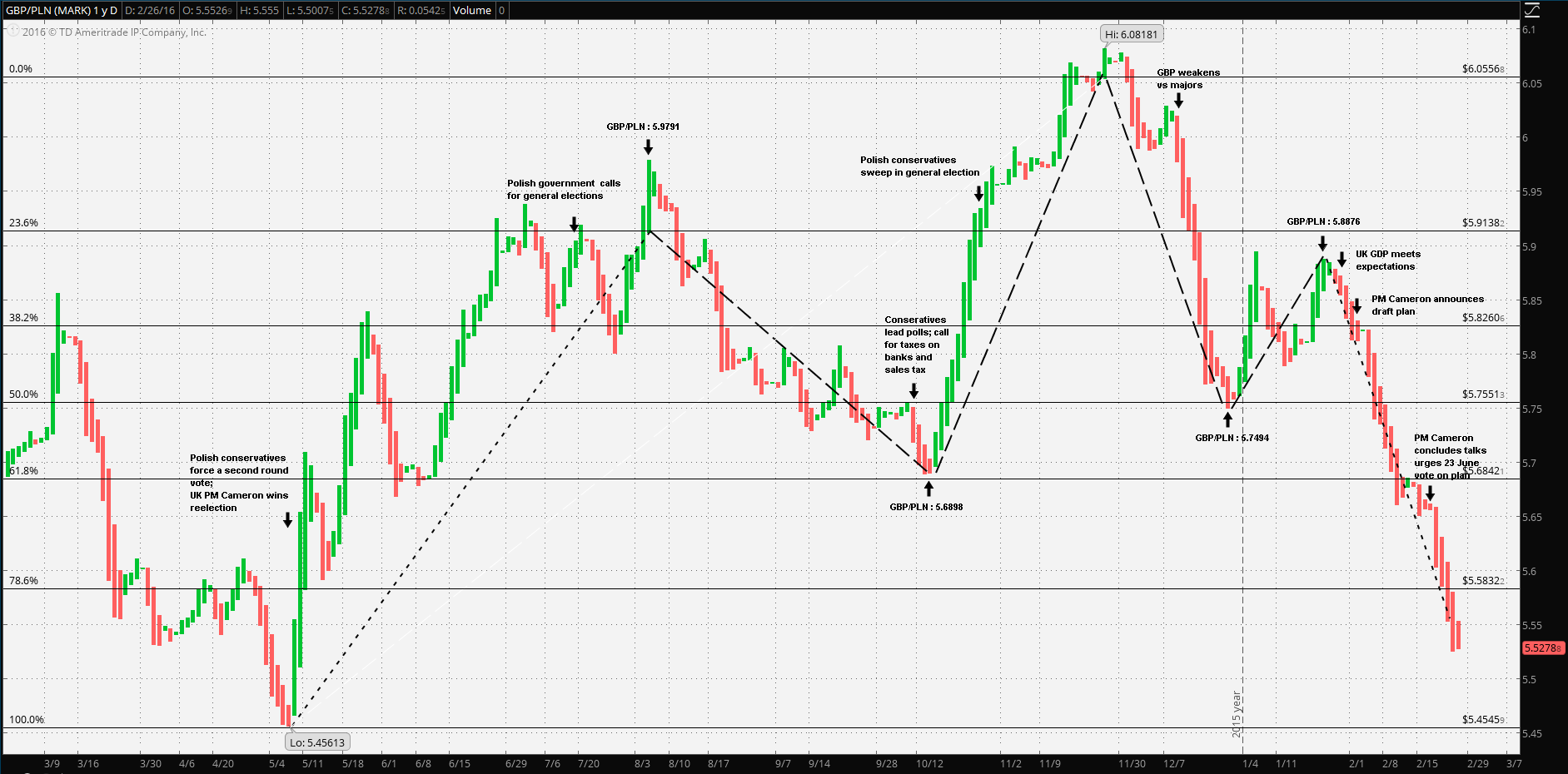

At this point ‘Brexit’ concerns began to take root and a sharp weakening of the pound took the cross to zł5.5540 per, a mere 1.794% above its 52 week low.

Although not ‘textbook perfect’ the chart demonstrates a head and shoulders top, confirmed by the recent decline of Pound Sterling against the majors, as well as non-Eurozone EU currencies. The question then becomes that of the driving factors which formed the pattern. In particular, will the Zloty continue to gain on Sterling?

