The last couple of weeks has seen the Australian dollar drift lower from resistance just below 0.95 after reaching a six month high in that area however in the last couple of days it has received solid support from near 0.93 moving it higher slightly. Over the last month or so the 0.93 level has become very significant as it first provided stiff resistance to movement higher and in the last couple of weeks, it has looked poised to offer support. The Australian dollar seems settled above 0.93 which has illustrated the strong resurgence it has experienced throughout this year.

For the best part of February and March the Australian dollar did very little other than continue to trade around the 0.90 level, although at the beginning of March it crept a little lower down to a three week low below 0.89. Towards the end of March however, the Australian dollar surged higher strongly moving to the resistance level at 0.93 before consolidating for a week or so.

For several months either side of the New Year the Australian dollar established and traded within a narrow range roughly between 0.88 and the previous resistance level at 0.90. Back in January the Australian dollar was able to rally higher pushing through the resistance at 0.90 to a one month high near 0.91, however it quickly returned to more familiar territory below the resistance levels at 0.90 and 0.88. After showing some resilience in early December moving to a one week high above 0.9150, the AUD/USD spent the next two weeks turning around sharply and falling heavily down to a then three month low close to 0.88.

Australia's central bank said economic developments in the past month had done nothing to sway its resolve to keep interest rates steady for a while, noting there had been further signs that low borrowing costs were supporting growth. In the minutes of its April 1 policy meeting, the Reserve Bank of Australia (RBA) again said the local dollar was high by historical standards, and that its recent appreciation meant the exchange rate was now less effective in helping the economy achieve balanced growth. "At recent meetings, the Board had judged that it was prudent to leave the cash rate unchanged and members noted that the cash rate could remain at its current level for some time if the economy was to evolve broadly as expected," the minutes said. "Developments over the past month had not changed that assessment." The RBA kept its cash rate at a record low 2.5 percent, where it has been since August. In all, the central bank has slashed 225 basis points off its benchmark rate since late 2011.

(Daily chart / 4 hourly chart below)

AUD/USD April 23 at 00:20 GMT 0.9365 H: 0.9378 L: 0.9347

AUD/USD Technical

During the early hours of the Asian trading session on Wednesday, the AUD/USD is continuing to move very little as it consolidates and trades around 0.9365 after finding solid support around 0.9320 for the last couple of days. The Australian dollar was in a free-fall for a lot of last year falling close to 20 cents and it has done very well to recover slightly to well above 0.90 again. Current range: trading right around 0.9365.

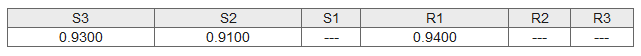

Further levels in both directions:

- Below: 0.9300 and 0.9100.

- Above: 0.9400.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.