On Tuesday, there were again few eco data with market moving potential. Early in Europe, it looked that the selling of risky assets could slow. However, the risk-off trading resumed around noon. USD/JPY was again an obvious victim. The pair returned to the 114.30 area, close to the Asian low but a new downleg didn’t occur. Oil declined sharply during the US trading session, but the direct impact on other markets was limited. On Monday, the impact of the risk-off trade on the dollar and the euro was more or less balanced. Yesterday, the dollar underperformed. EUR/USD cleared the 1.1246 resistance and jumped temporary north of 1.13 to close the session at 1.1293 (from 1.1193 on Monday).

This morning, several Asian markets are still closed for the Lunar New Year holidays. Japanese equities remain under pressure, recording losses of 2%+. The yen hovers near a 15 month high against the dollar. USD/JPY trades in the 114.50 area, but no new downleg below yesterday’s low occurred yet. Japanese PM Abe stated that the government is closely watching market moves. A new era of at least verbal interventions coming closer. Commodity currencies like the AUD and the CAD show a mixed picture, but in the end the losses on the oil price decline remained modest. EUR/USD is little changed, trading in the 1.1290 area.

Today, there are again only second tier eco data on the agenda in Europe and In the US. So, the focus for USD trading will remain on the swings in global markets and on a testimony of Fed’s Yellen before Congress. Yellen will have to find a difficult balance. She will probably maintain a positive tone on the domestic economy, in particular on the labour market. At the same time, she cannot but acknowledge quite a long series of risks coming from outside the US and from global markets. In the end, we expect her to leave the door open for further rate hikes, conditional to developments in the near future. In theory, such a scenario shouldn’t be that bad for the dollar as markets have priced out the chance for additional Fed rate hikes this year.

Of course, aside from Yellen’s testimony, global market stress/volatility will remain a factor for USD trading.

Yesterday, signs of global financial stress and intra-day EMU spread widening didn’t help the dollar, also not against the single currency. However, the reaction of EUR/USD to this kind of issues was not consistent of late. The drivers behind the price moves in EUR/USD weren’t always clear but with important pockets of rising financial stress coming to the surface, we don’t see a big case for the euro to be a better safe haven than the dollar. Ever deeper negative interest rates are also no help for the euro. We look out for signs of a topping out process in EUR/USD to reinstall shorts.

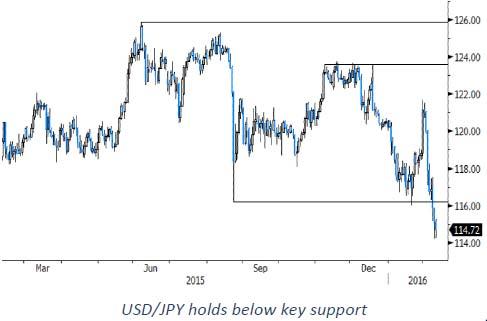

From a technical point of view, EUR/USD broke above the 1.1060/1.1124 resistance area (15 Dec top: 62% retracement). This is a dollar negative. The short-term correction high stands at 1.1338. Next important resistance kicks in at 1.1495.The jury is still out, but we have think that the EUR/USD rebound might be topping out. The picture for USD/JPY improved temporarily as the pair rebounded above 120 after the BoJ easing two weeks ago. However, the gains evaporated very soon. The pair even dropped below the key 115.98 pre-BOJ correction low. This a high profile warning signal. We expect the BOJ to send warning signals. However, for now there is no good reason to fight current yen strength as long as global uncertainty persists.

EUR/GBP regained another big figure (0.78)

Yesterday, sterling trading was still mainly driven by global factors. Domestic data like the BRC retail sales and UK trade balance were largely ignored. Early in the European session sterling regained temporary ground against the euro and the dollar as sentiment on risk improved slightly/temporary. However, the gains could not be sustained. A return of the risk-off trade, a decline of oil prices and a rebound of EUR/USD pushed EUR/GBP to a new correction top well north of 0.78. The pair closed the session at 0.7803 (from 0.7756). Cable showed some intraday swings against broadly weaker dollar. The pair closed the session at 1.4472, compared to 1.4433 on Monday.

Today, the UK industrial/manufacturing production data will be published. Both series are expected to signal an almost standstill (or even a decline) in production. So, the report probably won’t be a big help for sterling. Later in the session the NIESR January UK GDP growth estimate will be published.

Global factors will remain the key driver for sterling trading. It is difficult to call the end of the current rout, but in case of some easing of tensions, the decline of sterling might slow. The medium term technical picture of sterling against the euro remains negative as EUR/GBP broke above the 0.7493 Oct top. Next big resistance stands at 0.7854/75. A return below EUR/GBP 0.74 would be a first indication that sterling enters calmer waters.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.