Daily Forecast - 10 February 2015

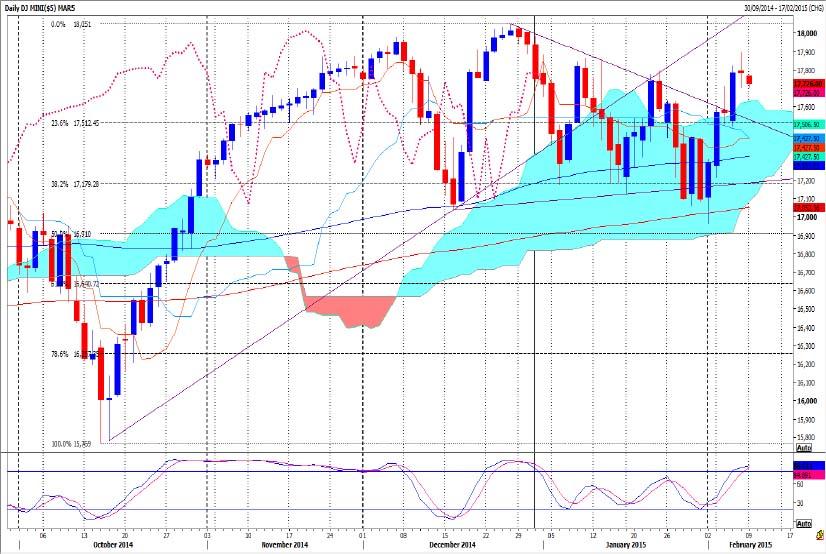

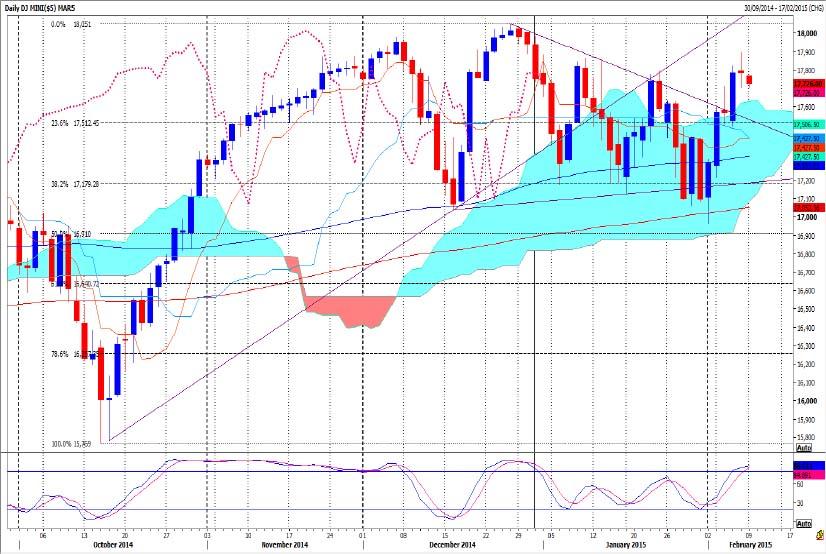

Emini Dow Jones March contract

Emini Dow Jones overbought and chances are we will continue lower. First support level at 17,680/670 is key to direction and if this does not hold the downside we are likely to retest yesterday’s low at 17,624 & perhaps see 17,615/600. However we don't meet strong support until the 17,500/17,535 area. There is a good chance of a low for the day here but longs need a stop below 17,500. Be ready to go with a break lower to target the next support level at 17,460/17,430. Try longs here with a stop below 17,400.

Emini Dow Jones overbought and chances are we will continue lower. First support level at 17,680/670 is key to direction and if this does not hold the downside we are likely to retest yesterday’s low at 17,624 & perhaps see 17,615/600. However we don't meet strong support until the 17,500/17,535 area. There is a good chance of a low for the day here but longs need a stop below 17,500. Be ready to go with a break lower to target the next support level at 17,460/17,430. Try longs here with a stop below 17,400.

Mini Russell 2000 March contract

Mini Russell 1199/98 level is key to direction again today. Failure beat this first resistance retests 1194/93 but we could continue lower today to support at 1190/89. A bounce from here is likely but below here targets 1182/81. If we continue lower look for good support at 1174/73. Buy with stops on a move below 1168.

First resistance at 1199/98 to try shorts, with stops above 1205. Be ready to go with a break higher however for a move towards last week’s high at 1213/14. Just be aware that a break higher this week targets the all time high at 1220.

