RBNZ signals mission accomplished

The RBNZ hiked by 25bps to 5.50% in its May 24 meeting. Although the RBNZ maintained that interest rates would need to remain restrictive for the foreseeable future to achieve its inflation target, this could be the last rate hike for now as it maintained its peak rate forecast at 5.50%. That was the main takeaway from the meeting, and it surprised markets as the RBNZ wants to see if it can end rate hikes and tackle inflation by keeping interest rates at these sustained levels.

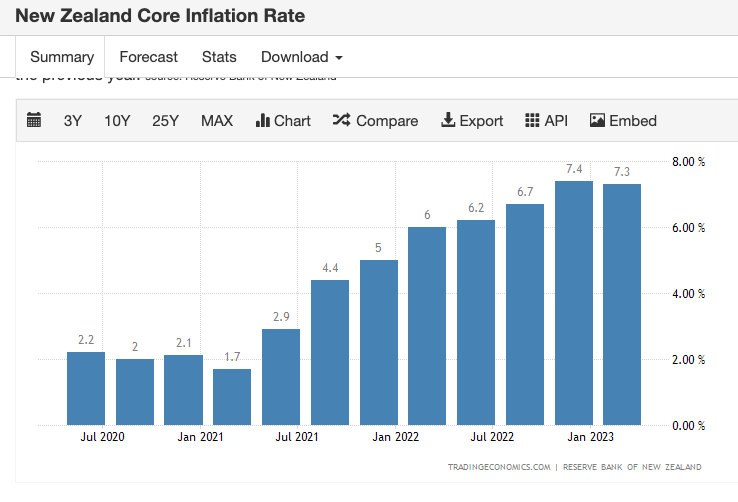

Inflation forecast

The RBNZ sees inflation continuing to fall from its peak, but it does note that the core reading of inflation is expected to be sustained. You can see that core inflation is still quite elevated and it is far from clear whether it has stopped rising or not, at 7.3% y/y.

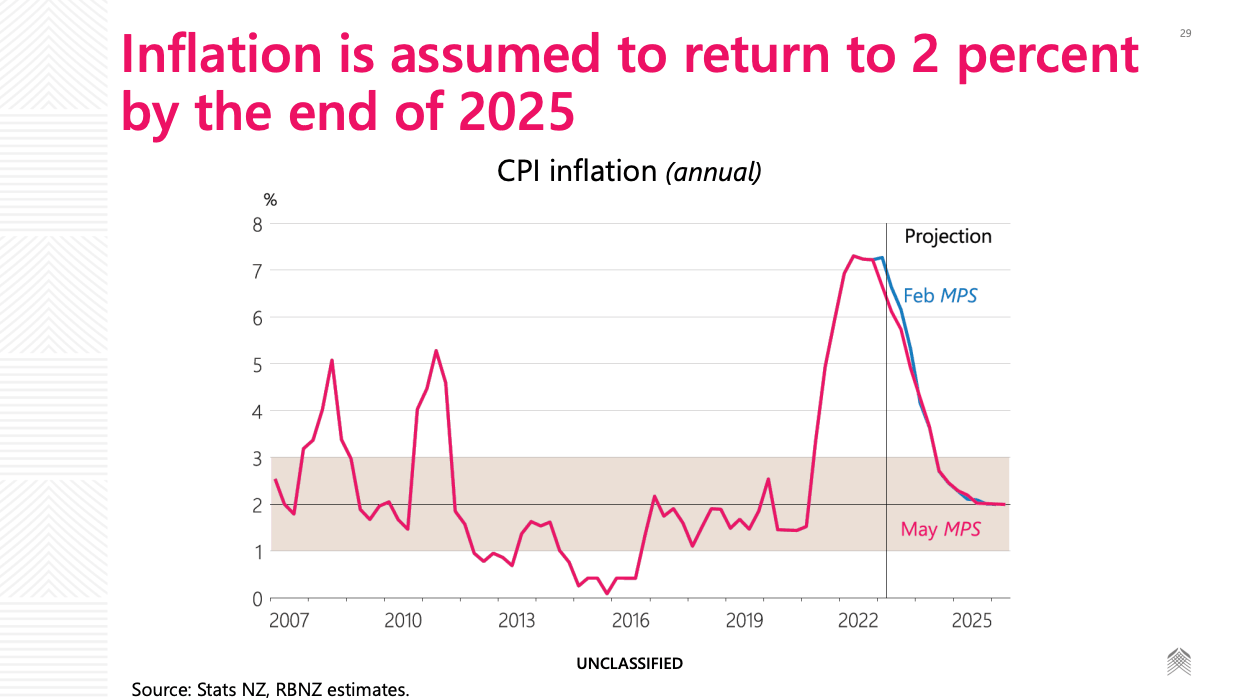

Over the long term, the RBNZ is confident that inflation will fall back to 2% by 2025.

