Outlook:

We get new home sales today, likely to buttress the nicely rising existing home sales already reported (but not a market mover in its own right). The potential market mover is the preliminary PMI, even though it is not expected to show a gain and the best we can hope for is a flat reading at 53.6. The important thing is that the PMI not fall, as it did in China and the euro-zone. We are building in a scenario where US recovery gains traction and others do not, so we need raw material like the PMI.

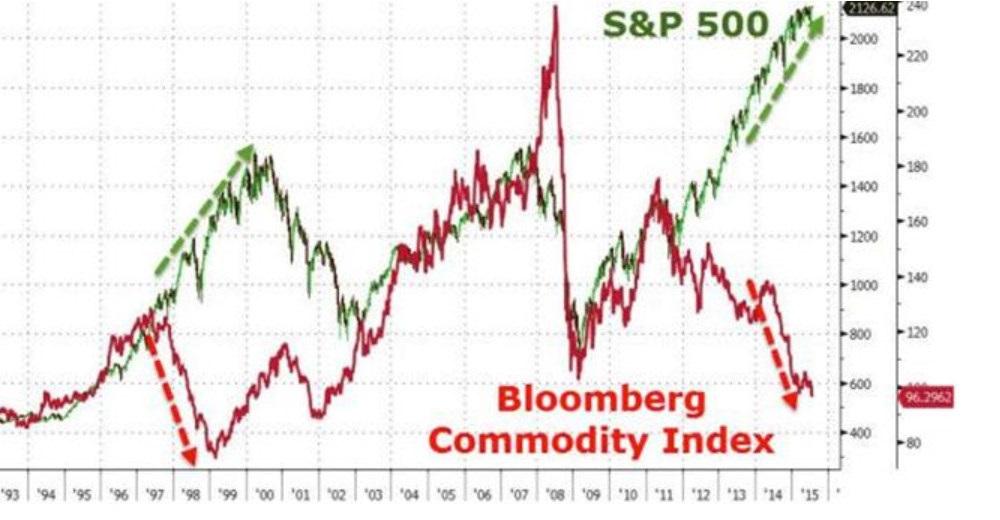

Off on the sidelines is the drop in commodity prices, which can be interpreted to mean two awful things—slowing growth and deflation. The Bloomberg Commodities index is down 14% this year and down 28% from May 2014. A seeking alpha contributor notes it is down 47% since 2011. And some-times the commodity index is inversely correlated with equities, as it is now.

This author, Nicolas Cheer, deduces that a Fed rate hike is dead wrong, at least now and for the foresee-able future. “It has now become the new orthodoxy on Wall Street that rising rates will push this market to new heights, and begin the next leg of the bull market in risk assets. But the reality is that the economic data continues to disappoint, and the world is mired in the winds of deflation, which are pointing to slow growth. To me this is absurd to think about raising rates in a world with falling prices. The mandate of the Federal Reserve is to achieve maximum employment within a context of price stability. Seeing, as we have not reached either of those objectives, I am not sure why now is the time for the Fed to tighten. Especially when the dollar continues to strengthen against foreign currencies. I expect these deflationary forces to gain strength in coming months, as commodities continue to slide, and the dollar continues to move in its bull trend, especially against the Euro.”

Hmm, we would really like to know how much weight the Fed places on commodity index prices. We know, or think we know, the Fed eschews trying to identify a stock market bubble, but does it look much at oil, gold and the industrial metals like copper? At a guess, falling commodity prices are just an-other “external” factor to the Fed, like Greece or China (or Ukraine), even though the effect on inflation is more direct.

About Greece, the consensus has it that the Syriza regime worsened conditions more than we know and the recession is deeper and wider than we think, making recovery nearly impossible, as both the IMF and former finmin Varoufakis keep saying. But there is one little ray of light. The creditors, while put-ting on their austerity face, are likely to let Greece slip a little here and there on the fiscal rules as long as they see signs of genuine reform. What’s important is not strict adherence to budget deficit rules and all the austerity folderol demanded by the uptight Germans. What’s important is true reform of a dysfunctional economy—labor laws, pensions, tax collection, privatization, etc. This would be the wise course. Even if we get true reform, it will take a generation to grow roots. That’s a discouraging idea but not entirely out of the question.

Another aspect of the Greek situation is named by Marc Chandler in the FT today—Greece has tremendous geopolitical importance. Yes, the financial and economic stuff is important, too, but we are forget-ting Greece’s location, location, location and role in global political power struggles, including NATO. Chandler is right. We joke that the US doesn’t have a dog in this eurozone fight, but actually, we do.

Bottom line for the dollar today—short-covering should be the key theme. Who would want to go short into the weekend ahead of a Fed policy meeting, especially in the thin end-July market? You may not be able to get out. We expect the euro to slip down to red support and probably to near the previous low (1.0868 from Wednesday). A failure to break the old low would mean we are going to be stuck in a prof-it-less, messy range for some time to come.

Note to Readers: We will not publish any reports the week of Aug 3-7. Cape Cod beckons.

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

AUD/USD regains the constructive outlook above the 200-day SMA

AUD/USD advanced strongly for the second session in a row, this time extending the recovery to the upper 0.6500s and shifting its focus to the weekly highs in the 0.6580-0.6585 band, an area coincident with the 100-day SMA.

EUR/USD keeps the bullish performance above 1.0700

The continuation of the sell-off in the Greenback in the wake of the FOMC gathering helped EUR/USD extend its bounce off Wednesday’s lows near 1.0650, advancing past the 1.0700 hurdle ahead of the crucial release of US NFP on Friday.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.