For the best part of the last couple of weeks the Australian dollar has traded close and around the 0.93 level after spending the preceding few weeks drifting lower from near 0.95 and so it remains there now. Earlier last week it fell lower to below the 0.93 level level and moved towards the previous key level at 0.9220, before rallying well to return to the 0.93 level where it is presently consolidating. Over the last month or so, it has generally been sliding lower from close to 0.95 down to its present trading levels around 0.93. A few weeks ago the Australian dollar surged higher to a one week high near 0.9375, before easing back and then falling sharply. It has done well of late to cling onto the 0.93 level after its sharp fall which saw it move from above 0.9400 down to a seven week low below 0.9240. Several weeks ago it was easing back below both the 0.9425 and 0.9400 levels with the former providing some resistance.

The Australian dollar reached a three week high just shy of 0.9480 a month ago after it enjoyed a solid period which saw it surge higher through the resistance level at 0.9425 to the three week around 0.9480, before easing back towards that level. The Australian dollar enjoyed a solid surge higher reaching a new eight month high above 0.95 at the end of June, only to return most of its gains in very quick time to finish out that week. Since the middle of June the Australian dollar has made repeated attempts to break through the resistance level around 0.9425, however despite its best efforts it was rejected every time as the key level continued to stand tall, even though it has allowed the small excursion to above 0.95. After the Australian dollar had enjoyed a solid surge in the first couple of weeks of June which returned it to the resistance level around 0.9425, it then fell sharply away from this level back to a one week low around 0.9330 before rallying higher yet again. Its recent surge higher to the resistance level around 0.9425 was after spending a couple of weeks at the end of May trading near and finding support at 0.9220. The 0.9220 level has repeatedly reinforced its significance as it is again likely to support price should the Australia dollar retreat further.

Throughout April and into May the Australian dollar drifted lower from resistance just below 0.95 after reaching a six month high in that area and down to the recent key level at 0.93 before falling lower. During this similar period the 0.93 level has become very significant as it has provided stiff resistance for some time. The Australian dollar appeared to be well settled around 0.93 which has illustrated the strong resurgence it has experienced throughout this year. For the best part of February and March the Australian dollar did very little other than continue to trade around the 0.90 level, although at the beginning of March it crept a little lower down to a three week low below 0.89. Towards the end of March however, the Australian dollar surged higher strongly moving to the resistance level at 0.93 before consolidating for a week or so.

Consumer confidence in Australia is back above its long-run average, according to the ANZ-Roy Morgan Weekly Confidence index released this morning. The index showed a 0.9% increase to 113.5 in the week ending Saturday the 24th of August. This weekly index has been volatile lately as consumers reflect and react to the various budget measures and the to-ing and fro-ing in the Senate. But ANZ sees a solid sign in the sub-indices within the index which suggest that the outlook for retail consumption is improving. “Importantly, the improvement was driven almost entirely by an 11.1% rise in household perceptions about their ‘financial situation compared to a year ago’, the subindex most closely correlated with consumer demand,” the bank said in the press release accompanying the index. “This is now above average levels (since 2001) and is an encouraging sign for consumer spending in coming months.” Warren Hogan, ANZ’s chief economist, was really positive about the impact of the bounce in the index, saying that: “Signs that consumer confidence is bouncing back, combined with strengthening business surveys, gives us more confidence that the non-mining recovery remains on track.”

(Daily chart / 4 hourly chart below)

AUD/USD August 26 at 23:30 GMT 0.9311 H: 0.9312 L: 0.9302

AUD/USD Technical

During the early hours of the Asian trading session on Wednesday, the AUD/USD is trading in a small range right above 0.93 after spending the last week trading around it. The Australian dollar was in a free-fall for a lot of last year falling close to 20 cents and it has done very well to recover slightly to well above 0.95 again. Current range: trading right around 0.9310.

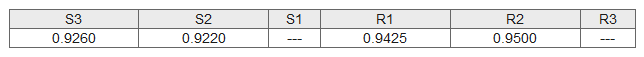

Further levels in both directions:

- Below: 0.9260, and 0.9220.

- Above: 0.9425 and 0.9500.

Recommended Content

Editors’ Picks

AUD/USD: Further losses retarget the 200-day SMA

Further gains in the greenback and a bearish performance of the commodity complex bolstered the continuation of the selling pressure in AUD/USD, which this time revisited three-day lows near 0.6560.

EUR/USD: Further weakness remains on the cards

EUR/USD added to Tuesday’s pullback and retested the 1.0730 region on the back of the persistent recovery in the Greenback, always against the backdrop of the resurgence of the Fed-ECB monetary policy divergence.

Gold flirts with $2,320 as USD demand losses steam

Gold struggles to make a decisive move in either direction and moves sideways in a narrow channel above $2,300. The benchmark 10-year US Treasury bond yield clings to modest gains near 4.5% and limits XAU/USD's upside.

Bitcoin price dips to $61K range, encourages buying spree among BTC fish, dolphins and sharks

Bitcoin (BTC) price is chopping downwards on the one-day time frame, while the outlook seen in the one-week period is a horizontal trade. In this shakeout moment, data shows that large holders are using the correction to buy up BTC.

Navigating the future of precious metals

In a recent episode of the Vancouver Resource Investment Conference podcast, hosted by Jesse Day, guests Stefan Gleason and JP Cortez shared their expert analysis on the dynamics of the gold and silver markets and discussed legislative efforts to promote these metals as sound money in the United States.