Rates

Yesterday, global core bonds had a volatile trading session. The recent lows were tested twice on German and US eco data strength, but a soft Draghi and intraday equity weakness (due to Russian sabre-rattling) prevented a further slide lower. The pop higher on the Russian comments had no legs though, also as equities found their composure and rebounded. Afterwards, core bonds settled near opening levels. We highlight the US durable goods orders. They surprised friend and foe. Markets could no longer turn a blind eye to US eco data strength (following better retail sales and IP data last week) and both US Note future and Bund tested the recent lows. Ahead of next week’s big releases (FOMC, ISM, Q1 GDP, ADP, NFP), it’s too premature to position already for higher rates though. In a daily perspective, German bond yields were slightly higher with the exception of the 30-yr yield that closed marginally lower. In the US, yields were up to 2.8 bps lower, the curve still flattening.

Today, the eco calendar is thin both in the US and Europe with only Belgian and US consumer confidence. ECB’s Nouy and Knot are scheduled to speak and the ECB will announce the amount of LTRO repayments. These have an impact on the excess liquidity (together with the tenders) and on eonia (see graph below) Earnings reports are fewer but Ford and Volvo are worth looking at.

According to the first estimate, University of Michigan consumer confidence improved early April, from 80.0 to 82.6, slightly stronger than expected. The final reading is forecast to show a limited upward revision to 83.0. Recently, improved labour market conditions boosted consumer sentiment with the Conference Board’s indicator at a new cyclical high. We believe therefore that also Michigan consumer sentiment might surprise on the upside.

The US $29B 7-yr Note auction went quite well. The auction stopped through the 1:00 PM bid side and the bid cover (2.60) was just above the average of last year (2.57). The buy side takedown figures remained quite healthy as well due to a very good indirect bid and a smaller, but aggressive direct bid. The auction marked the end of the end-of-month financing operation following mixed 2-yr and 5-yr Note auctions earlier this week.

Overnight, several rating agencies gave updates on country ratings. Fitch affirmed the Italian BBB+ rating, but revised the outlook from negative to stable. The outlook revision reflects the end of a deep and prolonged recession in the second half of 2013 and the significant improvement in financing conditions. Earlier this year, also Moody’s raised the outlook of the Italian rating (Baa2) to stable. Rating agency S&P affirmed the French AA-rating (stable outlook) and EFSF AA-rating (stable outlook) and raised the Cypriot rating from B- to B (positive outlook). Also Fitch upgraded Cyprus, from CCC to B-. On intra-EMU bond markets, we don’t think that these rating actions will have an impact.

Overnight, most Asian equity indices trades negative. Two heavyweights reported earnings after the US close with Microsoft (stronger) and Amazon (mixed). Japanese stocks outperform, slightly helped by lower Japanese inflation figures released this morning. US Secretary of State Kerry warned that Russia is running out of time to comply with last week’s Geneva accord to ease tensions in Ukraine. The US Note future trades with a very small upward bias.

Today, the eco calendar is less interesting with only the final figure of Michigan confidence. The corporate earnings calendar is also less enticing. Ahead of next week’s key eco releases, investors might stay side-lined.

Risk sentiment on equity markets can’t be completely ruled out as a force for bond markets though. In that respect, we closely look whether the situation in Ukraine escalates again. Finally, technical elements should be considered as well. Positioning into the weekend and early end-of-month extension buying are modestly supportive for bonds.

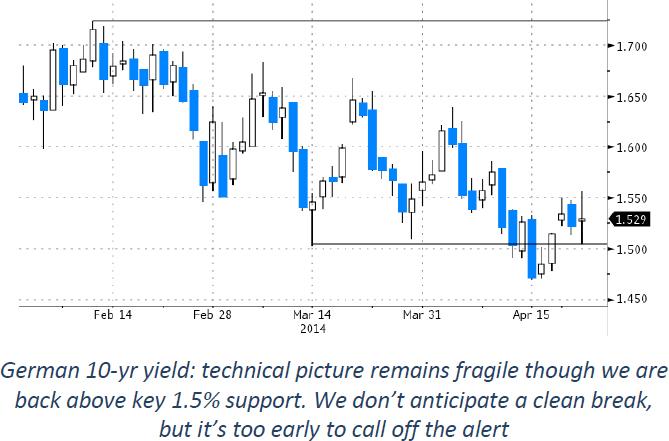

The technical picture of the German 10-yr yield remains fragile though we moved back north of 1.50% support since last Thursday. Overall, we don’t anticipate a clean break below 1.50%. In the US, the test of the downside of the 2.6%/2.8% failed and we’re comfortably back in the middle of that channel.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

High hopes rouse for TON coin with Pantera as its latest investor

Ton blockchain could see more growth in the coming months after investment firm Pantera Capital announced a recent investment in the Layer-one blockchain, as disclosed in a blog post on Thursday.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.