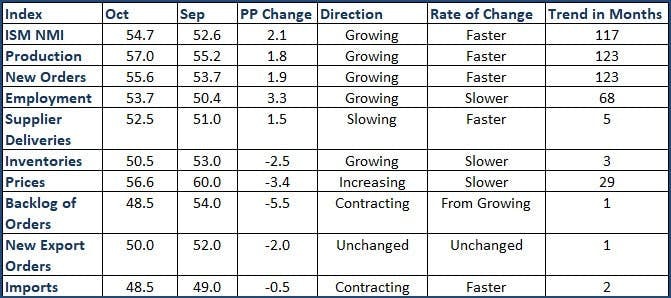

Tale of Two Indexes: Non-Manufacturing ISM vs Markit PMI

The ISM Non-Manufacturing Index strengthened in October. Markit's Service PMI weakened.

ISM Report on Business

The October 2019 Non-Manufacturing ISM® Index strengthened this month.

- The overall NMI Index rose from 52.6% to 54.7%

- Business Activity rose from 55.2% to 57.0%

- New Orders rose from 53.7% to 55.6%

- Employment rose from 50.4% to 53.7%

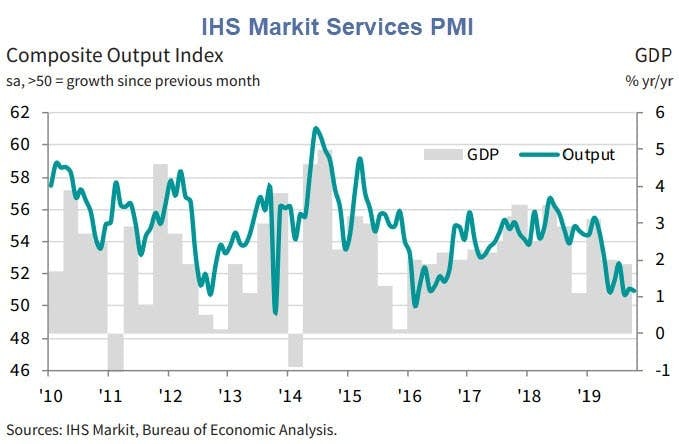

Markit Services PMI™ Slowest Since Feb 2016

Markit reports U.S. Services PMI™ Slowest Since Feb 2016

Key Findings

- Marginal upturn in output

- Fastest fall in employment for almost a decade

- Renewed rise in input prices

The seasonally adjusted final IHS Markit US Services Business Activity Index registered 50.6 in October, dropping slightly from 50.9 in September and downwardly revised from the flash figure of 51.0. The rate of increase in business activity was only marginal overall and the slowest since the current expansion began in February 2016. Growth was weighed on by lacklustre client demand and greater hesitancy among customers to place orders.

Concurrently, the New Business Index posted below the 50.0 neutral mark for the first time since data collection began a decade ago, signalling a marginal drop new order levels. Companies stated that the postponement of orders placed by clients and weaker demand underpinned the broad stagnation.

Meanwhile, new export orders fell for the third month running. The rate of contraction eased slightly from September's recent record, but was still the second-fastest fall in the series' history.

Subsequently, service providers registered a faster decline in employment in October as voluntary leavers were not replaced and firms struggled to fill outstanding vacancies. The rate of contraction was solid overall and the sharpest for almost a decade.

At the same time, backlogs of work fell for the third month running as service providers noted that weaker client demand allowed firms to process incoming new orders in a more timely manner.

IHS Markit Services PMI

Chris Williamson, Markit Chief Business Economist Comments

- “Although October saw signs of manufacturing pulling out of its recent soft patch, the far-larger service sector remained in the doldrums as inflows of new work failed to grow for the first time since 2009. Taken together, the manufacturing and service sector surveys consequently suggest that the US economy got off to a disappointing start in the fourth quarter, consistent with GDP growing at an annualized rate of less than 1.5%.”

- “With inflows of new work drying up, firms are relying on previously-placed orders to sustain current output growth, meaning the rate of expansion could weaken further in coming months if demand doesn’t revive. Hence we’re seeing jobs being cut at an increased rate among surveyed companies, with employment falling for a second successive month and to a degree not seen since 2009. Such a weakening of the survey’s employment index will likely feed through to the official jobs numbers as we move toward the end of the year.”

- “The news was by no means all negative, however, with firms becoming more optimistic about the year ahead, buoyed by hopes of an easing of trade tensions and stimulus from lower interest rates. However, the overall degree of optimism remains sharply lower than this time last year as companies remain concerned by ongoing uncertainty about the outlook.”

These reports supposedly measure the same thing.

One shows a big jump in employment the other, the fastest decline in a decade.

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc