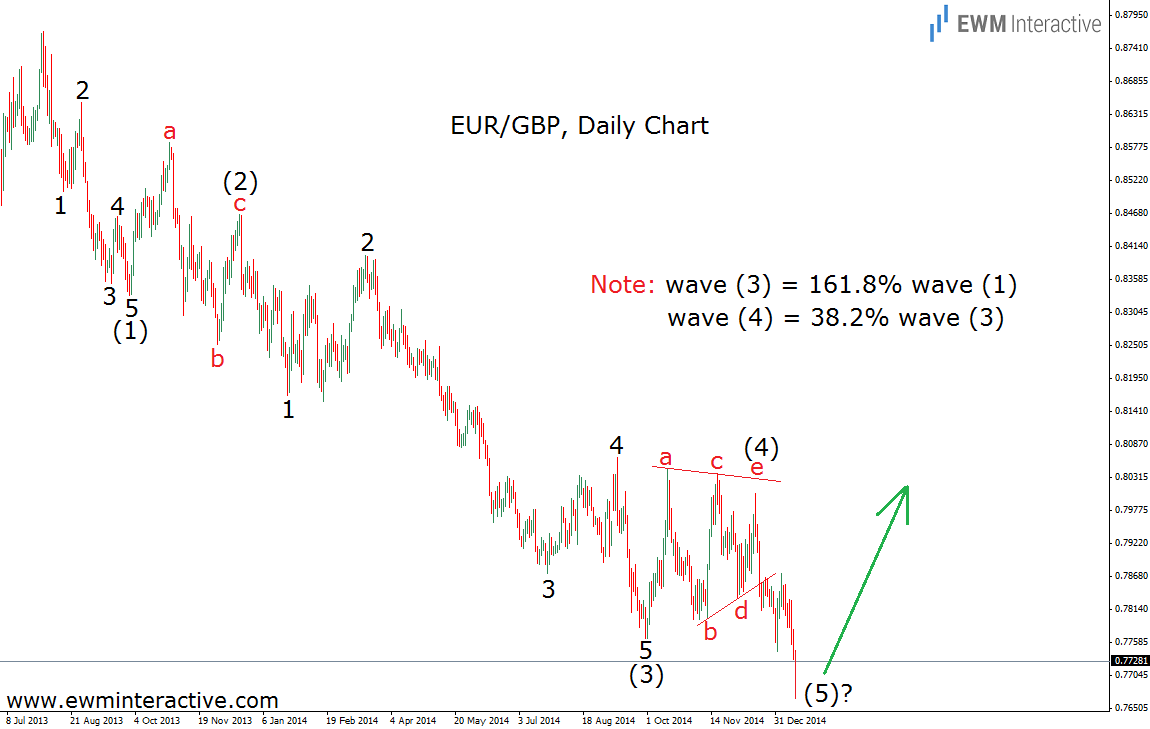

The EUR GBP exchange rate went below 0.77 today, which is its lowest level since March 2008. To many this may be a reason to get more and more bearish on the pair with each pip to the downside. However, the Elliott Wave Principle signals a “proceed with caution” sign, because it could be time at least for a temporary recovery soon. The chart below shows one of the clearest impulses in terms of wave structure and Fibonacci ratios. See for yourself.

As visible, the whole decline that started from 0.8770 could easily be counted as a five-wave sequence, where wave (5) is still in progress. The structure of waves (1) and (3) is also very clear. Wave (3) is extended to exactly 161.8% the length of wave (1). Wave (4) retraces 38.2% of wave (3). There are two reasons we believe the bears may be running out of power. First, according to the theory, every impulse is followed be a correction in the opposite direction. So regardless of how the bigger picture would look like if we examine it, this five-wave decline here suggests we should expect a reversal, once wave (5) is over. And second, wave (4) is a triangle. No matter where you see this pattern, it precedes the final move of the larger sequence. In this case, the wave (4) triangle precedes wave (5). Now, wave (5) does not seem finished yet. It could take the form of a regular impulse or an ending diagonal. In both scenarios, EUR GBP could visit the territory of 0.75, but not much lower.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.