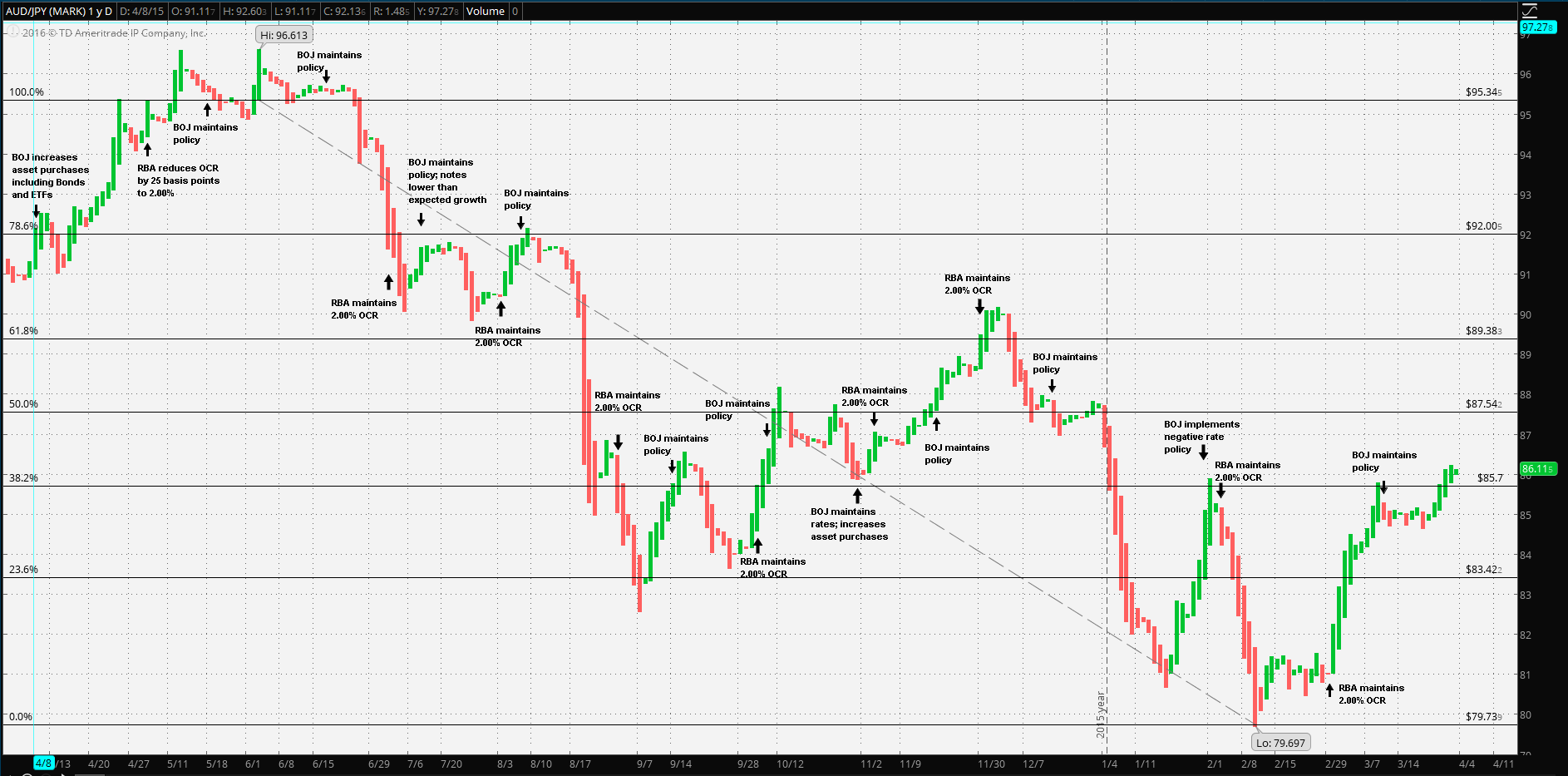

The Bank of Japan might have been wishing for similar results through its policy management, but that wasn’t the case. At the 8 April 2015 meeting the BOJ decided to increase Yen liquidity by increasing its asset purchases of JGBs and ETFs. The BOJ’s assessment was encouraging but contained. “...Japan's economy is expected to continue its moderate recovery trend... ...Risks to the outlook include developments in the emerging and commodity-exporting economies... ...the risk of low inflation rates being protracted in Europe...” The BOJ did call it correctly but perhaps was too cautious in subsequent policy decisions. Shortly after the BOJ May policy meeting, the Yen attained its 52 week low vs the Aussie at ¥96.613 per.

That low point marked the beginning of a 14.55% strengthening trend to ¥82.55 per Aussie. The trend leveled off a bit in July when the BOJ noted that economic growth would be lower than expected with concerns over “...the debt problem and the momentum of economic activity and prices in Europe...”

The strengthening trend resumed immediately following the August meeting at which the BOJ maintained it accommodative policy and did so during extreme regional market volatility. On 9 September, the Yen reached an intermediate 52 week high vs the Aussie at ¥82.85. From there traders may have been expecting some action, especially after the previous year’s October surprise. The Yen began to weaken, but the BOJ did not act at the 8 October meeting. The trend leveled off perhaps in anticipation of action at the November meeting. This time the surprise might have been BOJ inaction; there was little change in the statement wording. AUD/JPY traded between ¥85.70 support to ¥89.38 resistance even through the December meeting, at which the BOJ, again, took no action.

At this point it’s worth noting that had China’s markets not unraveled just when the calendar turned to 2016vii, the AUD/JPY cross might have carried on that way for some time. The RBA had made clear that it had no intentions of reducing its OCR unless absolutely necessary. After all, hosing prices had been collared and the economy was dampened mainly due to commodity demand deterioration. As for the BOJ, they must have been seeing something in their data with which they were satisfied with their current policy. All was well until PRC markets corrected sharply.

It’s also worth looking back at the above mentioned inflating Australian housing market in early 2015. One problem for the high bidding was due to capital investment from China. The new regulations put into place stemmed the flow of foreign capital. Hence, panicked capital in the region might have ‘funneled’ into Yen during the crisis, and not into Australian property.

AUD/JPY broke out of its range early in 2016 with the Yen spiking 6.13%, then retracing, testing and failing at ¥85.57 then to its 52 week best vs the Aussie at ¥79.697 just days after the BOJ responded to the strengthening Yen by implementing the negative rate policy! The Yen has since given up its gains vs the Aussie, but the retracement coincides with conditions in Asian markets stabilizing. It seems to indicate that the BOJ is extremely hesitant to increase their QQE except under the most dire of circumstances.

Hence it’s reasonable to conclude that the AUD/JPY is likely to move more on external conditions rather than domestic monetary policy, if any, and then it seems that the cross will be more of a function of the Yen than the Aussie.

Risk warning: Spreadbetting, CFD trading and Forex are leveraged. This means they can result in losses exceeding your original deposit. Ensure you understand the risks, seek independent financial advice if necessary. The value of shares and the income from them may go down as well as up. Nothing on this website constitutes a solicitation or recommendation to enter into any security or investment.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.