Daily Forecast - 29 January 2015

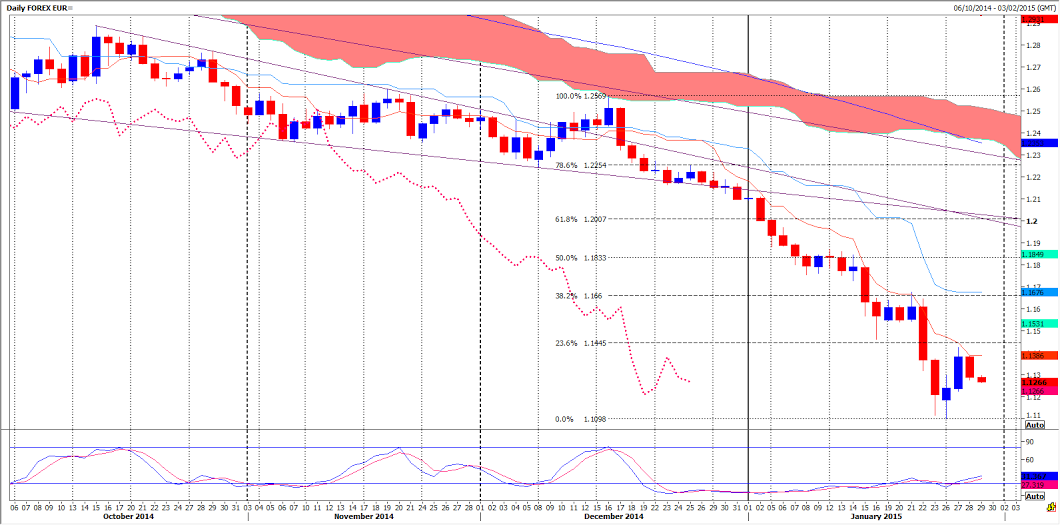

EURUSD

EURUSD failure to beat first resistance at 1.1320/15 sees a retest of support at 1.1275/70. A break lower today targets support at 1.1235/30. Any longs here need stops below 1.1195/90 to target 1.1150/00 before a retest of two-day lows at 1.1113/1.1098. Failure here this week targets 1.1045 then 1.1010/1000. If we continue lower look for 1.0965/62 then 1.0930 and 1.0907/05. A break below here risks the move as far as 1.0845.

Holding support at 1.1275/70 triggers a recovery to 1.1320/25 but above here look for a selling opportunity at 1.1375/85. Shorts need stops above 1.1400 for a move towards very strong resistance at 1.1445/55 & an excellent selling opportunity with stops above 1.1480. An unexpected break higher however sees 1.1455/1.1445 work as good support for a move up towards the next target of 1.1545/50. This should be a very good selling opportunity with a stop above 1.1585.

