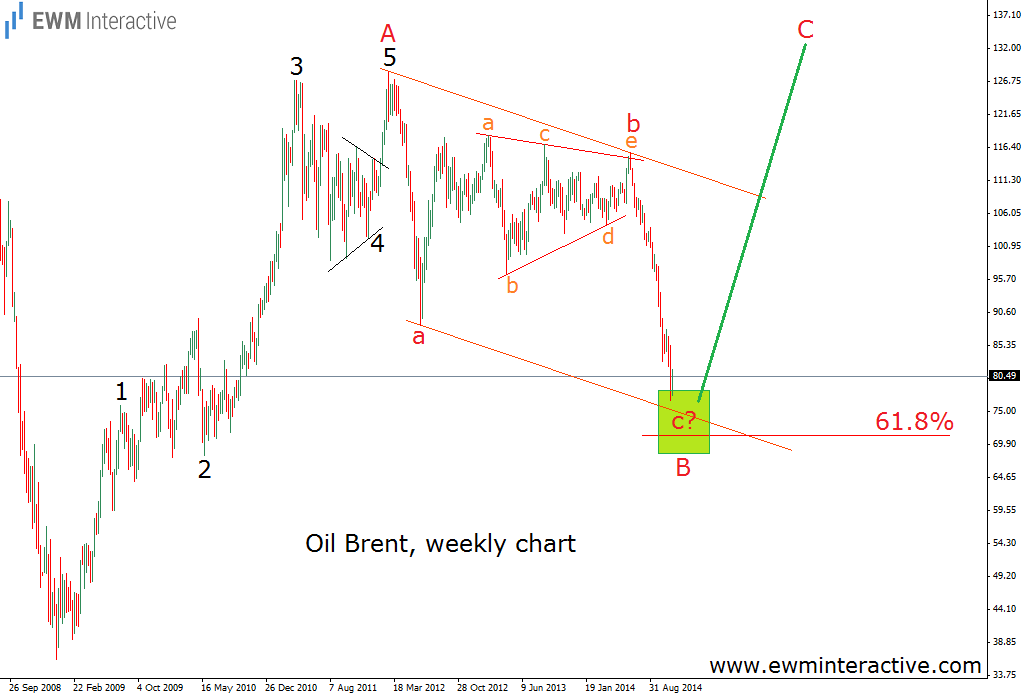

Brent Oil has been declining sharply during the last five months, falling down from above $115 per barrel in June to under $77 in November. It may seem the sell-off will last forever, but the Elliott Wave Principle gives us the right to disagree. It states that every price move, regardless of how big, is just one wave of a larger patterned cycle. So, where does this 38-dollar slump fit into the bigger picture? In order to find the answer, we have to look at a large enough time-frame chart, such as weekly.

According to the theory, the five-wave impulse shows the direction of the larger trend. Every impulse is followed by a three-wave correction in the opposite direction. The chart shows, that after the crash of 2008 there is one such impulse from $36 to $128. We will label it “A”. This means that all that happened after the $128 peak should be the natural three-wave retracement. And it really looks like oil brent has drawn an a-b-c zig-zag corrective pattern, where wave “b” is a triangle. Triangles precede the last move of the larger sequence. Here, the larger sequence is the a-b-c zig-zag and the last move is wave “c”, which is currently in progress. If this is the correct count, wave “c” of B should be expected to end somewhere in the zone of the 61.8% Fibonacci level. Then the 5-3 Elliott Wave cycle would be completed and the uptrend could resume in the face of wave C. It may seem impossible now, but if this count is right, brent oil could reach the $130 mark in the next two or three years.

Trading financial instruments entails a great degree of uncertainty and a variety of risks. EMW Interactive’s materials and market analysis are provided for educational purposes only. As such, their main purpose is to illustrate how the Elliott Wave Principle can be applied to predict movements in the financial markets. As a perfectly accurate method for technical analysis does not exist, the Elliott Wave Principle is also not flawless. As a result, the company does not take any responsibility for the potential losses our end-user might incur. Simply, any decision to trade or invest, based on the information from this website, is at your own risk.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.