The last couple of weeks has seen the Australian dollar drift lower from resistance just below 0.95 after reaching a six month high in that area. Over the last month or so the 0.93 level has become very significant as it first provided stiff resistance to movement higher and in the last couple of weeks, it has looked poised to offer support. The Australian dollar seems settled above 0.93 which has illustrated the strong resurgence it has experienced throughout this year.

For the best part of February and March the Australian dollar did very little other than continue to trade around the 0.90 level, although at the beginning of March it crept a little lower down to a three week low below 0.89. Towards the end of March however, the Australian dollar surged higher strongly moving to the resistance level at 0.93 before consolidating for a week or so.

For several months either side of the New Year the Australian dollar established and traded within a narrow range roughly between 0.88 and the previous resistance level at 0.90. Back in January the Australian dollar was able to rally higher pushing through the resistance at 0.90 to a one month high near 0.91, however it quickly returned to more familiar territory below the resistance levels at 0.90 and 0.88. After showing some resilience in early December moving to a one week high above 0.9150, the AUD/USD spent the next two weeks turning around sharply and falling heavily down to a then three month low close to 0.88.

Australia's central bank said economic developments in the past month had done nothing to sway its resolve to keep interest rates steady for a while, noting there had been further signs that low borrowing costs were supporting growth. In the minutes of its April 1 policy meeting, the Reserve Bank of Australia (RBA) again said the local dollar was high by historical standards, and that its recent appreciation meant the exchange rate was now less effective in helping the economy achieve balanced growth. "At recent meetings, the Board had judged that it was prudent to leave the cash rate unchanged and members noted that the cash rate could remain at its current level for some time if the economy was to evolve broadly as expected," the minutes said. "Developments over the past month had not changed that assessment." The RBA kept its cash rate at a record low 2.5 percent, where it has been since August. In all, the central bank has slashed 225 basis points off its benchmark rate since late 2011.

(Daily chart / 4 hourly chart below)

AUD/USD April 22 at 00:50 GMT 0.9336 H: 0.9346 L: 0.9318

AUD/USD Technical

During the early hours of the Asian trading session on Tuesday, the AUD/USD is trying to climb back up to the short term resistance level at 0.9340 after finding solid support around 0.9320 for the last day or so. The Australian dollar was in a free-fall for a lot of last year falling close to 20 cents and it has done very well to recover slightly to well above 0.90 again. Current range: trading just below 0.9340 around 0.9335.

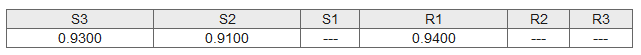

Further levels in both directions:

- Below: 0.9300 and 0.9100.

- Above: 0.9400.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

High hopes rouse for TON coin with Pantera as its latest investor

Ton blockchain could see more growth in the coming months after investment firm Pantera Capital announced a recent investment in the Layer-one blockchain, as disclosed in a blog post on Thursday.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.