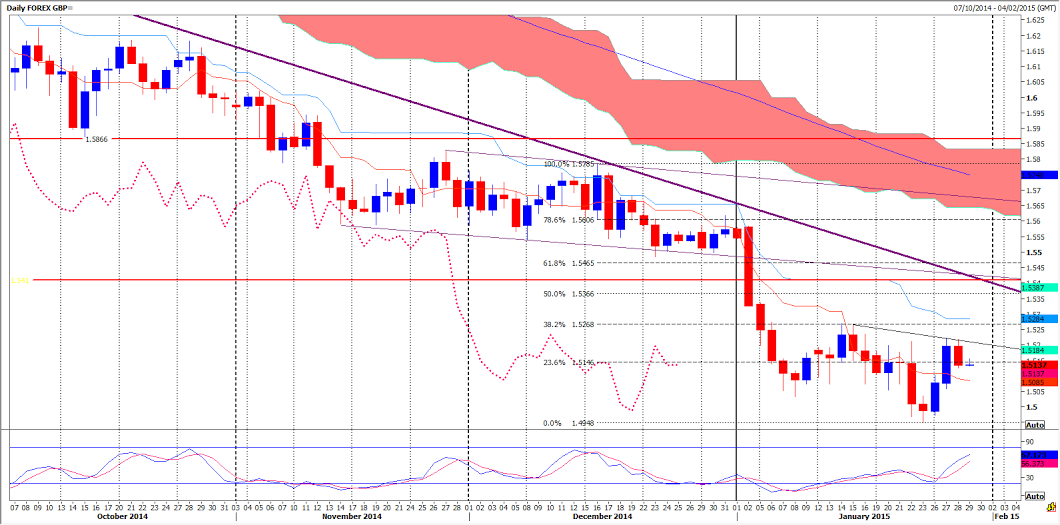

GBPUSD

GBPUSD is overbought short term & failure to beat first resistance at 1.5155/45 targets our buying opportunity at 1.1520/1.1515. Try longs with stops below 1.1500. However a break lower targets 1.5085 then strong support at 1.5065/1.5055. A bounce from here is expected but longs will need a stop below 1.5035.

First resistance at 1.5145/55 but above here targets 1.5210/1.5220 again today. There is a better chance of a break higher so shorts need stops above 1.5235 for a move to the next target of 1.5265/1.5270. There is a good chance of a high for the day here so try shorts with a stop above 1.5300. Just be aware that an unexpected break higher will then target 1.5325/1.5335.

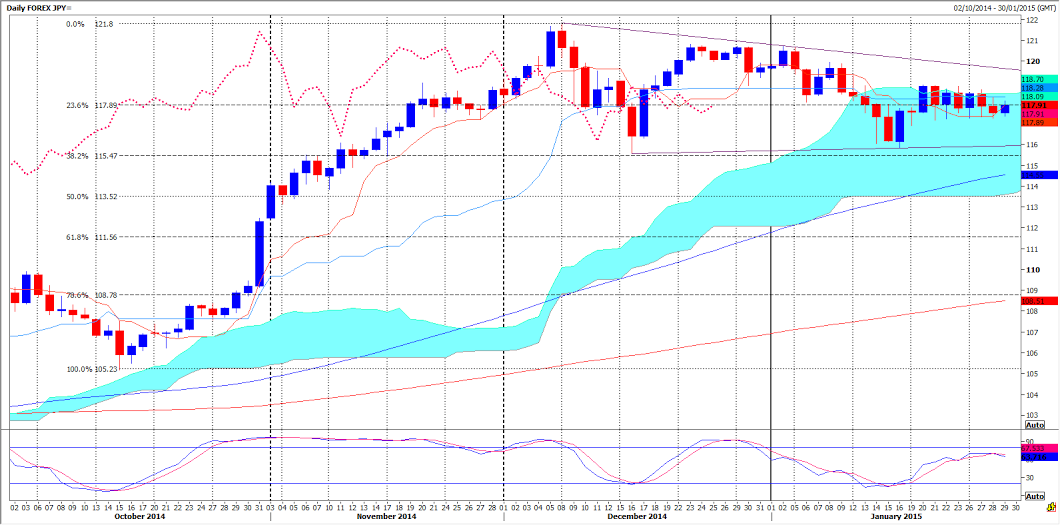

USDJPY

USDJPY holding below 117.75/70 targets support at 117.35/25. On a break lower this week look for good support at 117.00/96. Try longs with stops below 116.80. Be ready to go with a break lower using 117.00 as resistance to target 116.50/45 then 116.05/00 before January lows at 115.82.

First resistance at 117.75/70 but above here targets resistance at 118.20/25. A break higher today meets strong resistance again at 118.80/85. Try shorts with a stop above 119.00. A break above the five-day range today is positive, so be ready to go with a break to target 119.30/35 and perhaps as far as trend line resistance at 119.70. A good chance of a high for the day here but if we continue higher this week look for 119.88/96.

