Friday, the dollar fell prey to modest profit taking as equities and especially oil returned part of the gains build up earlier in the week. However, the moves were only of intraday significance. The US eco data were mixed, but the production output and the Michigan consumer confidence disappointed.

EUR/USD rebounded temporary north of 1.13, but closed the session at 1.1284, only slightly higher above Thursday ‘s close of 1.1268. USD/JPY finished the session at 108.76 (from 109.40).

During the weekend, a group of major oil producers failed to reach a deal on limiting oil supply. Brent oil tumbled temporary to$40 p/b his morning. Asian equities are sold as is the case for other commodities and commodity related currencies. Japanese equities underperform as USD/JPY returned below 108.

The pair is coming within reach of the recent lows. At the G20, Japan didn’t get support to take action against the raise of the yen at current levels. AUD/USD dropped to the 0.76 area, but already rebounded to the 0.7675 currently.

EUR/USD opened north of 1.13, but trades again near Friday’s closing levels.

The eco calendar is very thin today with only the US NAHB housing market index. Since the end of last year, the US NAHB housing market index has weakened from 65 to 58 currently. The consensus is looking for a limited improvement to 59. Improving weather conditions and lower mortgage rates recently should be supportive for housing sentiment as well as the continued improvement in labour market conditions. We believe therefore that an upward surprise possible. However, the impact on the dollar will be limited. The outcome of the Doha oil negotiations will dominate the start of trading. Later this week, we look out for the ECB meeting (Thursday) the EMU PMI business surveys (Friday) and US earnings.

Last week, the dollar rebounded slightly, but the moves in EUR/USD and USD/JPY didn’t break any really important technical levels, suggesting that sentiment on the dollar remains fragile. This is especially the case for USD/JPY.

We are not convinced that the decline of oil after the Doha meeting will have a lasting impact on global markets. Even so, in a day to day perspective, we look out whether USD/JPY tests/breaks the 107.63 area.

A break below would further damage the picture if this cross rate and, to a lesser extent, of the dollar in general. Even so, the price action in EUR/USD is less USD negative. For EUR/USD we start the week with a neutral bias, waiting for more US data.

The dollar lost ground after the March ECB and FOMC meetings. EUR/USD set a new 2016 high at 1.1465, but the key 1.1495 resistance remained intact. Last week’s price action suggests that the topside of EUR/USD is better protected.

We see no trigger for a clear directional move in EUR/USD short-term. Medium term, the dollar probably needs really good news from the US to regain substantial ground. The soft Fed approach and risk aversion pushed USD/JPY below the 110.99/114.87 range. The pair reached a new correction low below 108. USD/JPY succeeded a technical rebound last week. However, a flaring up of risk-off and little support for the G20 to avoid yen strength is at play. Japanese authorities apparently lack tools to prevent further yen strength if sentiment remains risk off. We don’t row against the yen positive tide for now.

Sterling slightly in the defensive

On Friday, only the less important construction output data were published in the UK. Construction output declined again in February. However, the report was largely ignored for sterling trading. Sterling was driven by technical considerations and global market factors. Given the overall context (correction in equities and a rather sharp decline of oil) sterling performed quite well. Cable rebounded as the dollar declined across the board, especially during the US trading session. Cable closed the session at 1.4202 ( from 1.4155 on Thursday).

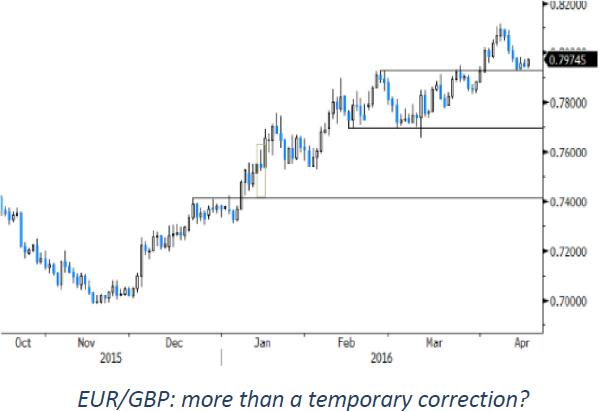

Even EUR/GBP initially traded with a slightly negative bias. The pair closed the session at 0.7944 (from 0.7961 on Thursday).

This morning, UK Rightmove house prices remained fairly strong at 1.3% M/M and 7.3% Y/Y. However the report doesn’t help sterling. The global risk-off context and the decline of oil weighed. EUR/GBP trades currently in the 0.7975 area. Today, sterling trading will again at the mercy of global market trends. The context is sterling negative, but we have the impression that sterling has become a bit less sensitive to global negative news than was the case of late.

The technical picture of EUR/GBP improved further as the pair broke above the resistance at 0.7929/31 and 0.8066. The recent sterling decline has been fast, raising the chances for a (temporary) pause, which finally occurred this week. Even so, we assume that sterling sentiment will remain fragile as long as the polls indicate a neck-and-neck race for the 23 June referendum.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.