Daily Forecast - 18 February 2016

Emini Dow Jones March contract

Emini Dow Jones tests resistance at 16450/470. Shorts need stops above 16520. A break higher is another buy signal & targets 16630/640 then 16666. If we continue higher look for 16710 then strong resistance at 16775/785 for a selling opportunity.

Failure to hold above 16450/470 targets first support at 16390/380. If we continue lower look for 16330/325 but below here strong support at 16250/240 could hold the downside today. Longs need stops below 16200. Further losses target 16165/160 then an excellent buying opportunity at 16095/085.

Ftse March contract

FTSE will need a break above 6020/30 to continue the recovery & target VERY STRONG resistance at 6070/80. We are overbought & we are in a bear trend so we could end the recovery here & this should be a good selling opportunity. In fact we also have the 100 day moving average at 6100/05 so only a break (& really a close too) above here then keeps bulls in short term control.

Failure to beat 6020/30 risks a slide to good support at 5960/50. This must hold the downside or we would have seen a false break of strong resistance yesterday. Below 5940 is more negative & targets 5900 then 5880. If we continue lower look for good support at 5840/30 which should hold the downside at this stage.

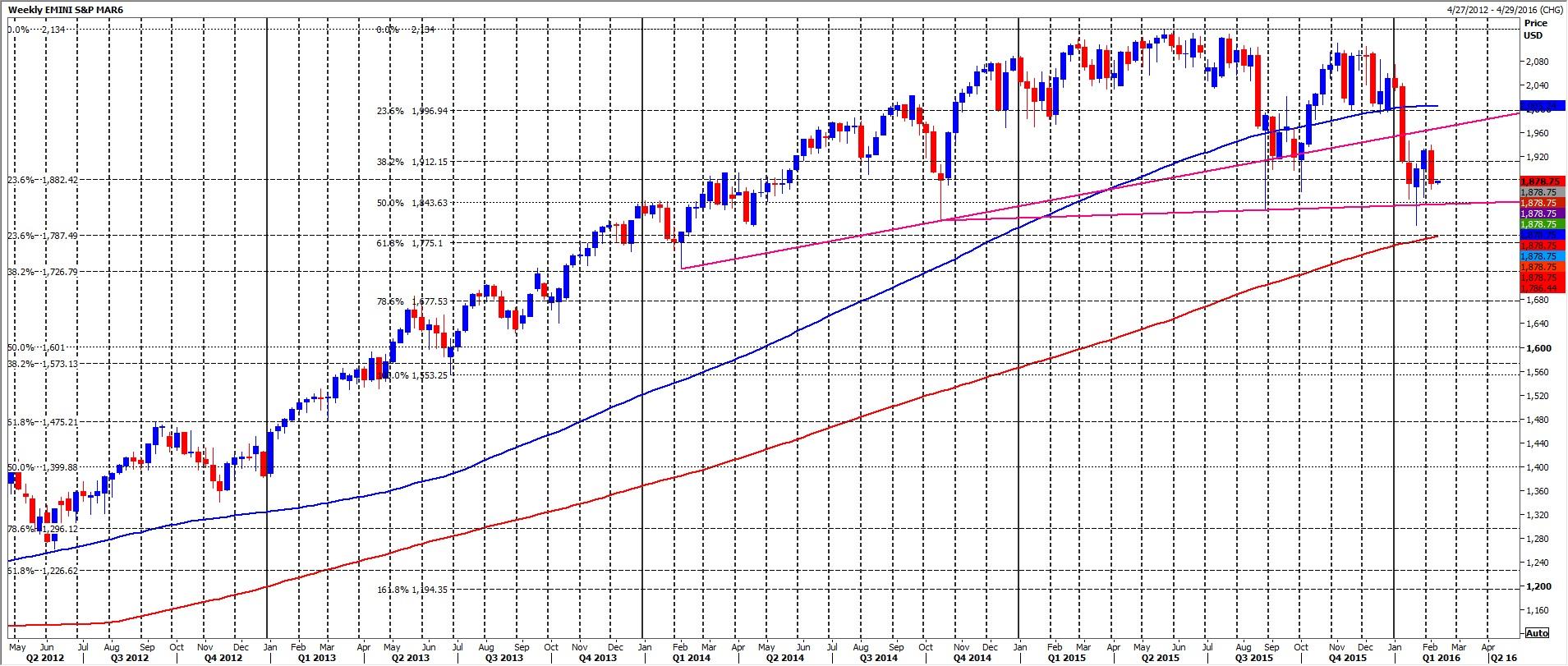

S&P March contract

Emini S&P has made it as far as 1928 as I write. Although overbought short term it looks like we can continue higher to 1938/40. This is important because it is the 2 week & therefore the February high, as well as a 50% recovery of the steep sell off from late December. So this is the main challenge for bulls today. A break above 1946 however is positive again & targets 1952 & 1956.

Below 1922 signals some weakness & risks a slide to 1918/17 then 1910. If we continue lower look for the best support of the day at 1905/04. Longs need stops below 1899. A break lower targets 1892/91.

Dax March contract

Dax strong resistance at 9430/40 is our first big challenge of course. We are short term overbought in a bear trend so we should struggle here. It is possible we turn lower but be aware that further gains target very strong resistance at in the 9530/70 band. This is the most important level of the week with a good chance the bear trend resumes from here. Shorts need wide stops above 9630 but I would only be more positive on a close above 9590.

Failure to beat 9430/40 targets 9350. If we continue lower look for 9310/05 then 9275 & good support at 9250/40. This is the best chance of a low for the day but longs need stops below 9190. A break lower targets minor support at 9140/30.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.