Daily Forecast - 15 December 2014

AUDJPY Spot

AUDJPY key to direction is immediate resistance at 9860/70 again today. It may be worth trying shorts with a stop above 9900 but be ready to go with a break higher using 9870/60 as strong support for a move to resistance at 9950. Watch for a high for the day here but if we manage to continue higher look for a very good selling opportunity at 9995/100.05.

Immediate resistance at 9800 & failure to get back above here keeps the market under pressure. We are then likely to retest support at 9750/45. If we continue lower today, look for an excellent buying opportunity at 9730/9720 with stops below 9705.

Bund March contract

Bund hit all targets to the 154.65/73 area to keep the outlook positive. Prices topped at 154.80 but on a break higher today we target 154.93/97 & perhaps as far as 155.08/11. Any further gains could reach 155.19/23.

Below 154.74 may trigger short term profit taking to 154.56/51 but below here risks a slide to 154.33 then Friday’s low at 154.23. Longs need stops below the gap at 154.17.

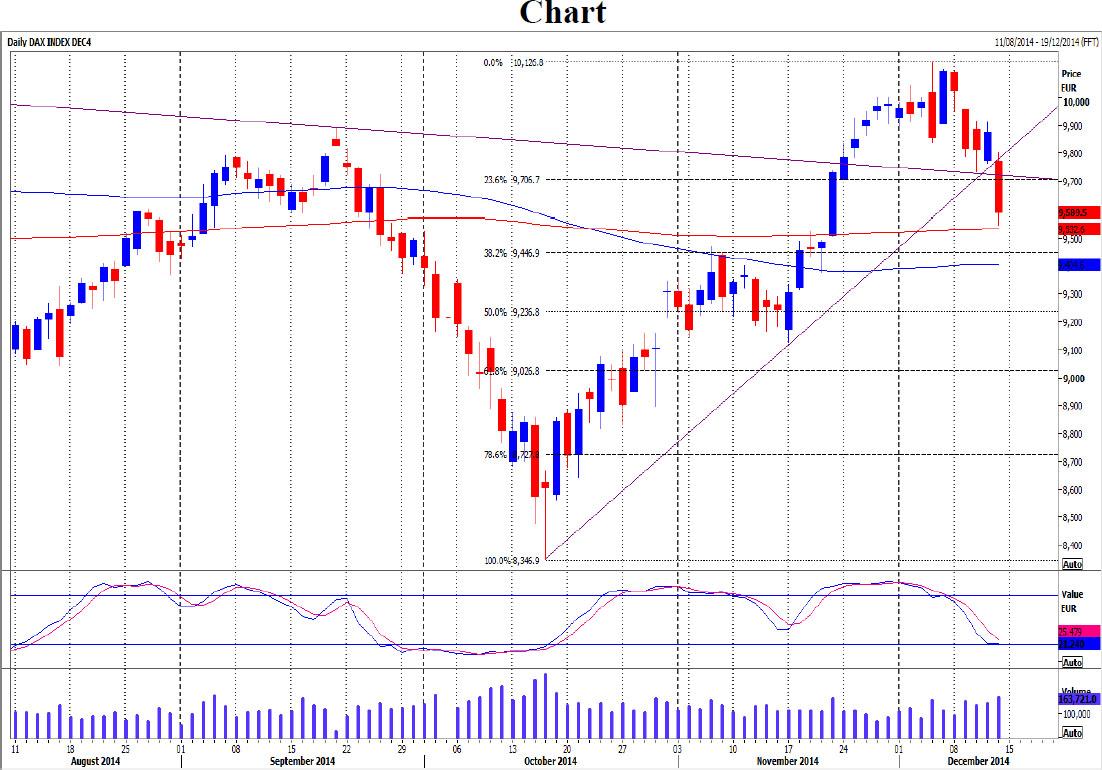

Dax December contract

Dax got to within 15 ticks of our ultimate target on Friday of 200 day moving average support at 9530/9520. Outlook remains negative so if trying longs here we need a stop below a small gap at 9490. Be ready to go with a break lower to target strong Fibonacci support at 9450/45. Try longs with stops below the 100 day moving average support at 9405/00. Just be aware that a break below here is again worryingly negative. Downside pressure should increase & we could see accelerated downside movement to target 9345/35 then important longer term trend line & Fibonacci support at 9315/10. A low for the correction is very possible here so is worth trying longs with stops below 9275.

If we do manage to hold important 200 day moving average support at 9530/9520, w e should recover back up to 9620/25. Above here is more positive and we could even reach as far as 9690/9700. There is a good chance of a high for the day here and it is worth trying shorts with a stop above 9745. However on a break higher be ready to jump into longs using 9700/9690 as good support for a move to 9785/90. A break above Friday’s high at 9801 would then turn the outlook much more positive for the rest of the week.

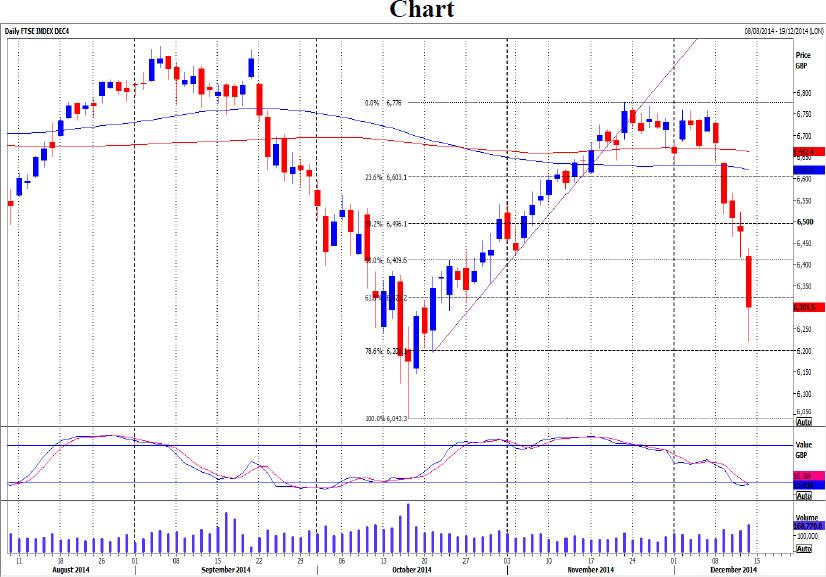

Ftse December contract

FTSE outlook remains negative after last week’s loss of over 500 points. A break below immediate support at 6200/6195 adds pressure to target 6150/45 with any further losses to test 200 month moving average support at 6125/20. A low for the day possible but longs need stops below 6100. Be ready to go with a break lower to target 6083/82 then 6065/60.

Our first resistance level is at 6260/65 then 6290/93. Above here look for a selling opportunity at 6310/15 with a good chance of a high for the day but our shorts need a stop above 6330. On a break higher we should target 6345/50 and any shorts here will need a stop above 6360.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.