Global markets were mixed today after data from China confirmed that the country’s economy is weakening. The GDP numbers from the country showed that the economy expanded by 6.4% in the fourth quarter, which was a point lower than the 6.5% growth in the third quarter. It was the slowest growth rate since 2009. In the aftermath, Chinese stocks rose as investors priced in a stimulus package from the government. In Europe, stocks declined with the DAX and the Stoxx shedding 45 and 10 points respectively.

The sterling was mixed today ahead of a key speech by Theresa May. In the speech, she will outline her key goals in the upcoming negotiations on Brexit. A report by Bloomberg said that the premier had given up on a bipartisan approach to the fresh negotiations. As such, she will work with her party and coalition partners to come up with a deal that will be acceptable by the European Union as well. On its part, the EU is torn between extending the Brexit deadline by one year to give time for the UK to come up with an acceptable deal.

In the United States, the government shutdown continued for the fourth week. This is the longest government shutdown in history and there are concerns that it could continue for the foreseeable future as disagreements between Donald Trump and congressional leaders continue. The main issue in the shutdown is on how to address Trump’s border wall and other immigration issues. Over the weekend, Trump offered a deal that would allow continued protections for the ‘Dreamers’ (a program that shields young undocumented immigrants from deportation) as well as increasing humanitarian aid. Democrats rejected the offer and asked the president to open the government first.

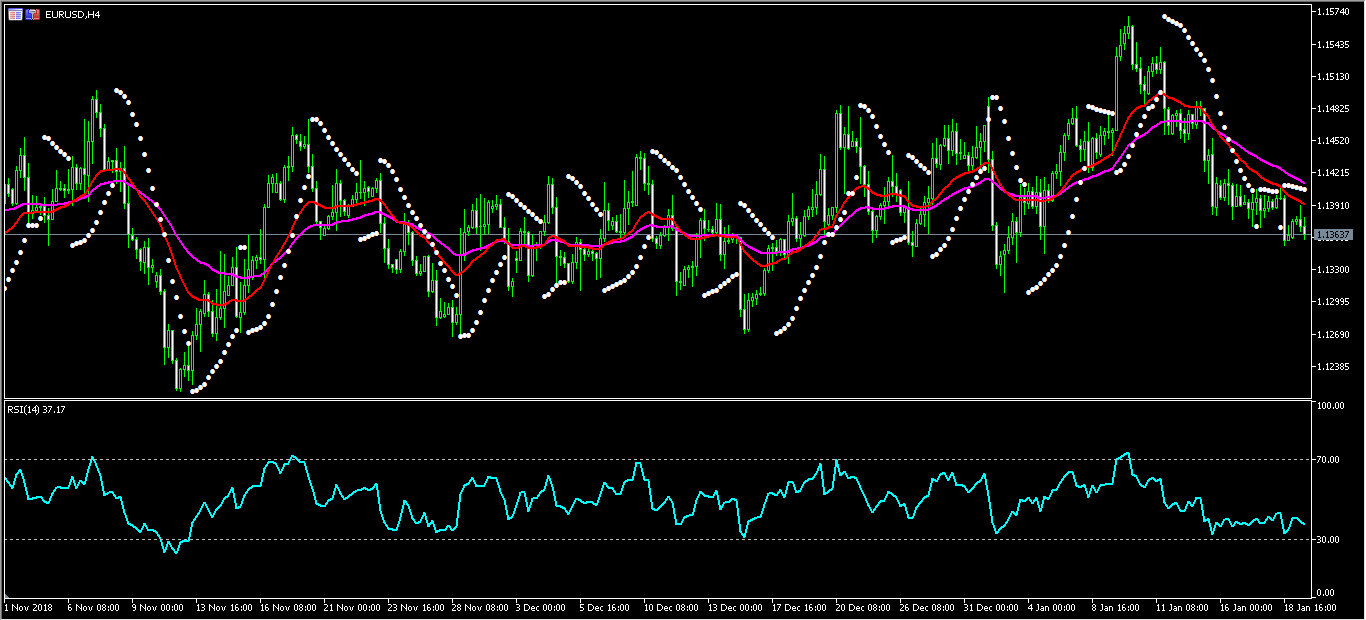

The EUR/USD pair declined today after weaker than expected data from the European Union. The pair reached an intraday low of 1.1350. On the hourly chart, the pair’s price is below the three-week and six-week moving averages while the RSI is slightly above the oversold level of 30. The parabolic SAR has flattened, which is an indication that the pair could breakout in either direction. This will mostly depend on the decision of the ECB later this week. Most analysts expect the bank to hike rates in October.

