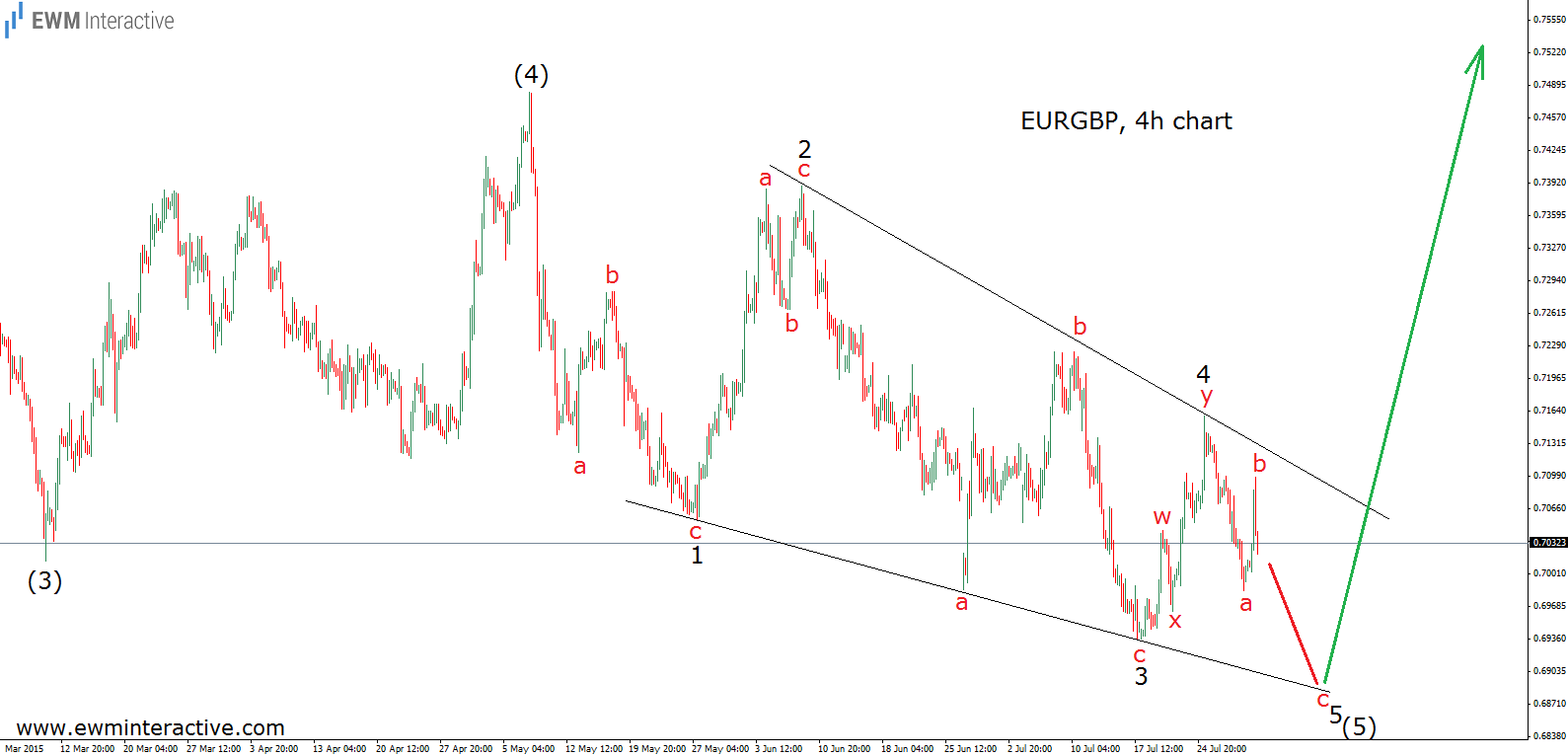

The Elliott Wave Principle is famous for its ability to help traders and investors identify price extremes and predict reversals. Two months ago, on August 2nd, we applied it to the 4-hour chart of EURGBP. In an article, called “EURGBP Trying To Find The Bottom”, it warned us that a bullish reversal might occur soon. You can see how the forecast was looking like on the chart below.

