Other issues causing growth concerns for BOK Governor Lee Ju-yeol is the very weakened Japanese Yen, down 11.648%, from ₩10.2352, 14 August 2014, finding support at a 52 week low on 5 June of ₩9.043 to the Yen. Further, China is outsourcing less and producing domestically more intermediate or finished goods that had previously been imported. The BOK actions were not unexpected as it were, more than half of analyst surveyed forecasting a rate reduction.

South Korea has a £1.195 trillion pound economy, ranking it 13th by IMF PPP-GDP rankings; £22759.5 per capita. Korea has mineral resources, coal, tungsten, graphite, molybdenum and lead. Over 23% of the labor force is in the industrial sector and over 69% in services. The largest component of GDP is household spending, 50.6%; government spending follows at almost 15% and fixed capital investment makes up almost 30%. South Korea’s unemployment rate is about 3.7% and sovereigns are well rated at A+, stable by S&P. The 10 year bond is currently yielding 2.50%.

South Korea is a major energy importer, 97% of its needs supplied from outside sources. Energy imports include crude oil, coal. LNG is shipped in as no pipelines serve the country; nuclear supplies 25% of the country’s power demands.

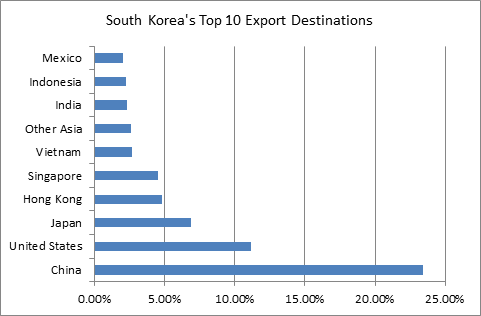

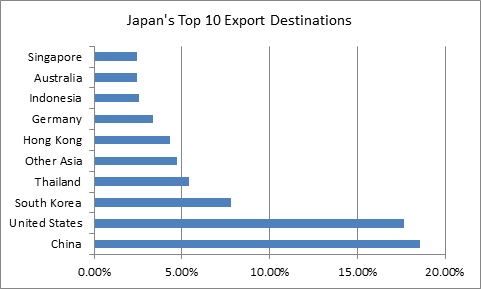

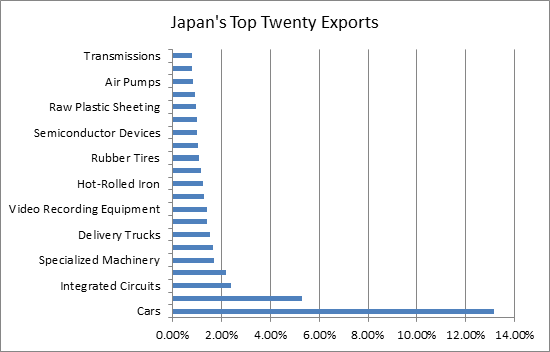

South Korea has an export dependent economy. The question becomes that of the economic health of export markets and that of competing Japanese exports. Clearly, Korea and Japan compete in export products and in export markets. So a weaker Won will make Korea’s product more competitive.

What event’s transpired which enabled the Yen to devalue relative to the Won? A few days after reaching its 52 week high of ₩10.2352 to the Yen and one month after initiating a £23 billion stimulus program, the BOK reduced the 7 day repurchase rate to 2.25% from 2.50% citing slow domestic growth, moderate global recovery and concerns about US monetary policy. There might have also been concerns over the Bank of Japan’s response to a -1.7% Q2 GDP contraction; -6.8 annualized

Towards the end of August, 2014 both South Korea and Japan export demand were contracting, particularly, exports to China. However, it needs to be noted that the Japanese economy was also adversely affected by a scheduled sales tax increase. The market was expecting something as the Won Strengthened to ₩9.7417, a decline of 4.78%iii and Korea’s current account surplus widened to £56 billion, a record high. Revisions to Japanese Q2 only confirmed the worse, now indicating an annualized -7.1% growth rate. By the end of September, Japanese factory output, consumer spending and real wages were contracting. During the same period, South Korea experienced a bounce in exports to the US and China, mostly in memory chips and petrochemicals, but domestic consumption remained weak. By the end of October, 2014 the Japanese government startled markets by announcing their intent to expand the current bond purchasing program. The announcement occurred only days after the BOK cut the 7 day repurchase rate another 25 basis points to 2.00%, after the tally of September exports to China, once again, declined. It was all downhill for JPY/KRW to the end of the year. South Korea ended the year measuring 2.7% growth for the year; below expectations. In March, the Bank of Korea once again cut the benchmark repurchase rate 25 basis points to another record low of 1.75%

JPY/KRW steadied in the first few months of 2015, trading in a range of ₩9.4703 support to ₩9.6088 resistance until the middle of May. At this time Asian currencies weakened on US Federal Reserve comments and a strengthening US Dollar. Japan’s GDP report on May 19 indicated two consecutive quarters of positive GDP growth, but the Yen continued to weaken against the Won. A week later BOK Governor Lee continued to express concerns over growth and indicated a further rate cut were not out of the question. The extraordinarily weak yen was beginning to show measurable results leading to the 52 week low of ₩9.043 to the Yen.

The unfortunate timing of the MERS outbreak further dampened consumer spending causing the BOK to reduce the repurchase rate another 25 basis points to 1.25%, its fifth consecutive record low in a year. The long back and forth between regional central banks ended with New Zealand cutting its cash rate 25 basis points and BOJ Governor Haruhiko Kuroda suggesting that further weakening in the Yen was unlikely.

Once again the key to any reversal would be increased demand especially from China, although demand from the US would be just as helpful. Since BOJ Governor Kuroda has opined on a stronger Yen, it’s reasonable to assume that further Yen easing is unlikely allowing for the Won to weaken, especially since the BOK still has room to cut rates again if need be.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.