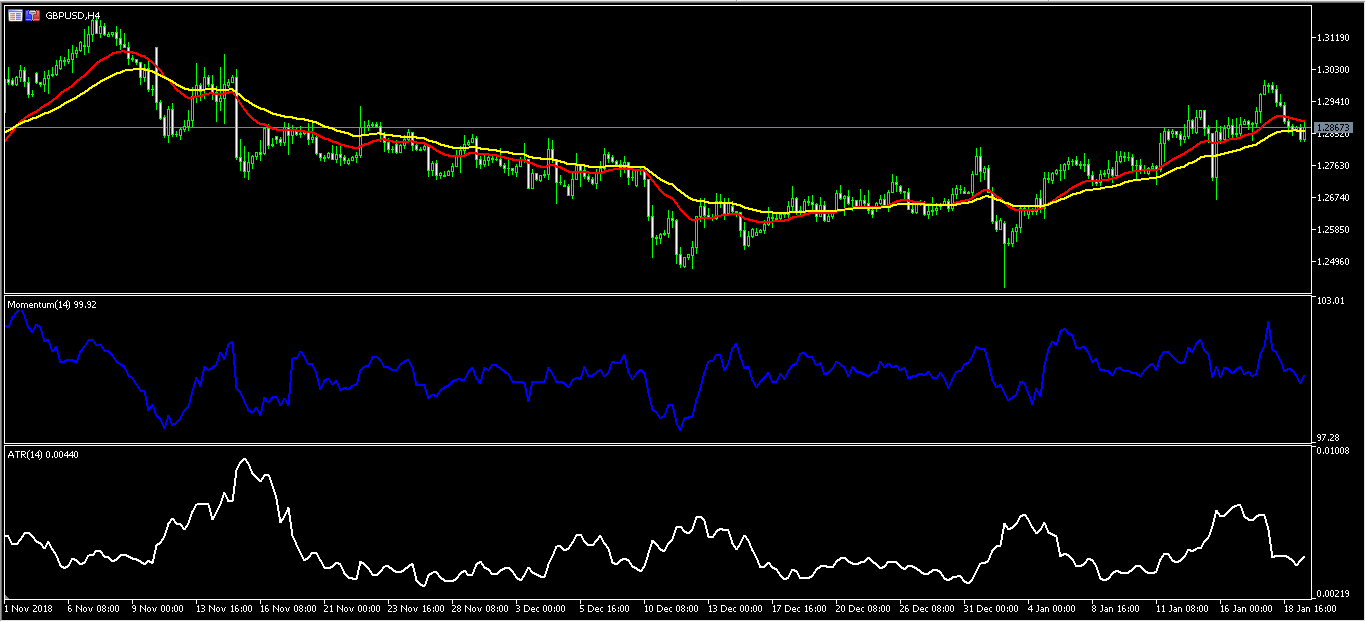

GBP/USD

The GBP/USD pair was little moved today as traders waited for the way forward from Theresa May. After declining to an intraday low of 1.2830, the pair then rose to an intraday high of 1.2885. On the four-hour chart below, the pair’s price is along the 21-day and 42-day EMAs, while the momentum and average true range index indicators have eased a bit. The pair will likely remain along this range until Theresa May’s speech later today.

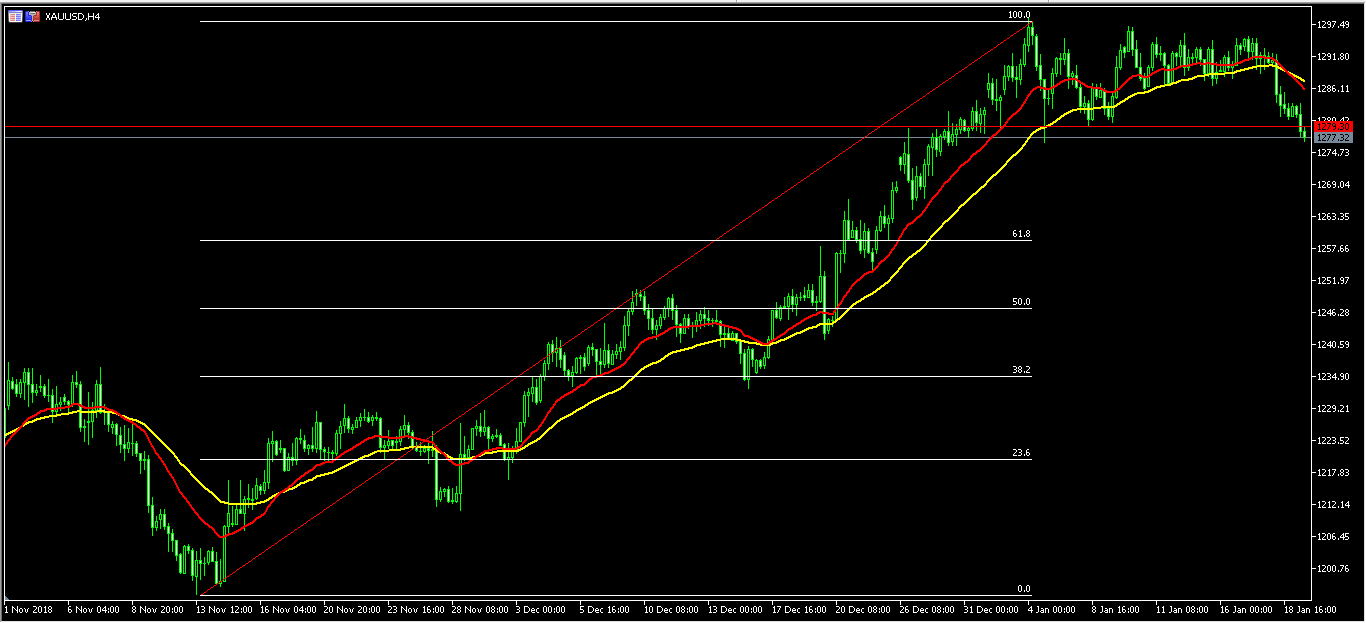

XAU/USD

The price of gold declined to a low of $1275 per ounce. This was a sharp decline from the YTD high of $1298, that was reached a week ago. On the four-hour chart, the current price of $1277 is below the short and medium-term EMAs. It has also broken past the important support of $1279 that is shown below. This means that the pair could continue moving down to potentially test the important level of $1260, which is also the 61.8% Fibonacci Retracement level.

General Risk Warning for FX & CFD Trading. FX & CFDs are leveraged products. Trading in FX & CFDs related to foreign exchange, commodities, financial indices and other underlying variables, carry a high level of risk and can result in the loss of all of your investment. As such, FX & CFDs may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with FX & CFD trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall we have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to FX or CFDs or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.