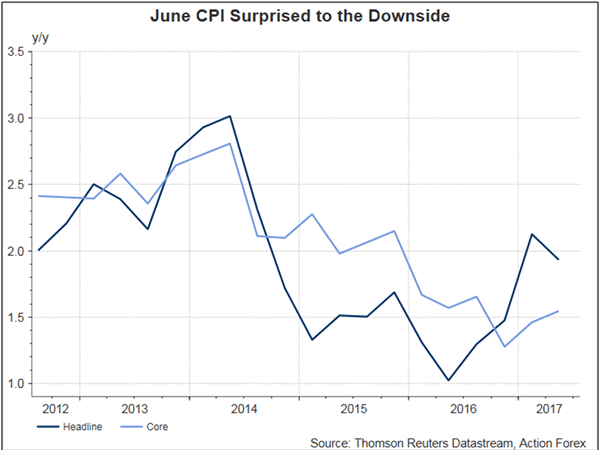

Aussie dropped after the weaker than expected inflation report, as traders took profit after the currency rallied to 2-year against USD and last week. Headline CPI moderated to +1.9% y/y in 2Q17 from +2.1% a quarter ago. The market had anticipated an increase to +2.2%. Key contributors to the weakness were lower automotive fuel prices as global oil prices plunged and the usual seasonal drop in domestic holiday, travel and accommodation prices. RBA's trimmed mean slipped 0.1 percentage point to +1.8%, in line with expectation, while the weighted median CPI climbed +0.1 percentage point to +1.8% in the second quarter. Consumer price levels are an important gauge of central banks' monetary outlook. The dilemma currently facing major central banks worldwide is the continuing economic growth and employment market improvement, alongside subdued inflation. At the July meeting minutes, RBA acknowledged that weak inflation is a global phenomenon with core inflation remaining low while headline inflation turning down..

RBA's Neutral Rate Rhetoric Overstated

Indeed, Aussie's rally last week was a result of market's overreaction to 'neutral rate' rhetoric's by the RBA and Fed Chair Janet Yellen. Recall that RBA suggested that the neutral nominal cash rate is around 3.5%, with medium-term inflation expectations well- anchored around 2.5%'. It also noted that 'a reduction in risk aversion and/or an increase in the potential growth rate could see the neutral real interest rate rise again'. Fed's Yellen noted at the testimony that 'the neutral rate is currently quite low by historical standards, the federal funds rate would not have to rise all that much further to get to a neutral policy stance'.

Despite initial impression that RBA's language was implying a tightening stance, RBA's estimated nominal neutral rate, currently at 3.5%, was weaker than the previous projection of 5% (prior to global financial crisis). More importantly, what RBA noted was 'nominal neutral rate' which, if adjusted with medium term inflation expectations of around 2.5%, would bring a real rate of 1%. This is indeed coincident with the Fed's long-run neutral rate in real terms. Meanwhile, Yellen's comments on neutral rate were not more pessimistic than previously. Indeed, the Fed's neutral rate stance over recent years has remained similar, suggesting that the neutral rate had fallen fell sharply after the financial crisis and has remained near zero; r-star would move high should the temporary factors dissipate over time and the long-term level of the neutral rate has permanently shifted downward due primarily to slower potential growth.

RBNZ Assistant Governor John McDermott also talked about the monetary policy outlook earlier today. His stance, while driven muted market reaction, was rather dovish. He suggested that current estimate of the neutral interest rate is around 3.5 % with potential output growth at 2.9% and core inflation at 1.4%. He added that the neutral rate has been slowly falling for some time, due to lower potential output growth. Dating back to early 2015, the central bank noted that the neutral interest rate is around 4.5%

Content in ActionForex.com website is for informational purposes only. Contributors submitted forecast, commentaries, analysis, articles are based upon information gathered from various sources believed to be reliable, complete, and accurate. However, no guarantee can be made as to the validity of the believed sources. All statements and expressions in the website are opinions, and not meant as investment advice or solicitation. Forex Markets can be volatile and opinions may change without notice.

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

FBI cautions against non-KYC Bitcoin and crypto money transmitting services as SEC goes after MetaMask

US FBI has issued a caution to Bitcoiners and cryptocurrency market enthusiasts, coming on the same day as when the US Securities and Exchange Commission is on the receiving end of a lawsuit, with a new player adding to the list of parties calling for the regulator to restrain its hand.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.