Outlook:

Yesterday we said we are mightily impressed by the Saudis apparently going ahead with an initiative to freeze oil prices even without participation by Iran or Libya. The head of the IEA’s oil division, one Mr. Atkinson, told the press any such deal is "meaningless" because only Saudi Arabia, of the participants, has the ability to raise production. “It's more some kind of gesture which perhaps is aimed ... to build confidence that there will be stability in oil prices."

Our pals in the logic department would snort. Just because your stick is small doesn’t mean your carrot won’t work. And our pals in the economics department are sniggering, too. The idea of sta-bility in oil prices is a very big prize in its own right for countries that are utterly dependent on oil and whose governments could get overthrown if revenues are not managed better. Think Venezuela. Even turmoil is to be avoided, as in Saudi Arabia itself. Russia is no doubt safe from anything resembling a mob, but they would still like to be able to plan with better-known factors. (Do they still use input-output tables?)

We can readily admit that the oil industry experts are probably right that the glut will continue for anoth-er two years. Storage is being expanded. But markets always anticipate well ahead of an Event. And what about demand? BP’s chief economist told a Moscow audience he expects oil demand growth to continue this year (but declined to comment on the proposed freeze).

Besides, as the FT reports today, we are in a new era for the oil industry with the US removing the ex-port ban last December. Weirdly, so far US outbound exports are down, not up (because of lower ship-ments to Canada). Those in the oil export business expect a pick-up, but we have yet to see a coherent analysis of the net effect of US oil exports in the medium term. We like the idea of “new era.” The old era in oil pricing was a mess.

On another front, the Bank of England meets today for the first time this year. It’s also the last meeting before the June 23 referendum on Brexit. Reuters reports the MPC will focus on contingency plans for the fallout if Brexit is the outcome. The FT reports that in addition to the drop in sterling, the price of a 3-month option on volatility is the highest in almost 6 years. Every economist on the planet says Brexit is a bad idea, economically, but that doesn’t mean it won’t win, because voters see non-economic benefits.

We wonder if the Scottish referendum outcome is not a good model—opponents of Scottish independ-ence scared voters with the costs they would have to pick up in the absence of British subsidies. Some of those assertions were false, but on the whole, people know which side of the bread their butter is on.

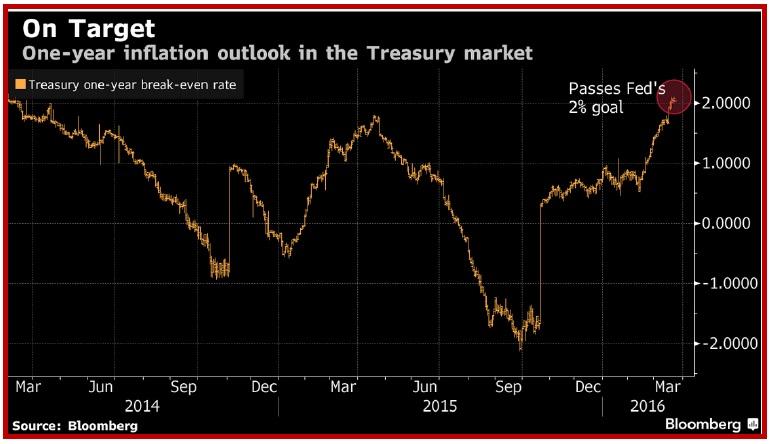

In the US, rising optimism about the trajectory of the US economy is visible. Bloomberg reports the TIPS spread indicates traders do expect the Fed to meet its 2% inflation target. The spread hit 2.11% yesterday, the highest in two years. See the chart. “Inflation expectations for the next decade rose to 1.67 percent this week, the highest level since August. Crude oil has rebounded from a 12-year low, raising speculation the gain will make it easier for the Fed to increase interest rates.” If the TIPS spread is a good gauge—and plenty of folks say it is not—yields are too low at current levels.

We need to be careful not to forecast rising yields, if that is what we get, as necessarily driving the dollar higher. For one thing, European yields could rise pari passu so that the differential doesn’t widen all that much. For another, there are plenty of non-yield reasons to prefer the euro over the dollar. Ironically, the foremost one is that the ECB is more committed (and more credible) on fighting inflation than the Fed, which now seems willing to get behind the curve on inflation to bring the bond boys over to its way of thinking. And finally, no matter what anyone says about the dollar being historically not much affected by US politics, Trump and Cruz—one of whom is the likely Republican candidate—are both a threat to the dollar. Trump is an isolationist and Cruz thinks it’s okay to default on sovereign debt.

While we await the current consolidation move to come to its inevitable end (and either reverse back to a rising euro or breakout further to the downside), we can ponder the latest political developments in the US. Commentators and TV pundits are appalled at the response from the two Republican candidates to the Brussels terrorist attacks. Cruz would patrol and monitor Muslim neighborhoods—although the US does not have Muslim ghettos as they have in Europe—while Trump would close the border to Muslims as well as put the arm on NATO members to pay more of the bill. Maybe NATO (and others like South Korea and Japan) should pay more, but isolationism and a lack of principle are hardly good long-term policy choices. And oh, yes, both candidates would torture the one captured terrorist.

You can’t avoid thinking of the much quoted Niemoller statement about the Nazis that became so popu-lar in the 1960’s: “…. they came first for the Communists, And I didn't speak up because I wasn't a Communist; And then they came for the trade unionists, And I didn't speak up because I wasn't a trade unionist; And then they came for the Jews, And I didn't speak up because I wasn't a Jew; And then . . . they came for me.”

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 112.69 | SHORT USD | STRONG | 02/04/16 | 117.57 | 4.15% |

| GBP/USD | 1.4169 | LONG GBP | STRONG | 03/11/16 | 1.4296 | -0.89% |

| EUR/USD | 1.1189 | LONG EURO | STRONG | 03/11/16 | 1.1094 | 0.86% |

| EUR/JPY | 126.08 | SHORT EURO | WEAK | 02/11/16 | 126.19 | 0.09% |

| EUR/GBP | 0.7896 | LONG EURO | WEAK | 03/11/16 | 0.7759 | 1.77% |

| USD/CHF | 0.9755 | SHORT USD | STRONG | 03/11/16 | 0.9877 | 1.24% |

| USD/CAD | 1.3079 | SHORT USD | STRONG | 02/01/16 | 1.4031 | 6.78% |

| NZD/USD | 0.6696 | LONG AUD | STRONG | 02/01/16 | 0.6478 | 3.37% |

| AUD/USD | 0.7578 | LONG AUD | STRONG | 01/25/16 | 0.6980 | 8.57% |

| AUD/JPY | 85.38 | LONG AUD | STRONG | 03/03/16 | 83.57 | 2.17% |

| USD/MXN | 17.3749 | SHORT USD | STRONG | 02/23/16 | 18.1208 | 4.12% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.