On Tuesday, rising oil prices drove global markets. The oil rally initially weighed temporary on the dollar, but probably wasn’t the only factor.

EUR/USD tested the recent highs, but the test was rejected. USD/JPY held north of 108 as equity sentiment improved throughout the day. USD/JPY closed the session at 108.54 (from 107.94). EUR/US finished the day at 1.1386 (from 1.1408).

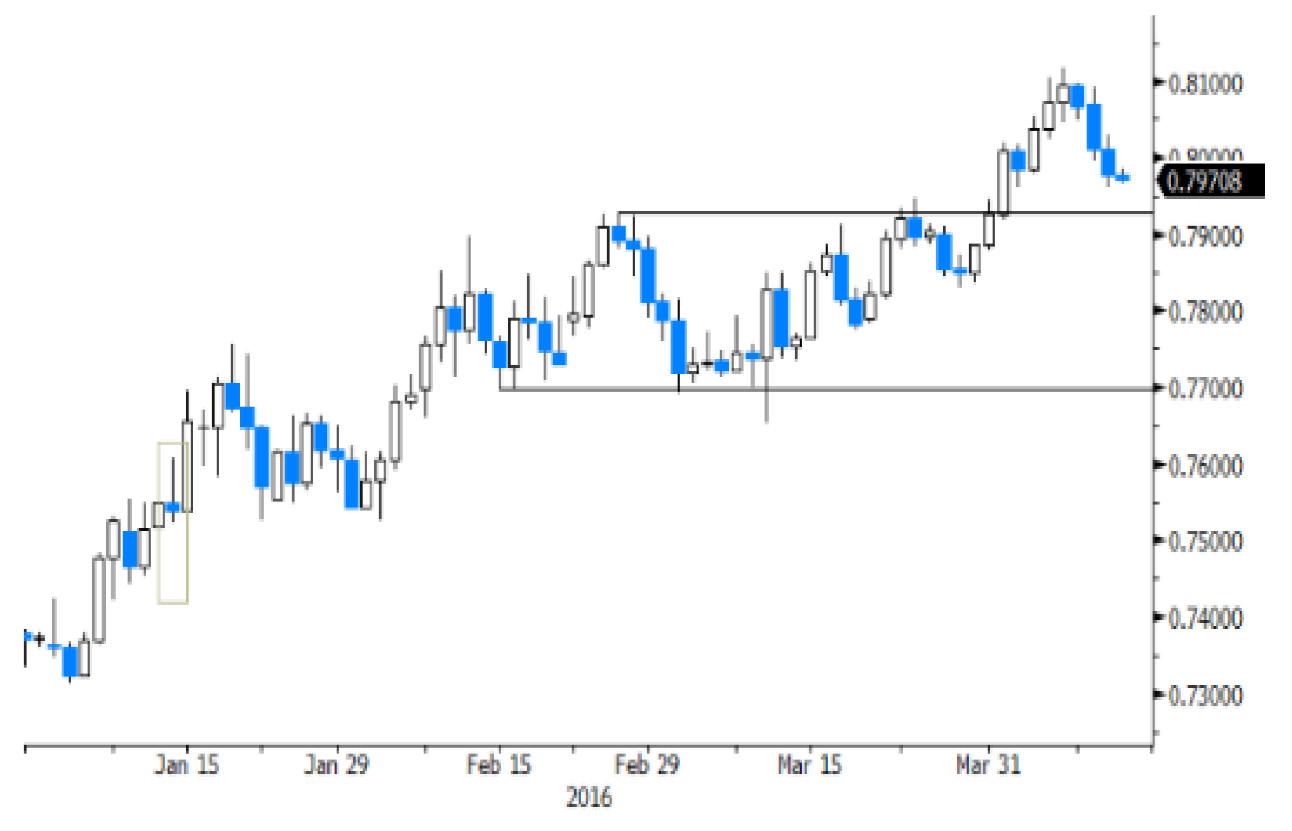

Overnight, Asian equities join the WS rally, with China and Japan recording gains of 2 to 3%. Regional sentiment in supported by the rise in oil and by better than expected Chinese trade (export) data (see headlines). The rise in oil and commodities lifted AUD/USD. The pair is testing the recent highs just north of 0.77. The dollar also rebounds, but the gains against the yen and the euro remain modest despite higher short-term US yields. USD/JPY is nearing the 109 big figure. EUR/USD trades currently in the 1.1360 area.

Today, The eco calendar heats up today with the US retail sales and PPI inflation data and euro zone production figures. ECB’s Knot, Nowotny and Constancio are scheduled to speak, the Fed will release its Beige Book and the Bank of Canada will decide on rates.

March US retail sales are expected to show a modest improvement after a disappointing January & February release. We see risks for a slightly better than expected outcome. Both US headline and core PPI are forecast to have increased further in March. Headline PPI is expected to have increased by 0.3% Y/Y. Also for the PPI we see upside risks. Better than expected US data published in a context of global positive risk sentiment should be supportive for the dollar. Regarding this sentiment on risk, we also keep a close eye on the US bank results, starting with JPM today. The latter is a wildcard, but in a day-to-day perspective, the context looks USD supportive. Nevertheless, the dollar remains vulnerable to negative surprises (which is not our favourite scenario).

Will the dollar drop below recent EUR/USD consolidation pattern? (ST correction low 1.1327) and will USD/JPY be able to move away from the recent lows. Over the recent days/overnight, the dollar performance was a bit disappointing.

After the March ECB and FOMC meetings, the dollar was sold. Subsequently, the EUR/USD 1.1376 resistance was broken after soft comments from Yellen. EUR/USD set a new 2016 high at 1.1454. The 1.1495 resistance is important medium term, but is left intact for now. We see no trigger for a clear directional move in EUR/USD short-term. Medium term, the dollar probably needs really good news from the US to regain substantial ground. The soft Fed approach and the risk-off sentiment pushed USD/JPY below the 110.99/114.87 range. The pair set a new correction low below 108 and this level was retested early this week. A sustainable USD/JPY rebound is difficult as long as risk sentiment remains fragile. We look whether official talk on more BOJ easing or ‘verbal interventions’ can stop the yen rebound. USD/JPY has moved into oversold territory. So, there is room for a technical rebound/consolidation.

Sterling extends rebound

On Tuesday, sterling shorts were again wrong-footed for a second consecutive day. This time the UK data were to blame. Both UK Marfch headline (0.5% Y/Y) and core CPI (1.5% Y/Y) surprised on the upside. Especially the rise in core inflation, if sustained, would be important for the BoE. EUR/GBP dropped below the 0.80 mark. The pair closed the session at 0.7976 (from 0.8011). Cable jumped from the 1.4235 area to fill offers just below 1.4350. However, the pair returned part of the early gains on a USD rebound later in the session and closed at 1.4275 (from 1.4239).

Today, the UK eco calendar only contains the BoE credit conditions and liabilities survey. So, sterling trading will probably be driven by global factors. Positive risk sentiment and a rise in oil prices are usually a slightly positive for sterling. We don’t expect a big leap higher however after the rebound earlier this week. The negative momentum clearly eased, at least short term.

The technical picture of EUR/GBP improved further as the pair broke above the resistance at 0.7929/31 and at 0.8066. The recent sterling decline has been fast, raising the chances for a (temporary) pause, which finally occurred this week. Even so, we assume that sterling sentiment will remain fragile as long as the polls indicate a neck-and-neck race for the 23 June referendum.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.