During the last couple of weeks the Australian dollar has been able to stop the bleeding and trade within a wide range roughly between 0.8650 and 0.88. Prior to that it had experienced a sharp decline throughout September which saw it move from close to 0.94 down to below 0.8650 and an eight month low in the process. Despite the current resistance at 0.88, it was able to move through to a two week high above 0.8900 towards the end of last week before recently falling sharply below 0.87 again to finish out last week. The resistance level at 0.88 remains a factor and is continuing to place downwards pressure on price, however more recently all eyes have turned on to the support level at 0.8650 to see if the Australian dollar can remain above it. Several weeks ago the Australian dollar found some much needed support at 0.8950 and rallied back up to just shy of the key 0.90 level before resuming its decline. The long term key level at 0.90 was called upon to desperately provide some much needed support to the Australian dollar, which it did a little a few weeks ago, however it has more recently provided resistance.

Back at the beginning of September the Australian dollar showed some positive signs as it surged higher again bouncing off support below 0.93 and reaching a new four week high around 0.94 however that all now seems a distant memory. The Australian dollar reached a three week high just shy of 0.9480 at the end of July after it enjoyed a solid period which saw it surge higher through the resistance level at 0.9425 to the three week around 0.9480, before easing back towards that level. The Australian dollar enjoyed a solid surge higher reaching a new eight month high above 0.95 at the end of June, only to return most of its gains in very quick time to finish out that week. Since the middle of June the Australian dollar has made repeated attempts to break through the resistance level around 0.9425, however despite its best efforts it was rejected every time as the key level continued to stand tall, even though it has allowed the small excursion to above 0.95.

After the Australian dollar had enjoyed a solid surge in the first couple of weeks of June which returned it to the resistance level around 0.9425, it then fell sharply away from this level back to a one week low around 0.9330 before rallying higher yet again. Its recent surge higher to the resistance level around 0.9425 was after spending a couple of weeks at the end of May trading near and finding support at 0.9220. Throughout April and into May the Australian dollar drifted lower from resistance just below 0.95 after reaching a six month high in that area and down to the recent key level at 0.93 before falling lower. During this similar period the 0.93 level has become very significant as it has provided stiff resistance for some time. The Australian dollar appeared to be well settled around 0.93 which has illustrated the strong resurgence it has experienced throughout this year.

A measure of Australian consumer sentiment rose in October, steadying from a sharp fall in the previous month as households signaled they were more confident about the longer term economic outlook. The survey of 1,200 people by the Melbourne Institute and Westpac Bank showed the index of consumer sentiment rose a seasonally adjusted 0.9 percent in October, from September when it dropped 4.6 percent. “Households, who reacted negatively to the Commonwealth Government’s May Budget, may have been encouraged by recent announcements that a number of budget initiatives have been set aside for the time being,” said Westpac chief economist Bill Evans. The index reading of 94.8 in October was down 12.5 percent on the same month last year, with pessimists exceeding optimists for eight months in a row. The index for economic conditions over the next 12 months fell 5.2 percent, but that for conditions over the next five years climbed 5.5 percent. The measure of family finances compared to a year ago rose 4.4 percent, and that on the outlook for the next 12 months climbed 1.2 percent.

(Daily chart / 4 hourly chart below)

AUD/USD October 16 at 22:45 GMT 0.8754 H: 0.8829 L: 0.8685

AUD/USD Technical

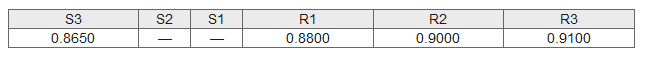

During the early hours of the Asian trading session on Friday, the AUD/USD is slowly but surely easing away from the resistance at 0.8800 after recently rallying well up to above the resistance level at 0.88 in the last couple of days. The Australian dollar was in a free-fall for a lot of last year falling close to 20 cents and it has done very well to recover slightly to near 0.95 again earlier this year. Current range: trading right around 0.8755.

Further levels in both directions:

- Below: 0.8650.

- Above: 0.8800, 0.9000, and 0.9100.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.