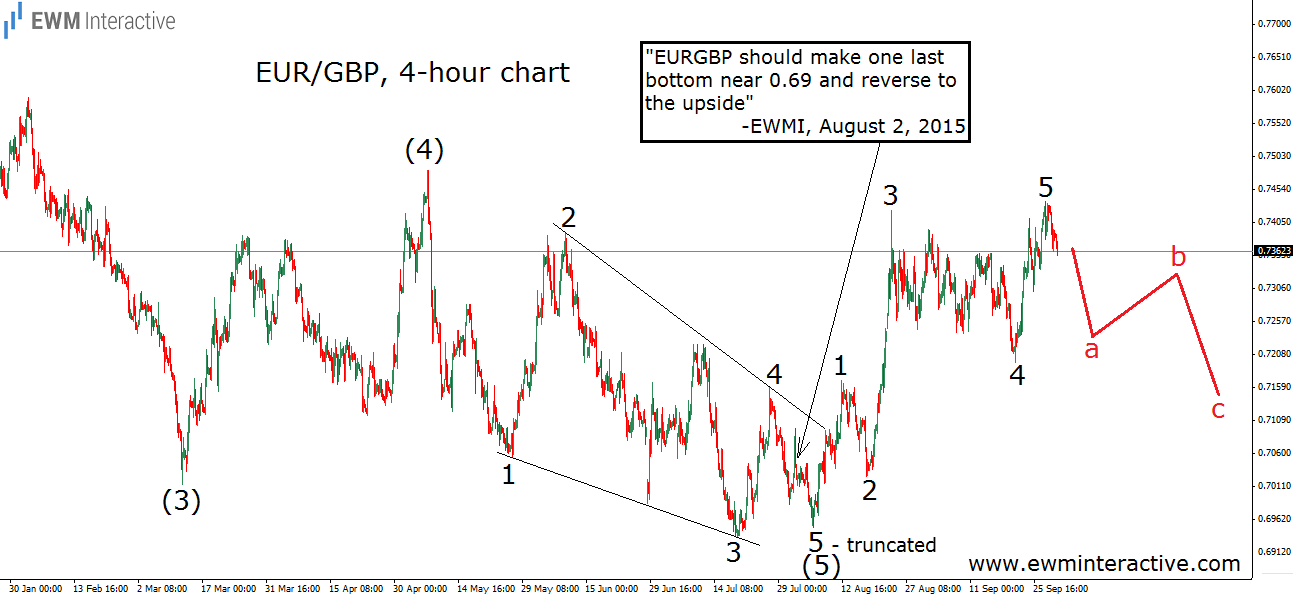

As visible, we thought there is an ending diagonal developing in wave (5), whose wave 5 was still under construction. That is why we said that “EURGBP should make one last bottom near 0.69 and reverse to the upside.” The updated chart shows how things went from then on.

It turned out the bulls were even more impatient than expected. EURGBP fell to 0.6950, which happened to be the level, where the bears finally gave up. Wave 5 of (5) did not make a new low, which allows us to call it a truncation. The pair then started rising. On September 29th, it reached as high as 0.7436.

What to expect in EURGBP from now on? As the chart depicts, the rally from 0.6950 to 0.7436 could easily be counted as a five-wave impulse. According to the theory, every impulse is followed by a three-wave correction in the opposite direction. So, we suspect the euro is going to weaken against the sterling in the near term. A pull-back to 0.7200 should not be excluded as a possibility.

Trading financial instruments entails a great degree of uncertainty and a variety of risks. EMW Interactive’s materials and market analysis are provided for educational purposes only. As such, their main purpose is to illustrate how the Elliott Wave Principle can be applied to predict movements in the financial markets. As a perfectly accurate method for technical analysis does not exist, the Elliott Wave Principle is also not flawless. As a result, the company does not take any responsibility for the potential losses our end-user might incur. Simply, any decision to trade or invest, based on the information from this website, is at your own risk.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.