According to the CME, the underlying for the option contract is one US Treasury Note futures contract. The underlying for each futures contract is one US Treasury 10 Year Note with a face value of $100,000. Each point move of the futures contract represents $1000.00.

The tick for the futures contract is ½ of a 32nd; that is to say in terms of a 64th. For example, a quote of 128 ‘03 represents 128 plus 3/32 whereas a quote of 128 ‘035 means 128 plus 3.5/32 which is just another way of saying 7/64. (Just multiply the numerator, 3.5, and the denominator, 32, by 2).

So the June US Treasury futures contract quote of 128 ‘30 works out to $1000 x (128 + 30/32) = $1000 x 128.9375 = $128,937.50 The tick size for the option contract with the underlying future works similarly. Each tick of the option contract is 1/64 of a futures contract point. That is to say (1/64 x $1000.00) = (0.015625 x $1000.00) = $15.625. The strikes are in half point increments, for example the June 129 strike is preceded by the June 128.5 strike and succeeded by the 129.5 strike.

Lastly, the pricing of the option contract is in terms of futures points. For example, the June 128.5 call is quoted at 1 “23. That means 1+23/64 = 1.359375 futures points. So that particular contact has a value of $1000 x 1.359375= $1359.375, not including fees and commissions. The June 130 option contract quote is 0 “54 meaning 0 + 54/64, hence has a market value of $1000 x 0.84375 = $843.75.

Once the archaic quotation system is squared away, the next question is what the situation is and what would be the best strategy to employ. A recent Bloomberg Business article titled, “No Joke, U.S. Treasuries Tend to Rally in the Month of April”, published on 1 April noted that US Government securities have gained in the month of April, every year from 2010 through 2014. One theory notes that the beginning of the Japanese fiscal year on the first of April requires new money to be put to work in the highest yielding, quality bonds. Among those investing in US Treasuries is the Bank of Japan itself, the third largest global investor in US Treasuries. The point being that global demand in the month of April is stronger.

The next consideration is that of the current state of mind of the Federal Reserve Board and the state of the US Economy. Recently, some hawkish Fed board members have publicly expressed their concern that the US economy no longer requires extraordinary measures and should lift its benchmark rate off the zero bound. On the other hand, the remaining voting members have reservations about the real strength of the US economy. Some insight may be seen in a recent Brookings Institute Blog written by Former Fed Chair, Mr. Ben Bernanke. It’s titled, “Why are interest rates so low?” In it he discusses a more comprehensive interest rate metric. To be brief, his view is that interest rates will remain relatively low. Lastly, one must consider the impact of a higher US benchmark rate on capital flows out of already yield depressed Europe and Japan.

Hence the trader in US Treasury Options may reasonably assume:

1) There’s a low likelihood of a rate increase in the near term and even if there is, it will not be the first of a sequence, as Chair Yellen had stated.

2) Exogenous demand will offset the ‘ripple effect’ across the spectrum of US Treasury securities in primary and secondary markets if there is an increase.

For a risk tolerant options trader, a bear credit spread seems to fit the bill.

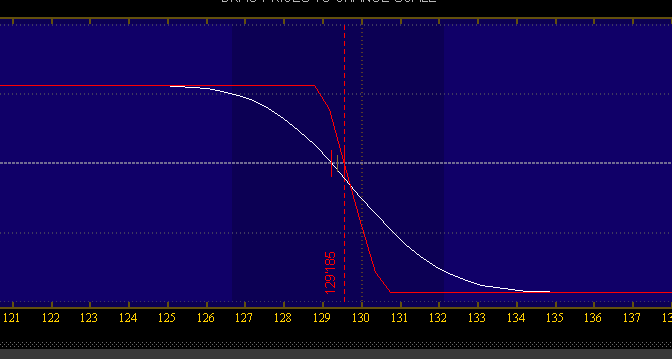

For example, with the expectation that the 10 Year Treasury Note will remain unchanged, or in a neighborhood of 129 by the May expiration, sell one May 129 call at 0 “57 and buy the May 130.5 at 0 “20. In decimal form that means sell the May 129 at $1000 x 57/64 = $890.625 and buy the May 130.5 at $1000 x 20/64 = $312.00. The maximum potential profit is $890.625 - $312.00 = $578.625 per position; losses are capped at $921 per position. Risk Profile Graph Time is on the trader’s side. First, the underlying is a futures contract, thus subject to Theta decay. Lift-off anxiety will certainly be higher in June than in May. Unless some event causes a rush to safety, the position will decay with time until the May expiration. Lastly, should fund managers sell ahead of the June Fed meeting, that’s a move in favor of the trader.

All things being equal, there seems to a better than even chance of this example, at the very least, expiring above breakeven. Spreadbetting, CFD trading and Forex are leveraged. This means they can result in losses exceeding your original deposit. Ensure you understand the risks, seek independent financial advice if necessary. The value of shares and the income from them may go down as well as up. Nothing on this website constitutes a solicitation or recommendation to enter into any security or investment.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.