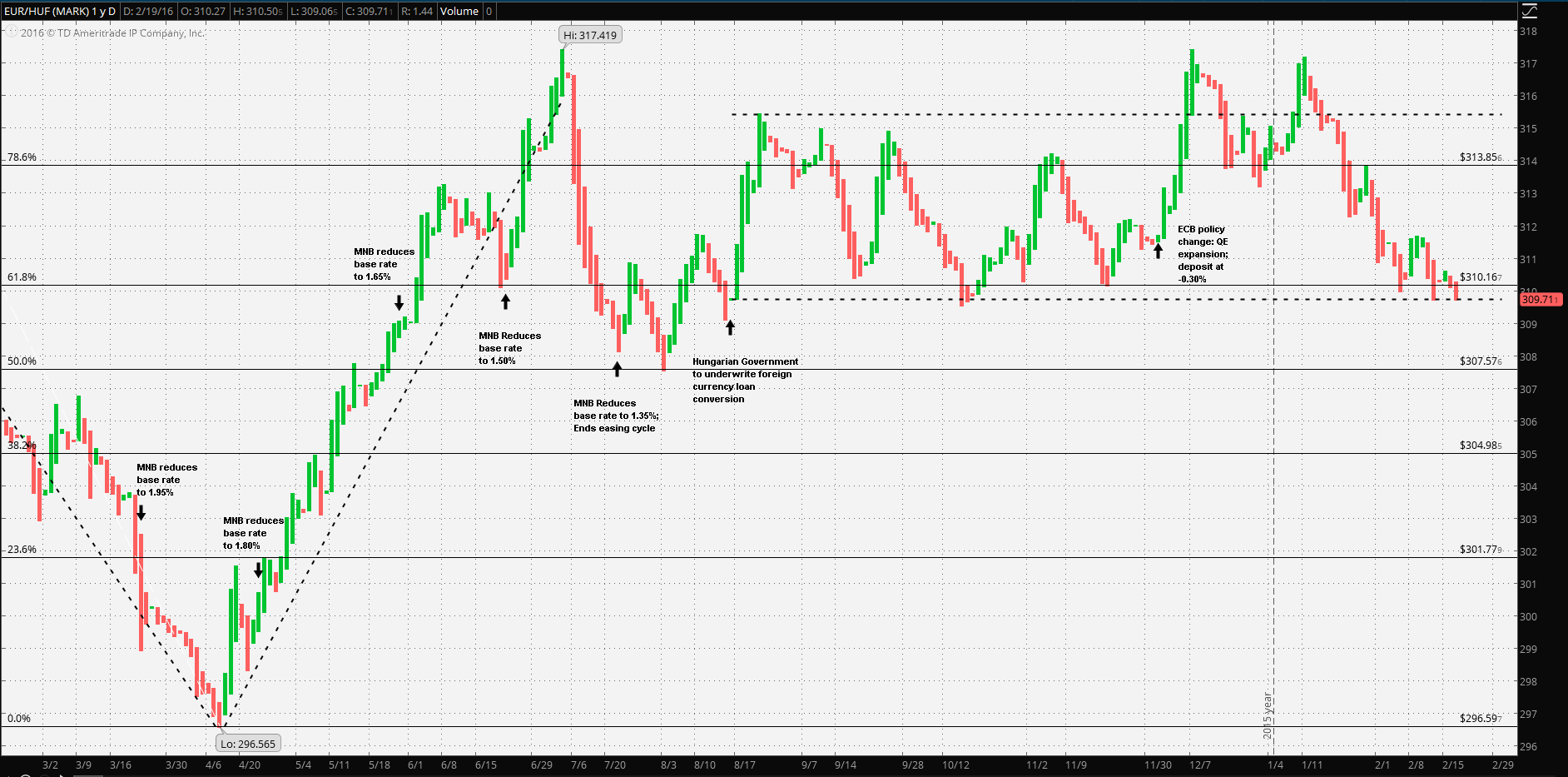

However, the most striking feature demonstrated in the chart is the relative stability of the Euro-Forint exchange after the foreign mortgage debate was resolved: not more than a 1% variation from the simple average from 18 August; well within an acceptable range of the official exchange rate of 309.85. It remained so until the 3 December ECB 10 basis point reduction of the overnight deposit rate to negative 0.30%.