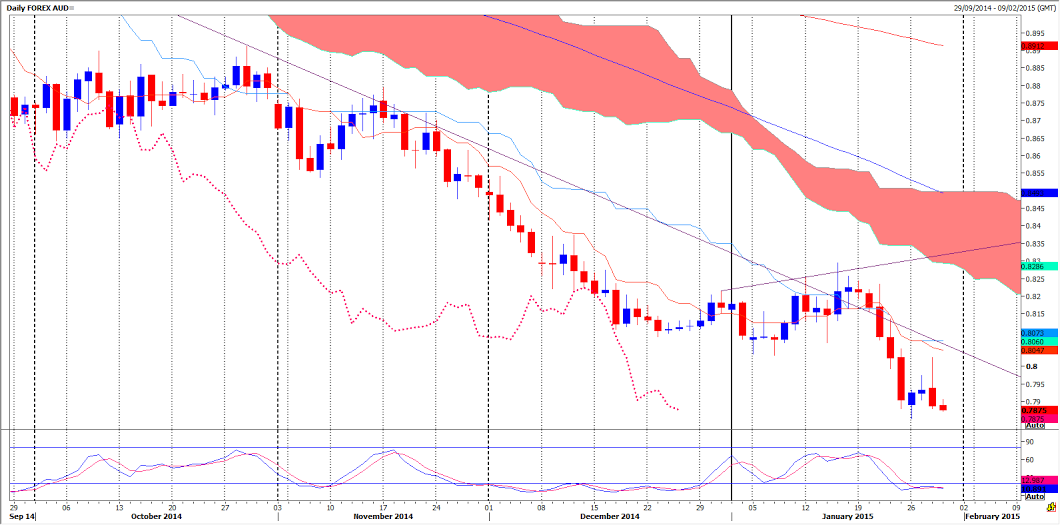

AUDUSD

AUDUSD holding below 7900/7895 keeps the market under pressure to target 7873/69 then retest this week's low & support at 7850/45. Be ready to go with a break lower to target 7800 & perhaps as far as 7787.

Above 7900 is less negative for now & opens the door to first resistance at 7935/40. Try shorts with stops above 7955. On a break higher however we meet strong resistance at 7995/8000 to try shorts with stops above 8025! However be ready to go with a break higher using 7995 as support to target 8040 & perhaps as far as strong resistance at 8080/85 for a selling opportunity.

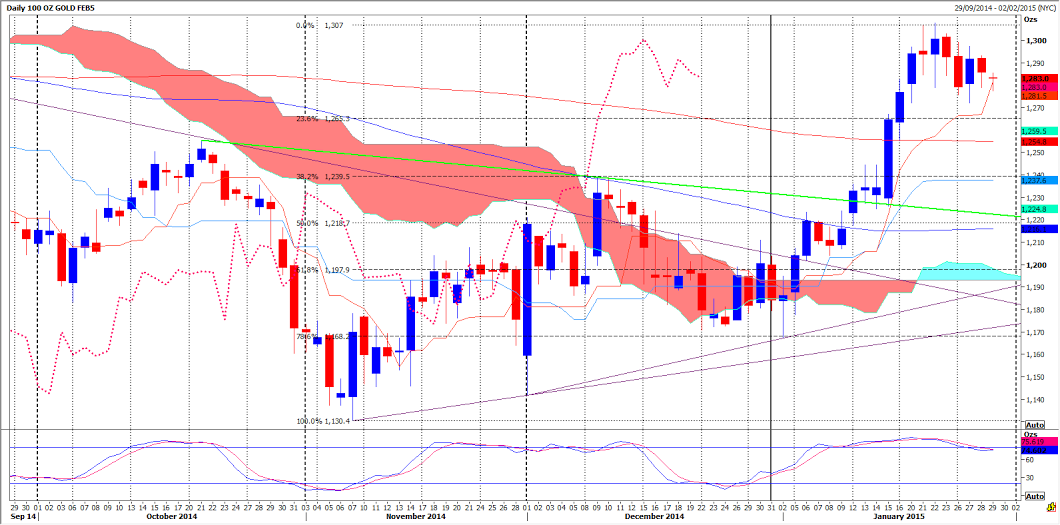

Gold February Contract

Gold February immediate resistance at 1288/89 is the main challenge today, but shorts need stops above 1293. A break higher targets 1298/1300 & we should struggle here. Hi if prices continue higher look for a selling opportunity at strong resistance at 1307/1308. Try shorts with a stop above 1311. However be ready to go with an unexpected positive break higher using 1308/1307 as support, for a move up to 1313 then 1319 and perhaps as far as 1322/1324.

First support at yesterday's low of 1280/79 but below here targets good support at 1275/1274. This could hold the downside so try longs with stops below 1270. A break lower however could then target stronger support at 1266/1265. It should be worth buying into longs here with a stop below 1260.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.