Recent comments by ECB Vice President Constancio has pointed out that compared to other central bank policies, the ECB “has the scope” to ease further if necessary: “...the total amount we have purchased represents 5.3 percent of the GDP... ...what the Fed has done represents almost 25 percent of the U.S. GDP, what the Bank of Japan has done represents 64 percent of the Japanese GDP and what the U.K. has done 21 percent of the UK’s GDP... ...So we are very far from what the major central banks have done... ...[therefore] there is scope, if the necessity is there...” There are many ways to interpret the statement. It might have been a simple matter of factual observation, it may have been a suggestion that the ECB can defend the Euro much more aggressively or perhaps signaling that more aggressive ECB asset purchases is in the works. On 23 September, ECB President Draghi reiterated Mr. Constancio’s statements in testimony to the EU parliament.

So the question becomes that of ‘what-if’. Will the ripples out of the Asia-Pacific economic region ‘negatively’ impact the Euro?

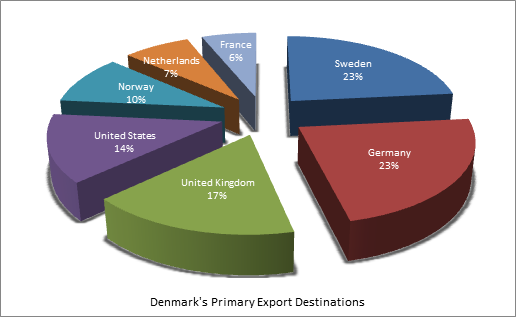

Over 57% of all Danish exports are concentrated in its top 7 trade partners. Its #1 trading partner is Sweden, accounting for 13.25% of all Danish exports and about 24.4% of the top 7 destinations. Next is Eurozone member Germany, which accounts for 23.66% of those top export destinations. Third in line is the United Kingdom, accounting for 16.65% of the top tier, followed by the United States at 13.5% of the top tier; Norway, almost 10% of the top tier; Netherlands, 7.43% of top tier and lastly France at 6.11% of top tier. The whole point of the matter is that Sweden, the U.K., the US and Norway, comprising 36% of Denmark’s top export destinations, trade with their own currency. Additionally, Germany, the U.K. and the United States are currently the top performing advanced global economies; the U.S. and U.K. having relatively strong currencies. Germany, Norway, Netherlands and France being Eurozone members will hardly affect trade due to currency valuation since a Danish Krone is a virtual Euro.

Thus a weak Euro is a weak Danish Krone and an advantage for Denmark’s export economy, both inside and outside of the EU.

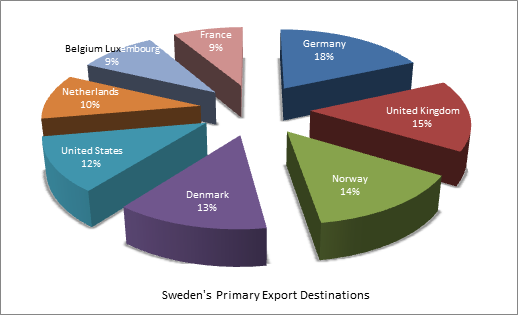

Just over 53% of Sweden’s exports are concentrated in its top 8 trade partners, Denmark ranking 4th with almost 7% of all exports and nearly 13% of the top tier. Of the top eight, 4 are Eurozone members, Germany, Netherlands, Belgium-Luxembourg, France plus Euro pegged Denmark; 60% of the top tier export destinations. A large portion of Swedish exports to its primary trading partners is refined petroleum, a commodity which currently lacks pricing power. A stronger Krona, or equivalently, a weaker Euro, will negatively affect Sweden’s mostly European centric, export economy.

The price/event chart demonstrates a sharp strengthening of the Swedish Krona vs the Danish Krone from a 9 month, 13 February high of 1.29087 to a 12 March low of 1.22309; a 5.42% advance. Within that span, Riksbank lowered its policy rates twice; in February, from -0.75% to -0.85% and then to -1.00% about a month later. These cuts were most likely in response to the DNB attempting to discourage ‘safe haven inflows’ by its Krone defense, possibly driving capital into the Crown. (The DNB went so far as to request the Danish government to postpone Treasury bill sales). Riksbank, concerned about a deflating Crown, initiated its own QE asset purchase program, acquiring short through medium term Swedish sovereign bonds. SEK weakened against the majors but not against DKK.

It’s possible that in his recent testimony, Mr. Draghi signaled that should the global economic contraction gain momentum, the ECB has the leverage to act. Riksbank does not have as much leverage as does the EU; its benchmark rates are already well negative. Had Riksbank reduced its benchmark rates at its last meeting and the global economy continues to worsen, it only would put the bank in a more difficult position.

The weight of weakening seems to fall on the side of the Euro, hence the Danish Krone. Hence, it would seem reasonable that the Swedish Crown continue to strengthen against the Danish Krone as long as the ECB continues to provide liquidity and signal that it is well prepared to intervene further, should it be necessary. Lastly, although Riksbank has proven itself to defend the Crown vigorously, will lower deposit rates have decisive impact vs the Euro, hence the Krone?

Risk warning: Spreadbetting, CFD trading and Forex are leveraged. This means they can result in losses exceeding your original deposit. Ensure you understand the risks, seek independent financial advice if necessary. The value of shares and the income from them may go down as well as up. Nothing on this website constitutes a solicitation or recommendation to enter into any security or investment.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.