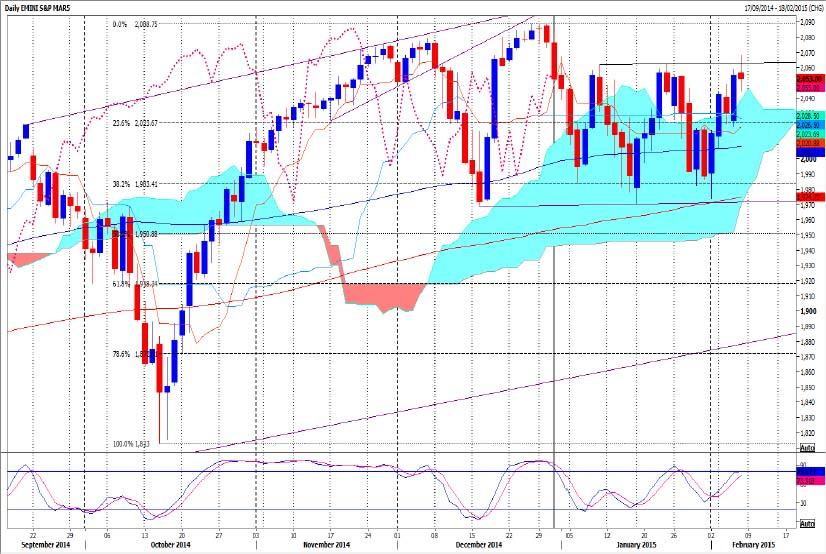

S&P March contract

Emini S&P failure to beat quite strong resistance at 2045/44 sees a retest of support at 2038/37. We could continue lower today however to test good support at 2031/30. A low for the day is possible here, but longs need stops below 2025 for the next target of 2021/20. It should be worth trying longs here with stops below 2016. However a break lower sees 2020/21 act as resistance for a move towards the next support at 2010/2008. Try longs with stops below 2004.

First resistance at 2044/45 is the main challenge to a recovery. Above here is more positive & targets resistance at 2052/2053. We should struggle here & a high for the day possible but shorts need stops above 2057 for a test of resistance at 2063. Try shorts with stops above 2068. An unexpected break higher is very positive however & we should then target 2073, 2076 & the all time high at 2086/2088.75.

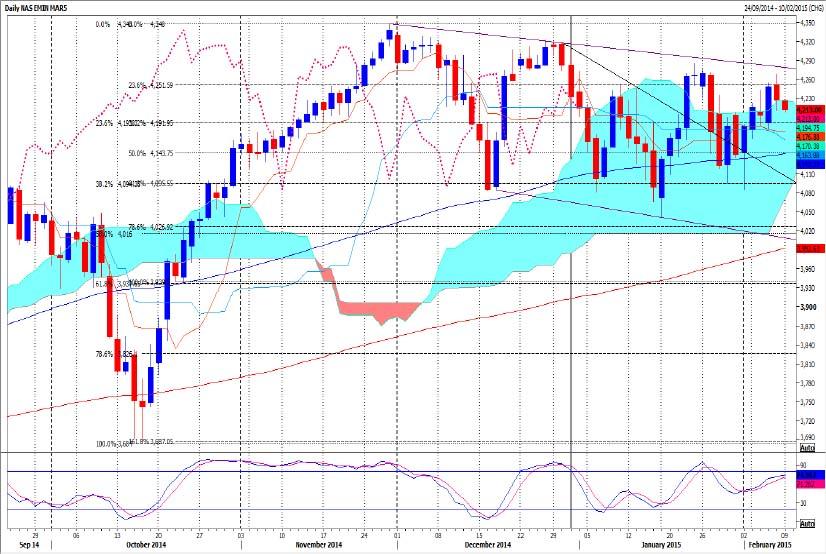

E Mini Nasdaq March contract

E-Mini Nasdaq outlook is not particularly positive so watch our first support level at 4199/4198. Longs need stops below 4190 to target 4185 then support at 4177/4176 but if trying longs we need stops below 4166. If this does not hold the downside however look for a test of better support at 4156/4155. This is an excellent buying opportunity and it is worth trying longs with a stop below 4140.

First resistance at 4225/4230 but above here is more positive for today at least and targets 4243 then 4252. If we continue higher look for a retest of last week's high at 4268 but only just above here we run into 2.5 month trendline resistance at 4276/79. A good chance of a high for today and it is worth trying shorts with a stop above 4290.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

AUD/USD: Gains appear capped near 0.6580

AUD/USD made a sharp U-turn on Tuesday, reversing six consecutive sessions of gains and tumbling to multi-day lows near 0.6480 on the back of the robust bounce in the Greenback.

EUR/USD tumbles out of recent range, tests below 1.0770 as markets flee into safe havens

EUR/USD slid below the 1.0670 level on Tuesday after an unexpected uptick in US wages growth reignited fears of sticky inflation, chopping down rate cut expectations and sending investors into safe haven bids.

Gold pullbacks on rising US yields, buoyant US Dollar as inflation heats up

Gold prices drop below the $2,300 threshold on Tuesday as data from the United States show that employment costs are rising, thus putting upward pressure on inflation. XAU/USD trades at $2,296 amid rising US Treasury bond yields and a stronger US Dollar.

Ethereum slumps again as long liquidations exceed those of Bitcoin

Ethereum experienced a further decline on Tuesday following a disappointing first-day trading volume for Hong Kong's spot Bitcoin and ETH ETFs. This comes off the back of increased long liquidations and mixed whale activity surrounding the top altcoin.

No tap dancing around inflation concerns

Tuesday saw U.S. stocks closing considerably lower as investors grappled with economic indicators indicating increasing labour costs and a decline in consumer confidence, all coming ahead of a crucial Fed policy meeting aimed at determining the trajectory of interest rates.