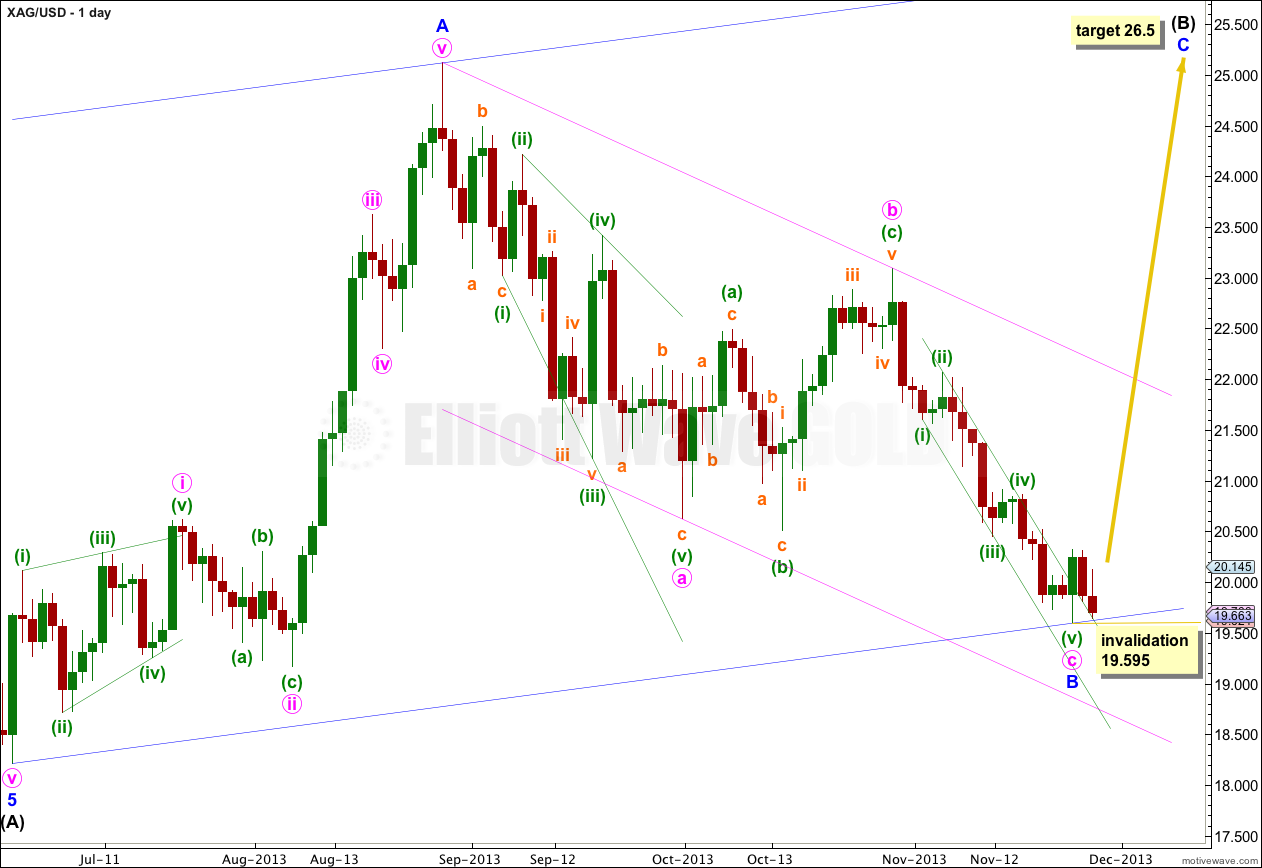

Last week’s analysis of Silver expected more downwards movement towards a target at 18.591 to 18.353. Price did move lower but has failed to reach the target. Downwards movement may have ended at 19.595, 1.004 short of the target zone.

The wave count remains mostly the same.

Minor wave B is now a complete zigzag.

Within minor wave B minute wave a subdivides nicely as a leading expanding diagonal. Within the leading diagonal all the subwaves are zigzags except the third wave which is an impulse. For this piece of movement this structure has the best fit.

Minute wave b is labeled as an expanded flat correction. Within it minuette waves (a) and (b) both subdivide as three wave zigzags, and minuette wave (b) is a 106% correction of minuette wave (a). There is no Fibonacci ratio between minuette waves (a) and (c).

Minute wave c is now a complete impulse. Within minute wave c there are no adequate Fibonacci ratios between minuette waves (i), (iii) and (v).

The narrow channel drawn about minute wave c is drawn using Elliott’s first technique. Draw the first trend line from the ends of minuette waves (i) to (iii), then place a parallel copy upon the end of minuette wave (ii). This channel is now clearly breached by upwards movement which indicates minute wave c is over and the next wave has begun. The upper edge of the channel is now providing support.

Within minor wave C no second wave correction may move beyond the start of its first wave. This wave count is invalidated with movement below 19.595.

At 26.50 minor wave C would reach equality in length with minor wave A.

What is very clear on this hourly chart is the three wave structure for recent downwards movement. If price does not break below 19.595 then I would expect a third wave upwards to begin from here.

Upwards movement for minuette wave (i) is very clearly an impulse. Ratios within minuette wave (i) are: there is no Fibonacci ratio between subminuette waves iii and i, and subminuette wave v is just 0.006 short of 0.618 the length of subminuette wave iii.

Within minuette wave (ii) subminuette wave c is 0.031 short of equality with subminuette wave a.

At 20.820 minuette wave (iii) would reach 1.618 the length of minuette wave (i).

The channel about minuette waves (i) and (ii) is an acceleration channel. I would expect minuette wave (iii) to break through the upper edge of this channel. At that stage I would be confident that a third wave is underway.

Our service is educational, we aim to teach you how to learn to perform your own Elliott wave analysis.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.