Market Overview

The decks are being cleared for the signing of “phase one” of a trade agreement between the US and China. With translations done, both sides are ready for the signing in Washington tomorrow. The US has even sweetened the deal by removing China from its “currency manipulator” list (which it was put on back in August). This was an easy win for both sides as no reasonable assessment of the yuan would suggest that the PBoC has been manipulating it (if anything the opposite). So for the US to magnanimously remove this status is simply good optics in front of the deal which helps relations, but effectively achieves little other than improve relations between the two. Market sentiment has taken a leap forward early this week, but there is a risk that it could become a “buy on rumour, sell on fact” moment. There is much to question about how much extra of US agricultural products that China can buy to make a difference. The most important part of the agreement is over forced technology transfers, however, something that again will be difficult to immediately measure. On market moves, the yen is under pressure at seven month lows against the dollar. However, this move is something of a disconnect to yield differentials and needs to be watched. Gold also remains under pressure. Once the dust settles on “phase one” and the difficulties of subsequent phases come out, will markets be so ebullient. Adding to today’s risk appetite is that China’s trade data showed signs of positivity as the surplus increased in December to +$46.8bn (from +$37.9bn in November). Although this was not as much as the $48.0bn expected, China did see exports increasing by +7.6% and imports increasing by +16.3%, both of which were better than forecast.

Wall Street closed solidly higher once more with the S&P 500 +0.7% at 3288 for another all-time high. Although US futures are a shade lighter this morning (-0.1%) Asian markets have been broadly positive (Nikkei +0.7%, Shanghai Composite -0.3%). In Europe, there is a mildly positive open in prospect with FTSE futures and DAX futures +0.1% higher. In forex, there is limited real direction across the majors, although recent weakness for both JPY and GBP continues. In commodities, gold and silver have continued lower early today, whilst oil is all but flat.

It is a quiet European morning on the economic calendar until US inflation into the afternoon. The US CPI for December is at 1330GMT and is expected to show headline CPI increasing by +0.3% on the month to +2.3% YoY (from +2.1% in November). Core US CPI is expected to grow by +0.2% and leave YoY at +2.3% (+2.3% in November).

Also be on the lookout for Fed speaker John Williams (voter, centrist) who gives a speech at 1400GMT.