It’s worth noting a few key comments in the intervening period from the last rate reduction in July until the 3 December ECB meeting. For instance, at the August meeting the MNB like other EU members had expected inflation to gradually increase going forward: “...Core inflation is likely to rise gradually as domestic demand picks up; however, the continuing decline in commodity prices may moderate the increase in the consumer price index...” The MNB also expressed its concerns over China and over the future rate decisions of the Fed: “...global risk appetite deteriorated, reflecting uncertainty about Chinese capital market... ... as well as an impending interest rate increase by the US Fed...” There was no mention of the ECB.

Inflation, or the lack thereof, continued to be an ongoing concern of the MNB as noted in the 20 October statement but still expressed optimism: “...Consumer prices fell in September 2015. Core inflation was broadly unchanged... ...Inflation is expected to move to positive territory in the coming months... ... and is only likely to rise to levels around 3 per cent at the end of the forecast horizon...” The MNB gently expressed its disagreement with the Fed’s expected rate increase: “... concerns over growth prospects in emerging economies had a negative impact on global appetite for risk. Global financial market environment improved in the second half of the period as market expectations of the Fed’s interest rate increase were postponed...”

At the 17 November meeting the ECB came into play: “... the ECB’s communication suggesting that it would adopt a looser monetary policy stance looking forward... ...Conditions in Hungarian financial markets were characterised by increased volatility, with the forint depreciating slightly against the euro...”

The next meeting, 15 December was held well after the ECB meeting of 3 December and coincided with the Fed’s 15-16 December meeting. The after-the-fact wording was unchanged from the previous statement: “...the main factors affecting appetite for risk were the ECB’s communication suggesting that it would adopt a looser monetary policy stance...” Surprisingly, EUR/HUF weakened, breaking out of its channel shortly after the ECB announcement 3 December.

The most recent meeting 26 January the MNB noted a continued gradual increase in core inflation as well as concerns over the lack of domestic economic growth. The main concern, however shifted from the ECB and Fed to China: “...risk indicators rose significantly... ... in response to unfavourable macroeconomic data from China, the fall in the Chinese equity market and the significant drop in oil prices...”

The most important point was the bank’s expressed satisfaction with “...unconventional, targeted monetary policy instruments... ... facilitate a decline in long-term yields... ... consequently... ... loosening in monetary conditions. Forward-looking money market real interest rates are in negative territory...”

As far as the base rate, the bank was specific: “...the current level of the base rate and maintaining loose monetary conditions for an extended period... ... are consistent with the medium-term achievement of the inflation target ...”

It all leads to the key point in the concluding paragraph: “...the Council closely examines developments in the foreign monetary environment, particularly the measures of the European Central Bank...”

All other issues aside, the Magyar Nemzeti Bank has a good hand at the helm. The MNB has carefully offset the exogenous deflationary effects with an expansionary policy which keeps the Forint at levels which support its export economy with its most significant trade partners in the EU and particularly in the Eurozone.

It’s reasonable to expect the MNB to maintain its three month MNB deposit facility as well as maintaining the Forint at 309 support to 317 resistance. Further, it’s reasonable to expect the MNB to do so, should the ECB continue easing.

Risk warning: Spreadbetting, CFD trading and Forex are leveraged. This means they can result in losses exceeding your original deposit. Ensure you understand the risks, seek independent financial advice if necessary. The value of shares and the income from them may go down as well as up. Nothing on this website constitutes a solicitation or recommendation to enter into any security or investment.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.