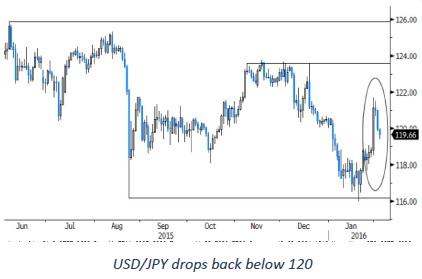

A new down-leg of the oil price was the dominant factor for global trading yesterday. There were hardly any in the US or in Europe. The oil-rout affected in the first place equities. However there was also a modest negative fall-out on the dollar. Especially USD/JPY was affected. Deepening losses on the US equity markets pushed the pair back to the 120 area. The pair closed the session 119.97 (from 120.99 on Monday). The losses of the USD against the euro were more modest. EUR/USD closed the session at 1.0919 (from 1.0888).

The global equity sell-off continues on Asian markets this morning. The Caixin China services PMI succeeded a nice rebound from 50.2 to 52.4, but doesn’t stop the bleeding. The PBOC set the CNY fixing marginally weaker against a relatively strong dollar. Still, the off-shore CNH weakens to USD/CNH 6.6420 currently, suggesting rising tensions. Brent oil is holding near yesterday’s low. For now there are no additional losses. Even so, commodity currencies like the Aussie dollar are trending south. AUD/USD is nearing the 0.70 barrier. The yen profits from the risk-off context. USD/JPY is drifting further below 120 (currently in the 119.60 area). BOJ’s Kuroda said that the BOJ can cut rates beyond minus 0.1% and that the Bank has ample room to expand stimulus. For now, the impact is limited. The loss of the dollar against the euro stays modest, even as interest rate differentials narrow. EUR/USD trades in the 1.0925 area.

Today, the eco calendar contains the final EMU services PMI’s. In the US, the nonmanufacturing ISM and the ADP labour market report will be published. The non-manufacturing ISM is expected to have declined slightly further in January, from 55.8 to 55.1. We believe that the consensus might be too pessimistic. The ADP employment will also be interesting ahead of Friday’s payrolls. The consensus is looking for private sector employment growth of 193 000, down from a strong 257 000 in December. After strong hiring in the fourth quarter of last year, we believe it might slow early 2016. So we see downside risks. A poor labour market report might cause additional nervousness. Also keep an eye at the interest rate differentials. Until now, declining interest rate differentials between the dollar and the euro had only a limited impact. However, if this narrowing continues, the euro might gradually come under further upward pressure. Last but not least, the US oil inventories might also be a wildcard for USD trading. So, looking at the developments in Asia this morning, we can only start the day with a cautious bias on the dollar. Will the 1.0985 resistance come under test? Or will global sentiment improve later today?

From a technical point of view, EUR/USD tried to break below the 1.08 barrier several times, but a sustained down-move didn’t occur, leaving the pair in a very tight sideways consolidation pattern. Next support is at 1.0711/1.0650 (correction low, 76% retracement off 1.0524/1.1060) and at 1.0524. On the topside, 1.0985/1.1004 (reaction top) is a first reference. This level was left intact even as sentiment was outright risk-off before the ECB meeting. Next resistance comes in at 1.1060/1.1124 (15 Dec top: 62% retracement). We expect this resistance to be difficult to break. We look to sell EUR/USD on upticks for return action lower in the range. The picture for USD/JPY improved temporarily as the pair rebounded above 120 after Friday’s BOJ policy decision. However, the gains could not be sustained. We stay reluctant to position for further sustained USD/JPY gains as long as global uncertainty persists.

Sterling holding stable despite risk-off

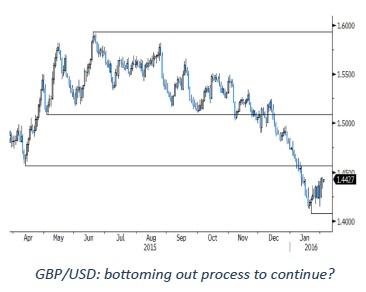

Yesterday, sterling hovered again up and down driven by conflicting signals. Early in the session, the British currency was pressured by lower oil and equities. The UK construction PMI was also weaker than expected at 55.0 (from 57.8). Sterling made a temporary comeback later, probably supported by headlines on a draft proposal from EU president Tusk on the new role of the UK within the EMU. During the US session, the focus turned again to the oil-driven risk-off correction, hampering the sterling rebound. EUR/GBP closed the session at 0.7577 (from 0.7544 on Monday). Cable closed the day at 1.4410 (from 1.4433).

Overnight, the BRC shop prices declined less than the previous month (-1.8% Y/Y from -2.0% Y/Y). Later today, the UK services PMI is expected to decline marginally to 55.4. A poor figure will fuel market expectations that the BoE will keep a very soft tone at tomorrow’s policy meeting. It is an important meeting as the Bank will have a new inflation report available. Over the previous days, sterling showed no clear trend. That said, the UK currency didn’t perform that bad given the overall negative context. Is sterling ripe for some ST consolidation if the news flow would become less negative? In a longer term perspective, uncertainty on Brexit and global negative risk sentiment remain a negative for sterling. As long as these issues aren’t solved, a sustained sterling rebound is unlikely. The medium term technical picture of sterling against the euro is negative as EUR/GBP broke above 0.7493. Next resistance stands at 0.7875. A return below 0.74 would be a first indication that sterling enters calmer waters.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD retreats to 1.0750, eyes on Fedspeak

EUR/USD stays under modest bearish pressure and trades at around 1.0750 on Wednesday. Hawkish comments from Fed officials help the US Dollar stay resilient and don't allow the pair to stage a rebound.

GBP/USD remains on the defensive around 1.2500 ahead of BoE

The constructive tone in the Greenback maintains the risk complex under pressure on Wednesday, motivating GBP/USD to add to Tuesday's losses and gyrate around the 1.2500 zone prior to the upcoming BoE's interest rate decision.

Gold flirts with $2,320 as USD demand losses steam

Gold struggles to make a decisive move in either direction and moves sideways in a narrow channel above $2,300. The benchmark 10-year US Treasury bond yield clings to modest gains near 4.5% and limits XAU/USD's upside.

SEC vs. Ripple lawsuit sees redacted filing go public, XRP dips to $0.51

Ripple (XRP) dipped to $0.51 low on Wednesday, erasing its gains from earlier this week. The Securities and Exchange Commission (SEC) filing is now public, in its redacted version.

Softer growth, cooler inflation and rate cuts remain on the horizon

Economic growth in the US appears to be in solid shape. Although real GDP growth came in well below consensus expectations, the headline miss was mostly the result of larger-than-anticipated drags from trade and inventories.