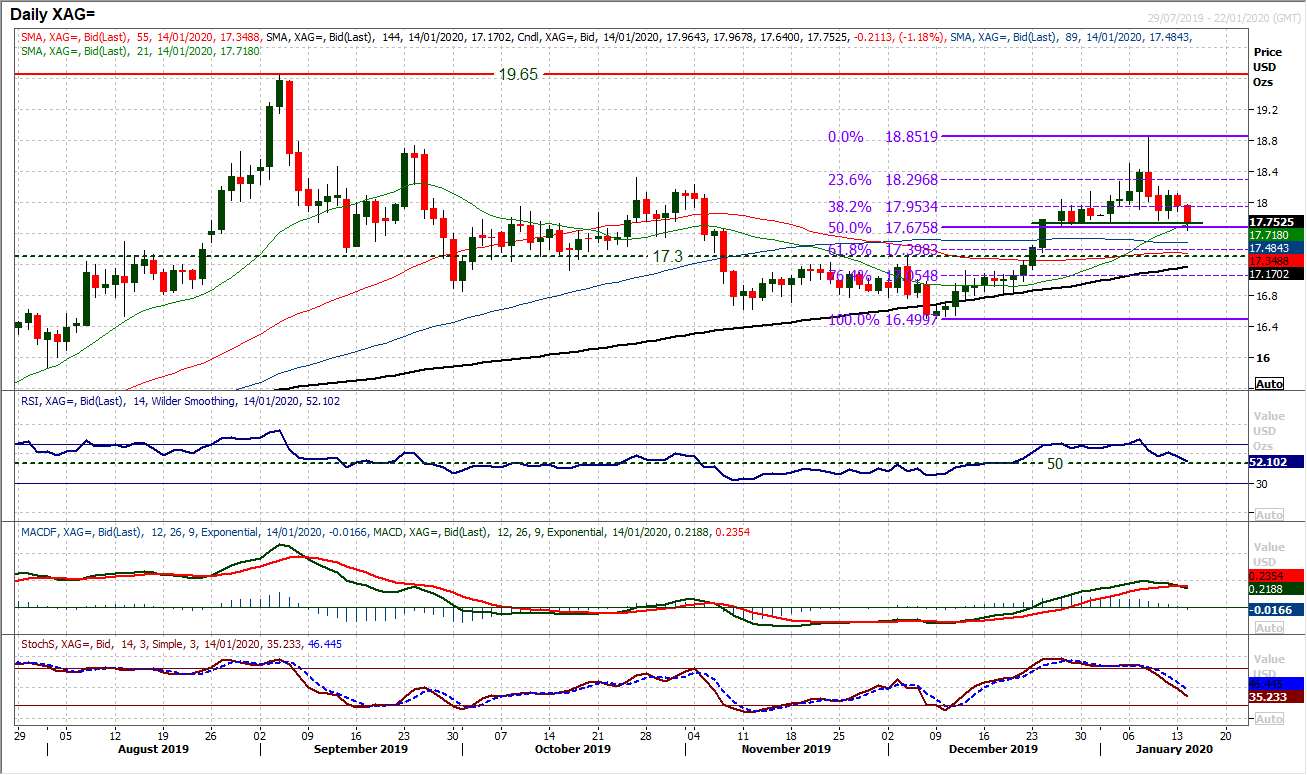

Chart of the Day – Silver

The accelerated rise of silver has come under decisive retracement pressure in the past week, but could the move go further? The pullback from a four month high of $18.85 has already unwound to the 50% Fibonacci retracement (of $16.50/$18.85) at $17.68. What is interesting is that this basis of support is also around what is now a neckline of a head and shoulders top at $17.75. With renewed corrective pressure from yesterday continuing today, the pattern is close to completion. Momentum indicators have been unwinding in the past week, with the Stochastics and RSI falling around their neutral points. However, this comes as the MACD lines are now posting a bear cross. The near term outlook is still very uncertain but the $17.75 neckline support will now be seen as an important near term gauge. If this is breached on a closing basis whilst being confirmed by RSI below 50, it would be a key breakdown which would also imply a much deeper corrective move. The next pivot support is $17.20/$17.30 area as an initial target, with 61.8% Fib at $17.40. Resistance is at $17.95 (38.2% Fib) and the key lower high at $18.15.

