Outlook:

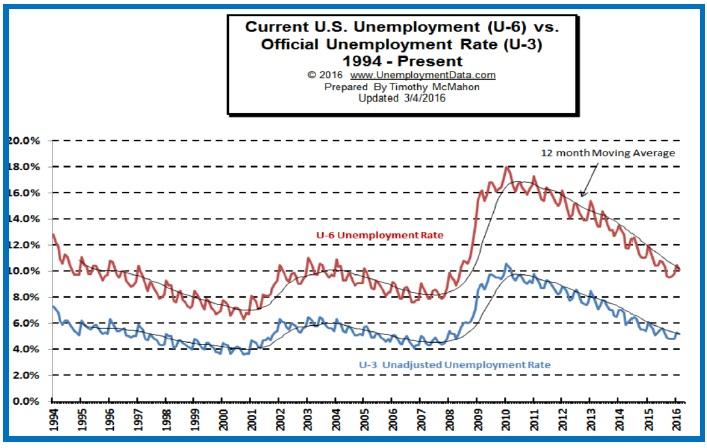

Payrolls was pretty good, beating forecasts by a mile and generating the euro spike low that it should, but pro-dollar cheeriness didn’t last past the half-hour mark. The report had only one negative but it was a critical one—after a 0.5% rise in average hourly earnings in Jan, Feb delivered a drop by 0.1%. You can’t get the Phillips Curve to work to generate inflation unless wages rise, no matter how shallow the pile of unemployed seeking work. Note that U-6, the “real” unemployment rate, fell from 10.5% in Jan to 10.1% in Feb. Critics note that the Gallup “underemployment” rate actually rose from 14.0% in Dec and in Jan to 14.7%. It’s supposed to be the same measure but differs by 4.6%.

But see the chart (from unemploymentdata.com). The downward slope of the two measures is unmistakable and shows a steady recovery.

All the same, we have nothing you could call escape velocity. Wall Street analyst Lynne writes this week that if oil prices had not been falling, household spending would not have been rising, one of our only green shoots. This is the context in which the correlation of oil and the S&P makes some sense. Assuming oil keeps rising on short-covering (if nothing else), the consumer gets hosed but the rich, or at least those who have equity positions, get richer.

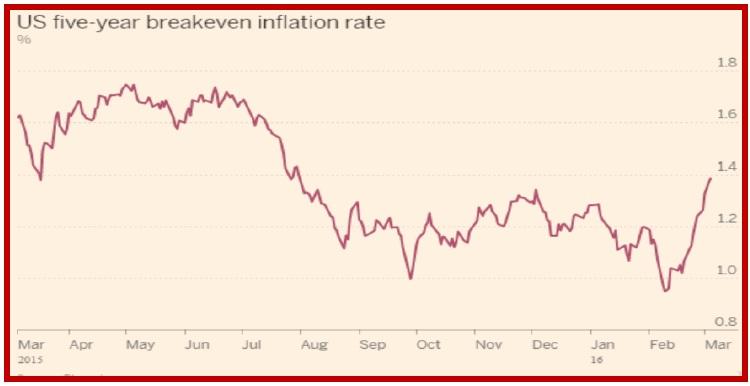

The doom-and-gloom crowd faces a new metric today—inflation expectations are, indeed, rising. The FT reports the 5-year breakeven is at its highest since August. “Known as an imperfect gauge of real world activity, it is nonetheless the latest sign of a growing optimism ahead of a key Fed meeting this month. Laurence Mutkin, global head of rates strategy for BNP Paribas, said: ‘When you look at the US inflation picture it’s increasingly difficult to find an inflation index which is not already at 2 per cent, or above the Fed’s target.’” See the chart. In addition, the 2-year note divergence between Germany and the US is rising and has hit 1.45%, according to BBH’s Chandler. The two-year is a better indicator than the 10-year for this purpose.

This is not to say the Fed will act in March and possibly not even in June, but it does affirm the overall picture of divergence in growth and inflation between the US and the eurozone, and divergence in monetary policy that “should” favor the dollar.

The big factor this week is the ECB policy meeting on Thursday. Judging from the resilience of the euro after payrolls, the preponderance of opinion about the ECB’s policy choices lies with the lesser options—only a 10 bp cut and a €10 increase in QE, if any at all. Market News reports just about everybody sees a deposit rate cut by 10 to 20 bp. Some say a tiered structure of deposit rates is in the cards. But as for raising the amount of QE, opinions differ. Some say no increase at all (Barclays), while others see a rise in bond buys by €10 billion (Goldman) or as much as €20 billion (Commerzbank, Credit Suisse, Capital Economics).

A “tiered structure” means charging big banks more and smaller banks less, and also insulating house-holds from negative rates at all. When consumers have to pay a bank to hold their deposits, thoughts turn to gold. Somewhere some smart person has figured out a breakeven between negative returns and the cost of storing and insuring gold. The ECB doesn’t much care about gold but it does care, like all central banks, that the price of gold not rise too much because a rising gold price is a direct vote on central bank credibility.

We shouldn’t forget that the Bank of Canada meets Wednesday (no change expected) and the Reserve Bank of New Zealand on March 10, but ahead of the ECB. The RBNZ is more likely to lower rates, but probably not this time. We guess either or both governors may mention the currency level and sometimes that has equal power to a rate change.

We are always reluctant to predict a dollar rally. It has been the wrong way to bet in a majority of situations—for decades. But it’s hard to see how an activist ECB engaging in policy loosening (in the face of 0.7% inflation) can lift the euro against the dollar (in the face of inflation expectations over the Fed’s target). Let’s not even joke about contentious elections in Europe being better than the embarrassing political sideshow in the US. As a rule, politics doesn’t affect currencies. Let’s keep it that way. The one factor that can drive the dollar down in this situation is an on-going rally in oil.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 113.50 | SHORT USD | WEAK | 02/04/16 | 117.57 | 3.46% |

| GBP/USD | 1.4146 | SHORT GBP | WEAK | 02/17/16 | 1.4349 | 1.41% |

| EUR/USD | 1.0953 | SHORT EURO | WEAK | 02/23/16 | 1.1011 | 0.53% |

| EUR/JPY | 124.32 | SHORT EURO | WEAK | 02/11/16 | 126.19 | 1.48% |

| EUR/GBP | 0.7743 | SHORT EURO | NEW*WEAK | 03/07/16 | 0.7743 | 0.00% |

| USD/CHF | 0.9994 | LONG USD | WEAK | 03/01/16 | 1.0002 | -0.08% |

| USD/CAD | 1.3364 | SHORT USD | WEAK | 02/01/16 | 1.4031 | 4.75% |

| NZD/USD | 0.6751 | LONG AUD | STRONG | 02/01/16 | 0.6478 | 4.21% |

| AUD/USD | 0.7399 | LONG AUD | STRONG | 01/25/16 | 0.6980 | 6.00% |

| AUD/JPY | 83.98 | LONG AUD | STRONG | 03/03/16 | 83.57 | 0.49% |

| USD/MXN | 17.8361 | SHORT USD | WEAK | 02/23/16 | 18.1208 | 1.57% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold slumps below $2,300 as US yields rebound

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.