Daily Forecast - 03 November 2015

EURUSD Spot

EURUSD first resistance at 1.1035/40 but a break above 1.1050 targets 1.1070 & perhaps as far as second resistance at 1.1085/90. Exit longs here & try shorts at 1.1115/20. This is an excellent selling opportunity & a high for the day is expected if we reach this far but shorts need stops above 1.1145.

Failure to beat first resistance at 1.1035/40 re-targets minor support at 1.1005. If we continue lower today look for 1.0985/80 then better support at 1.0965/60. This could hold the downside but longs need stops below 1.0930. A break lower risks a retest of October lows at 1.0890/84.

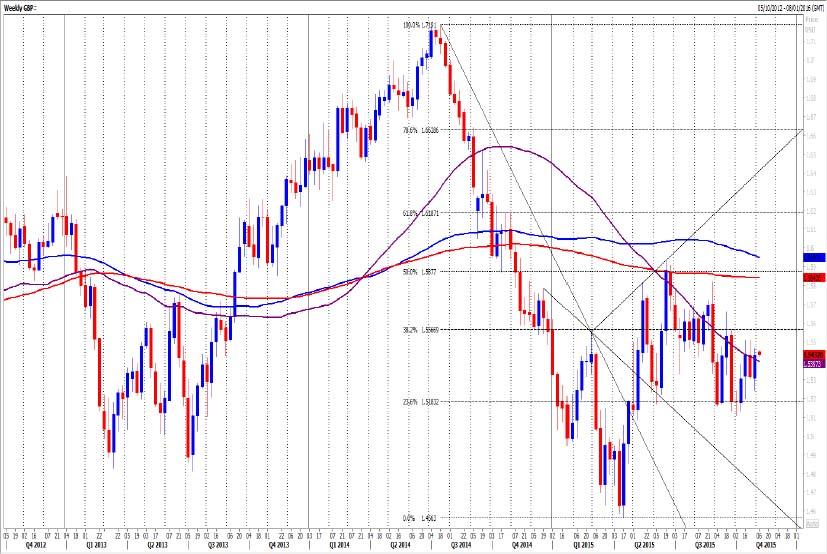

GBPUSD

GBPUSD direction remains impossible to judge day to day. First support at 1.5405/00 but below here targets 1.5370 & perhaps as far as good support at 1.5340/35. This could hold the downside but longs need stops below 1.5310.

First resistance at 1.5435/40. If we continue higher look for 1.5465/70 then October highs at 1.5500/08. Just be aware that a close above here is obviously positive & targets 1.5525/30 then 1.5550. If we continue higher look for 1.5565/69.

AUDUSD Spot

AUDUSD minor resistance at 7160 but a break above targets very strong resistance at 7185/90 for an excellent selling opportunity, with stops above 7205. A break higher however targets minor resistance at 7220/25 & perhaps as far as strong resistance at 7260/65 for the next selling opportunity.

Failure to beat first resistance at 7160 sees a dip to 7140 but minor support at 7120/15 could hold the downside. Longs need stops below 7100 to target last week's low at 7068/63. A break lower to target 7035 then 7000/6995.

USDJPY Spot

USDJPY holding below 120.70 would re-target 120.45, perhaps as far as our buying opportunity at 120.20/16. Our longs here need stops below 119.95. Be ready to sell a break below to target 119.80/75 then support at 119.40/35 for the next buying opportunity.

Holding above first resistance at 120.70 today however targets minor resistance at 121.00/03 then 121.15/20. We should struggle here this morning but a break above 121.25 targets October highs at 121.46/51. A break above here this week would be positive again & targets 121.72/75, perhaps as far as strong resistance at 121.90/95.

Gold Spot

Gold short term outlook negative & holding below 1137 targets 1130/29 then 1123/22. This area is a strong short term buying opportunity & could see a low for the week.

First resistance at 1137/38 but above 1139 could target stronger resistance at 1143/44. Try shorts with stops at 1147. On an unexpected break higher however look for 1144/43 to act as support for a move towards strong resistance at 1150/52. Try shorts with stops at 1156.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

Fed statement language and QT strategy could drive USD action – LIVE

The US Federal Reserve is set to leave the policy rate unchanged after April 30 - May 1 policy meeting. Possible changes to the statement language and quantitative tightening strategy could impact the USD's valuation.

EUR/USD stays below 1.0700 as focus shifts to Fed policy decisions

EUR/USD stays in its daily range below 1.0700 following the mixed macroeconomic data releases from the US. Private sector rose more than expected in April, while the ISM Manufacturing PMI fell below 50. Fed will announce monetary policy decisions next.

GBP/USD holds steady below 1.2500 ahead of Fed

GBP/USD is off the lows but stays flatlined below 1.2500 on Wednesday. The US Dollar stays resilient against its rivals despite mixed data releases and doesn't allow the pair to stage a rebound ahead of the Fed's policy decisions.

Gold rebounds above $2,300 after US data, eyes on Fed policy decision

Gold gained traction and recovered above $2,300 in the American session on Wednesday. The benchmark 10-year US Treasury bond yield turned negative on the day after US data, helping XAU/USD push higher ahead of Fed policy announcements.

A new stage of Bitcoin's decline

Bitcoin's closing price on Tuesday became the lowest since late February, confirming the downward trend and falling under March and April support and the psychologically important round level.

_20151103112544.jpg)