Demand is dropping

The RBNZ notes that consumer spending growth has fallen, construction activity declined, and house prices are now at more sustainable levels. Businesses are reporting falling demand, and the labor shortage is not the main constraint on business activity. So, the RBNZ feels confident to stop hiking rates now.

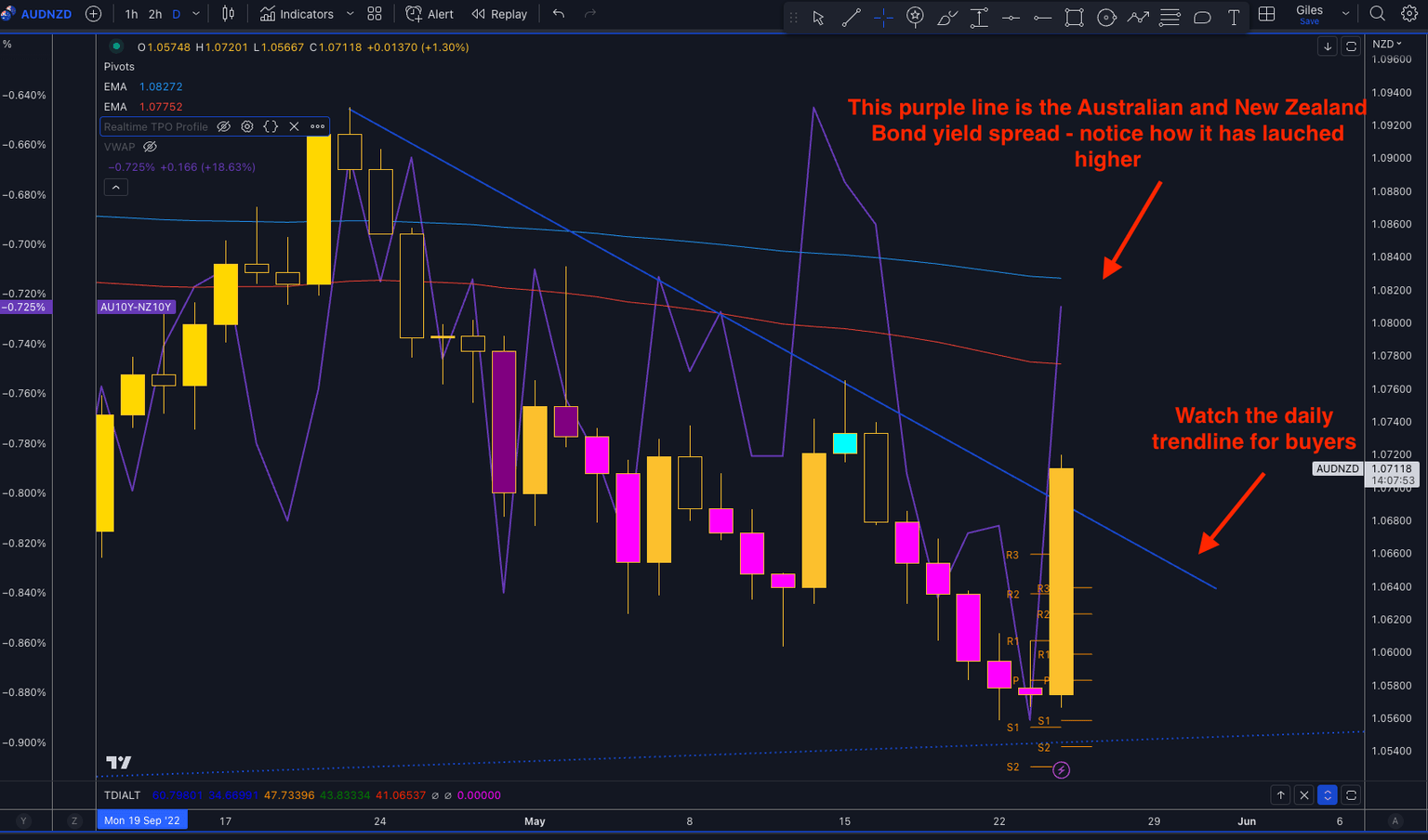

AUD/NZD outlook

This has opened up a sharp move higher in the AUDNZD pair as the RBNZ rate path diverges from the RBA. Looking at the overlay of the Australian and New Zealand bond yield spread, you can see that rate traders are signaling a shift in paths ahead. This should support the AUDNZD with buyers on the dips as long as the yield spread keeps heading higher. Watch incoming inflation data as if that surprises markets to the upside the RBNZ may have to go higher than originally intended.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.