Polish elections were being decided in May of 2015. The issues reflected a growing conservative populist movement. In the first round of elections, the Law and Justice party unexpectedly forced a run-off second roundi against the incumbent, moderate ‘Civic Platform’. It wasn’t simply a matter of populist-politics, per se. Not unlike several CEE EU member states, Poland’s foreign mortgage issue still weighed on individuals as well as the banking system. In particular, the rising ‘Law and Justice’ party was calling for the banks to ‘bear the brunt’ of the cost of relieving mortgage holdersii. From the GBP/PLN May low, the weakening Zloty may have been election related.

An election played a part in the results on UK side of the narrative as well. Conservative incumbent Prime Minister David Cameron succeeded in his reelection campaign. PM Cameron was also faced with the potential secession of Scotland from the UK, hence may have been forced to secure his reelection by aligning himself with pro EU-reforms coalitionsiii. Although the PM had more leverage after his reelection, he would have to now make good on his promise for a referendum vote. However, PM Cameron had played for time, establishing a 2017 deadline for the referendum vote; or so it was thought.

Initially, the driving factor may have been more Zloty than Pound Sterling. By the end of May, the second round had put the Polish conservatives in power. Aside from the foreign mortgage issue the new president Andrzej Duda was a ‘moderate Eurosceptic’, had also promised to ‘renegotiate’ Poland’s commitments in the EU in order to make the relationshipiv more “distinct”. What might have moderated the new government’s stance was the political reality that the Polish economy was one of the better performing economies in the EU, in large part due to with its manufacturing relationship with Eurozone member, Germany. In June, National Bank of Poland’s Governor Marek Belkav promised to keep the policy rate at 1.5%: “...Something extraordinary would have to happen to change our view that rates should be kept unchanged... ...For now, we’re not seeing anything of this kind...” It’s reasonable to conclude that the Zloty was reflecting the NBP policy and the economy, more than it was responding to the newly elected government.

With the momentum of public opinion shifting towards the conservatives a general election was called; it would take place in Octobervi 2015. The conservatives promised to take Poland out of the EU mainstream. Indeed, the chart demonstrates the strengthening Zloty as the nation approached the October elections and then the reversal as it became clear that the conservatives would gain a majority in parliament; which they did 26 Octobervii. The GBP/PLN cross rose sharply to its 52 week high. It is about this point where the driving currency of GBP/PLN would shift from weakening Zloty, and to Pound Sterling.

On 15 October, PM Cameron “quickened the pace” of EU negotiationsviii however, the 2017 deadline was still in place at this time. What seems to have taken the market by surprise was this quickened pace, indeed. Non-stop negotiations ended 19 February, PM Cameron having won concessions from the EUix. Markets must have assumed the worst for the UK’s position in the EU. From 25 January, through the summit and after PM Cameron announced the 23 June referendum vote, well ahead of the original deadline of sometime in 2017, Pound Sterling weakened against the majors as well as many non-Eurozone member nations, which of course includes the Zloty. A recent S&P downgrade of Polish debt was likely due to concerns of NBP independence; Moody’s and Fitch, however, maintained ratings. Further, in spite of global market volatility, the Polish economy was doing reasonably well. In a 19 February Bloomberg interviewx, Poland’s Finance Minister expressed confidence in EUR/PLN and that the Central Bank would maintain its independence. In fact, Finance Minister Pawel Szalamacha likened to appointment of NBP board members to the upcoming US Supreme Court nomination.

It’s clear that the Pound Sterling will remain weak as long as the polls remain uncertain. Hence, the trend to keep an eye on is the referendum polls. The populist political party would never risks jobs, particularly in front of the UK 23 June vote.

Hence, should the trend indicate support for PM Cameron’s efforts, markets will regain confidence in Sterling. Whereas, the new conservative Polish government may drag its feet when it comes to keeping campaign promises. The likely path for GBP/PLN will depend more on Sterling, than Zloty.

Risk warning: Spreadbetting, CFD trading and Forex are leveraged. This means they can result in losses exceeding your original deposit. Ensure you understand the risks, seek independent financial advice if necessary. The value of shares and the income from them may go down as well as up. Nothing on this website constitutes a solicitation or recommendation to enter into any security or investment.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.