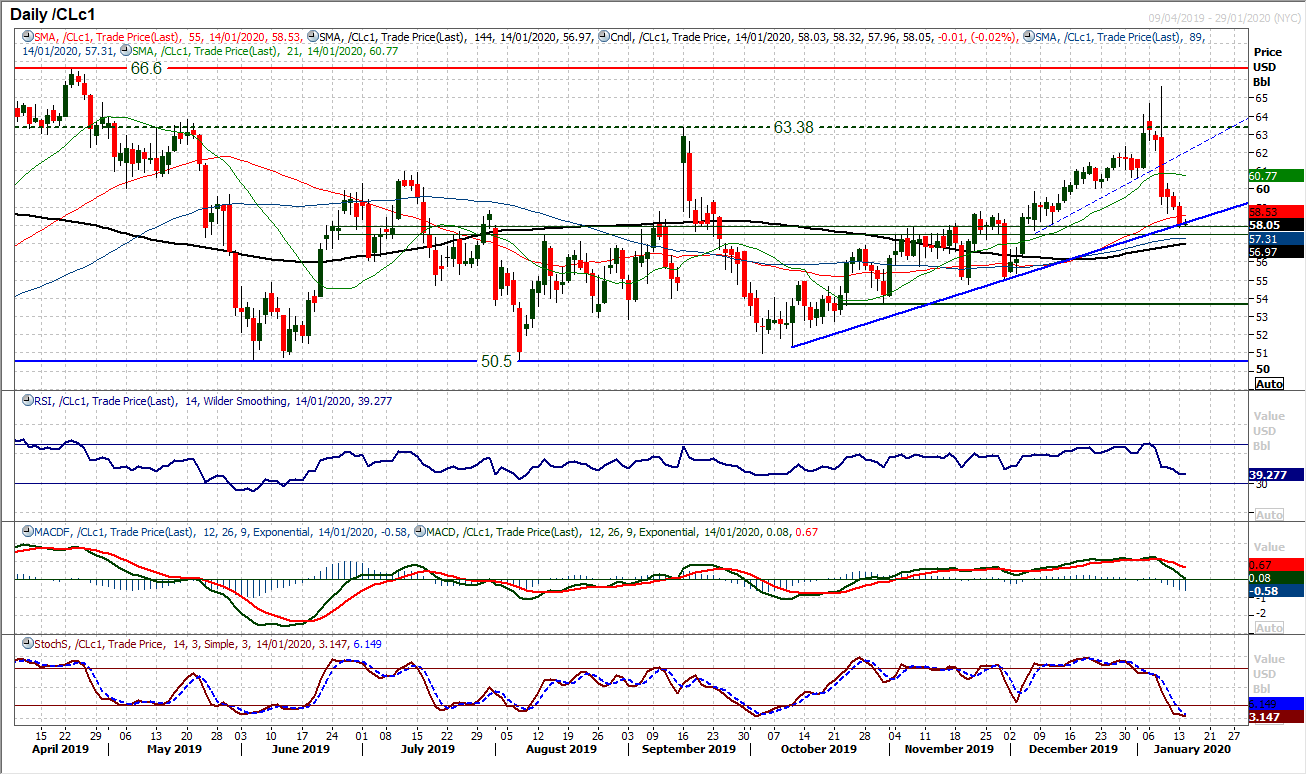

WTI Oil

The calming of immediate tensions between the US and Iran has allowed the excesses of the January spike higher to retrace. This has continued over the past week and again found key selling through yesterday’s session. This morning we see the market right back to a key confluence area of support. A three month uptrend comes in at $58.15 today, whilst an old key pivot band $57.50/$57.85 is also in proximity. The RSI is back around 40 (around where rallies have kicked in over recent months) and this looks to be a key moment for the bulls. Below $56.95 would breach all the moving averages we look at too (where the 144 day ma is). The hourly chart shows $58.60/$59.80 is a resistance band to be breached to allow the bulls back in control.

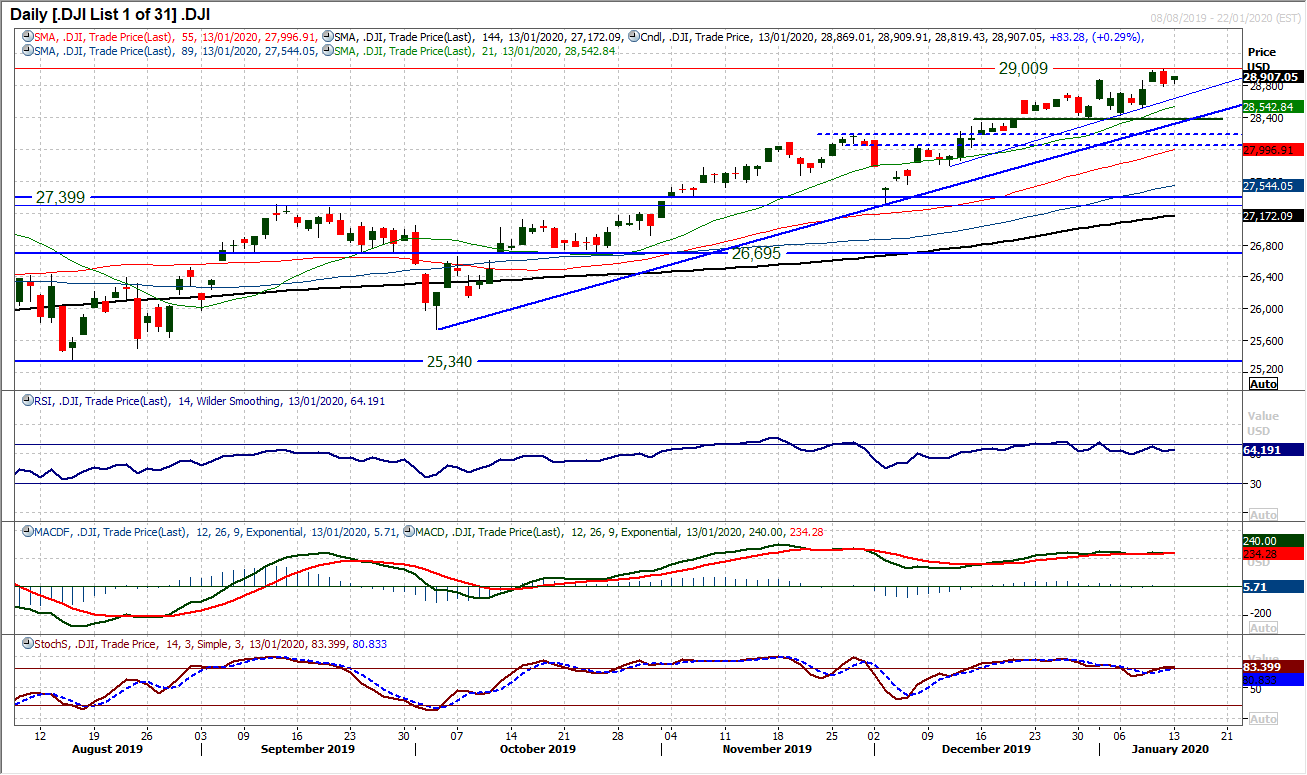

Dow Jones Industrial Average

A bearish engulfing candlestick on Friday has just pushed the pause button on the latest move to all-time highs on the Dow. This pause is being reflected through momentum indicators which have just eased mildly out of very strong configurations. However, there is little to suggest an imminent end to the bull run will be seen. We can draw in several uptrends to reflect that this is simply a consolidation, as the market posted a mildly positive candle yesterday. A five week uptrend comes in to support at 28,700 today and this is still well above all the rising moving averages. Any near term weakness should still be seen as a chance to buy. The main initial higher low support is back at 28,376, whilst anything back around the 28,700 area will be seen as another opportunity for the bulls coming into earnings season. Resistance is at the all-time high at 29,009.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 inflation forecast, disappointing the Japanese Yen buyers.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.