On Thursday, the focus remained on equity volatility. The impact on currency trading was initially moderate. The dollar started the session in the defensive.

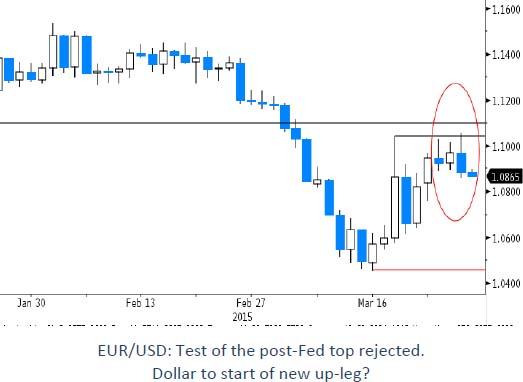

EUR/USD even tested the post-Fed highs, but the test was rejected. Later in the session, fortunes changed in favour of the dollar. The US currency got support from higher US bond yields. USD/JPY rebound north of the 119 barrier as US equities found a better bid later in the session.

Overnight, Asian markets show again a mixed picture. Chinese equities outperform. Japan underperforms. Japanese eco data were mixed. Labour data were OK. Household spending, retail sales and inflation were soft but near expectations. Even so, Japanese bond yields jumped higher this morning. The rise in bond yields weigh on Japanese equities, but the yen is little affected.

USD/JPY is holding in the 119.20 area. USD strength and higher Japanese bond yields apparently keep the dollar and the yen in balance. EUR/USD is preserving most of yesterday’s late-session gains. It changes hands in the 1.0871 area.

Today, the eco calendar in Europe only contains some second tier eco data. In the US, the final revision of the US Q4 GDP and the final Michigan consumer confidence will be published. An upward revision in the Michigan confidence might be slightly supportive for the dollar. More interesting, Fed Fischer and Fed’’s Yellen will speak. The speech of Yellen in San Francisco will address monetary policy and is very much worth looking at. However, it occurs after the close of the European markets. After last week’s FOMC meeting, markets took the FED message from the soft side, even as Yellen and Co removed the patient wording. US bond yields and the dollar retreated. Over the past two days US bond yields went again a bit higher and the dollar shows signs of bottoming out. Will Yellen hold a less dovish tone today? If the decline in US bond yields has run its course,. it might help to put a floor for the dollar, too. Greece remains a wild card as next week is once again earmarked as ‘crucial’ for reaching an agreement on new reform measures and to unlock additional funding for the country.

Over the previous days, we had the impression that the EUR/USD rally was gradually losing momentum, but saw no sign of a trend reversal. Such a tentative signal appeared yesterday. EUR/USD tested the post Fed top in the mid 1.10 area, but the test was rejected. In addition, rising US bond yields might again provide some support for the dollar, too. We reinstall a cautious sell-on –upticks approach for the EUR/USD cross rate.

The technical picture for the EUR/USD cross rate is bearish since the pair dropped below the previous cycle low (1.1098). The 1.0500 area was extensively tested, but a sustained break didn’t occur. In the wake of the Fed meeting, a first intermediate resistance at 1.0717 area was easily regained. The 1.1043/98 (post FOMC high/prev. low) is a very important resistance, but rejected yesterday. A rebound north of 1.1534, still far away, is needed however to question the downtrend. USD/JPY tested the 121.85/122.03 resistance, but a break didn’t occur. The post-Fed setback doesn’t change the USD/JPY picture fundamentally. The pair is till captured in a tight sideways pattern in the 120 area (118-122). The downside looks a bit better protected short-term.

EUR/GBP test of the 0.74 rejected, for now.

EUR/GBP tested the highs in the 0.7380/85 area early in Europe. UK retail sales disappointed recently, but the February data were strong. EUR/GBP dropped to the mid 0.7360 area upon the publication of the report. However, sterling initially wasn’t able to make more progress. Cable came close to the 1.50 barrier after the retail sales. However, this level proved to be a tough resistance of late and again yesterday. Later in the session cable was hit hard as the dollar rebounded and dropped to the low 1.48 area. The decline in EUR/USD finally pushed EUR/GBP off the highs, too. The pair closed the session at 0.7330, a decent correction when compared to the 0.7371 close on Wednesday. Even so, the picture for sterling still looks mixed/fragile.

This morning, nationwide house prices were marginally below consensus (0.1% M/M and 5.1% Y/Y). The reaction of sterling is very limited. Later today, there are no eco data in the UK but BoE’s Carney, Haldane and Broadbent will speak. Of late, the BoE indicated that it was in no hurry to raise rates soon, but this message should now be discounted. Will the BoE send some less dovish signs?

Recently, we advocated to protect EUR/GBP shorts against a temporary countermove and were in no hurry to reinstall EUR/GBP shorts. Yesterday, we got a first sign that the EUR/GBP rally was running out of steam. However, the picture for sterling remains fragile as cable remains in the defensive. We look how the EUR/GBP 0.74 resistance fares. Any decline in EUR/GBP will probably be due to euro weakness rather than a sustained rebound of sterling. For now keep a neutral/wait-and-see bias on EUR/GBP and look for confirmation that the rebound as run its course.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

AUD/USD: Further losses retarget the 200-day SMA

Further gains in the greenback and a bearish performance of the commodity complex bolstered the continuation of the selling pressure in AUD/USD, which this time revisited three-day lows near 0.6560.

EUR/USD: Further weakness remains on the cards

EUR/USD added to Tuesday’s pullback and retested the 1.0730 region on the back of the persistent recovery in the Greenback, always against the backdrop of the resurgence of the Fed-ECB monetary policy divergence.

Gold flirts with $2,320 as USD demand losses steam

Gold struggles to make a decisive move in either direction and moves sideways in a narrow channel above $2,300. The benchmark 10-year US Treasury bond yield clings to modest gains near 4.5% and limits XAU/USD's upside.

Bitcoin price dips to $61K range, encourages buying spree among BTC fish, dolphins and sharks

Bitcoin (BTC) price is chopping downwards on the one-day time frame, while the outlook seen in the one-week period is a horizontal trade. In this shakeout moment, data shows that large holders are using the correction to buy up BTC.

Navigating the future of precious metals

In a recent episode of the Vancouver Resource Investment Conference podcast, hosted by Jesse Day, guests Stefan Gleason and JP Cortez shared their expert analysis on the dynamics of the gold and silver markets and discussed legislative efforts to promote these metals as sound money in the United States.